- Saudi Arabia

- /

- Luxury

- /

- SASE:4180

The 12% return this week takes Fitaihi Holding Group's (TADAWUL:4180) shareholders five-year gains to 193%

Fitaihi Holding Group (TADAWUL:4180) shareholders might be concerned after seeing the share price drop 14% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 170% higher today. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. The more important question is whether the stock is too cheap or too expensive today.

Since it's been a strong week for Fitaihi Holding Group shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Fitaihi Holding Group

Fitaihi Holding Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Fitaihi Holding Group saw its revenue shrink by 19% per year. Given that scenario, we wouldn't have expected the share price to rise 22% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

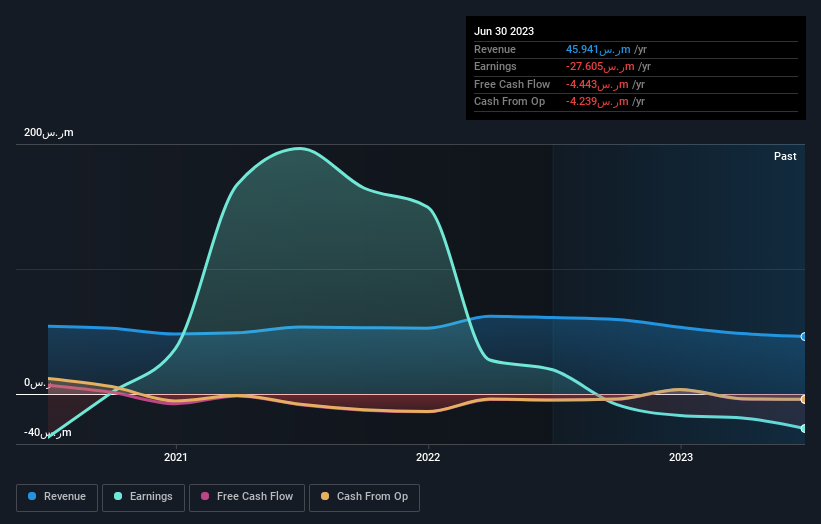

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Fitaihi Holding Group's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Fitaihi Holding Group's TSR for the last 5 years was 193%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Fitaihi Holding Group shareholders are down 5.3% for the year (even including dividends), but the market itself is up 9.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 24%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You could get a better understanding of Fitaihi Holding Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Fitaihi Holding Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4180

Fitaihi Holding Group

Provides gold, jewelry, and luxury products primarily in Saudi Arabia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives