- Saudi Arabia

- /

- Packaging

- /

- SASE:2150

Undiscovered Gems And 2 Other Promising Small Caps To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience with indices like the S&P MidCap 400 and Russell 2000 posting gains. In this environment, identifying promising small-cap opportunities requires a keen eye for companies that demonstrate strong fundamentals and potential for growth amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We'll examine a selection from our screener results.

National Company for Glass Industries (SASE:2150)

Simply Wall St Value Rating: ★★★★★★

Overview: The National Company for Glass Industries focuses on the production and sale of returnable and non-returnable glass bottles as well as float glass, with a market capitalization of SAR1.79 billion.

Operations: The company's primary revenue stream is the production and sale of glass bottles, generating SAR141.48 million.

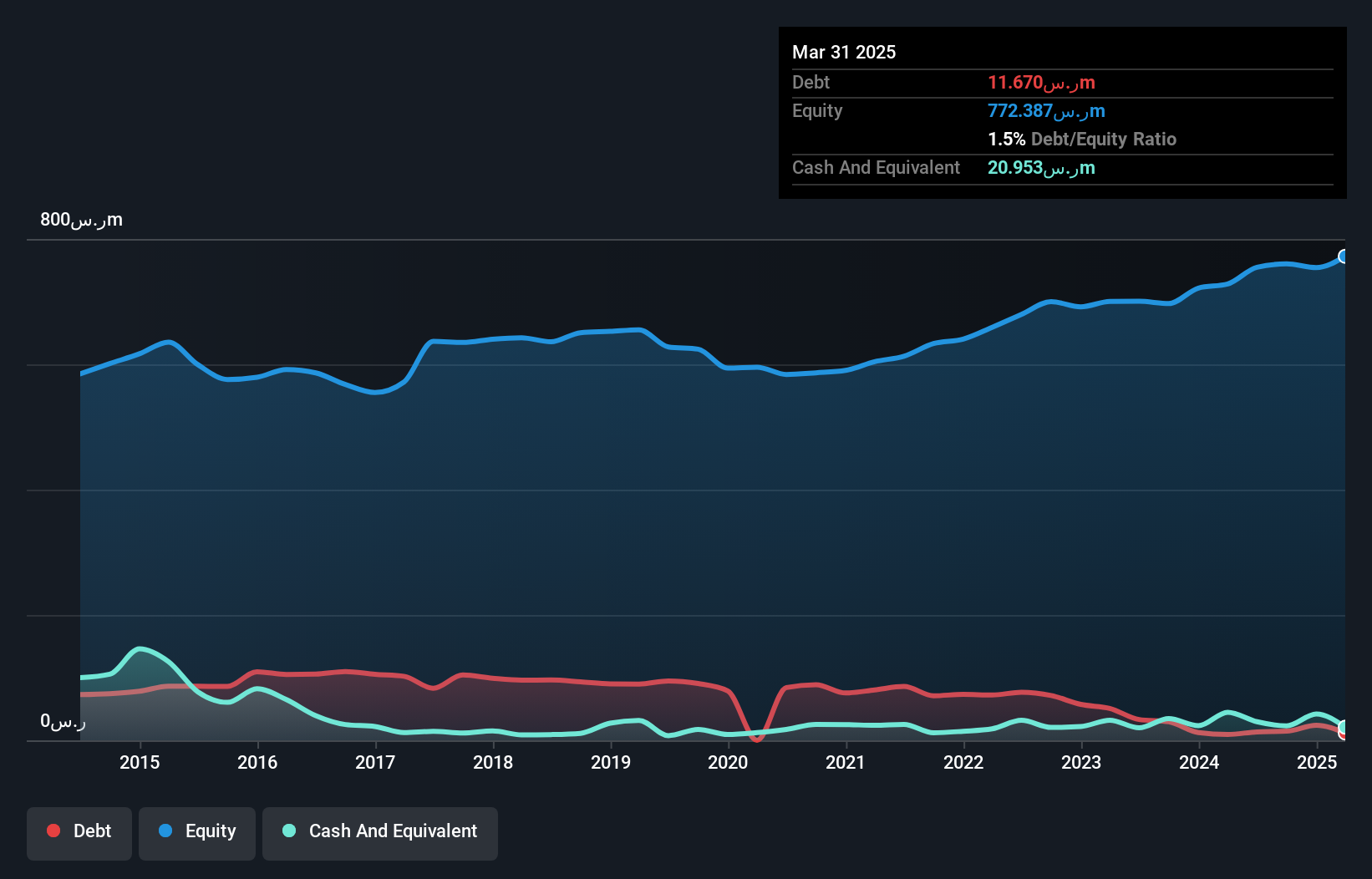

National Company for Glass Industries, a small player in the market, has shown impressive financial resilience. Its debt to equity ratio significantly decreased from 14.5% to 1.9% over five years, indicating strong financial management. The company's earnings surged by 202.9% last year, outpacing the Packaging industry’s growth of just 1.5%. With a price-to-earnings ratio of 17.8x below the SA market's average of 23.4x, it appears attractively valued for potential investors seeking growth opportunities in niche markets like glass manufacturing in Saudi Arabia (SAR).

Thob Al Aseel (SASE:4012)

Simply Wall St Value Rating: ★★★★★★

Overview: Thob Al Aseel Company is engaged in developing, importing, exporting, wholesaling, and retailing fabrics and readymade clothes with a market capitalization of SAR1.70 billion.

Operations: Thob Al Aseel generates revenue primarily from two segments: Thobs, contributing SAR391.02 million, and Fabrics, with SAR120.65 million.

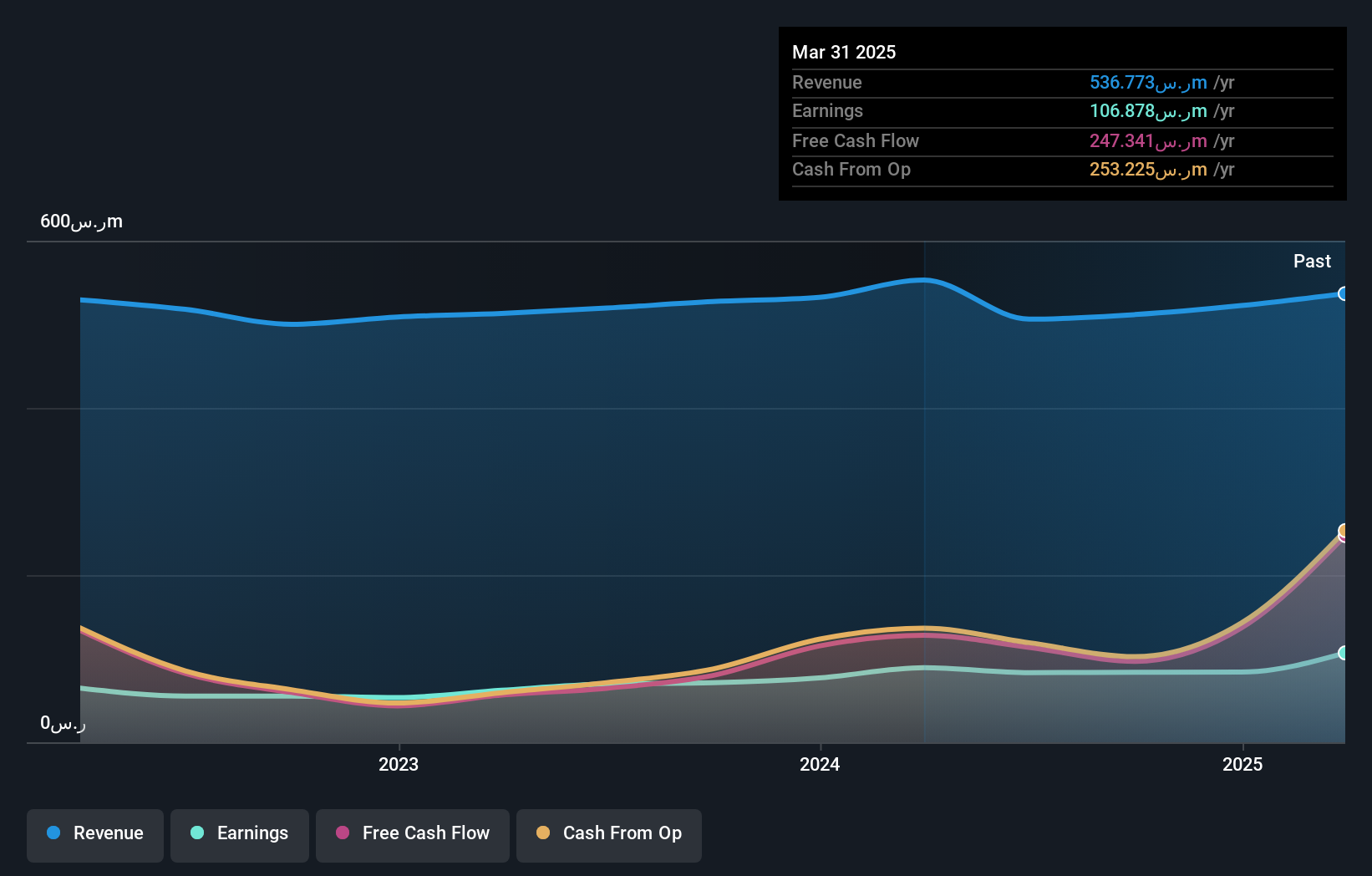

Thob Al Aseel showcases a compelling profile with its recent earnings growth of 17.7%, surpassing the Luxury industry's 9.6%. Despite a slight dip in earnings over the past five years, it remains debt-free, eliminating concerns about interest payments. The company reported third-quarter sales of SAR 78.56 million, up from SAR 73.13 million last year, and net income increased to SAR 5.59 million from SAR 5.16 million previously. Trading at approximately 16% below estimated fair value suggests potential for investors seeking undervalued opportunities in this sector, while its high-quality earnings further bolster confidence in its financial health.

- Click here and access our complete health analysis report to understand the dynamics of Thob Al Aseel.

Assess Thob Al Aseel's past performance with our detailed historical performance reports.

Addiko Bank (WBAG:ADKO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Addiko Bank AG operates as a banking institution offering a range of financial products and services across Croatia, Slovenia, Serbia, Bosnia and Herzegovina, Montenegro, Austria, and Germany with a market capitalization of approximately €379.96 million.

Operations: Addiko Bank AG generates revenue primarily from its Consumer segment (€162.50 million) and SME Business segment (€93.80 million), with additional contributions from Mortgage and Public Finance segments. The Corporate Center records a negative impact on the overall revenue, amounting to -€25.90 million.

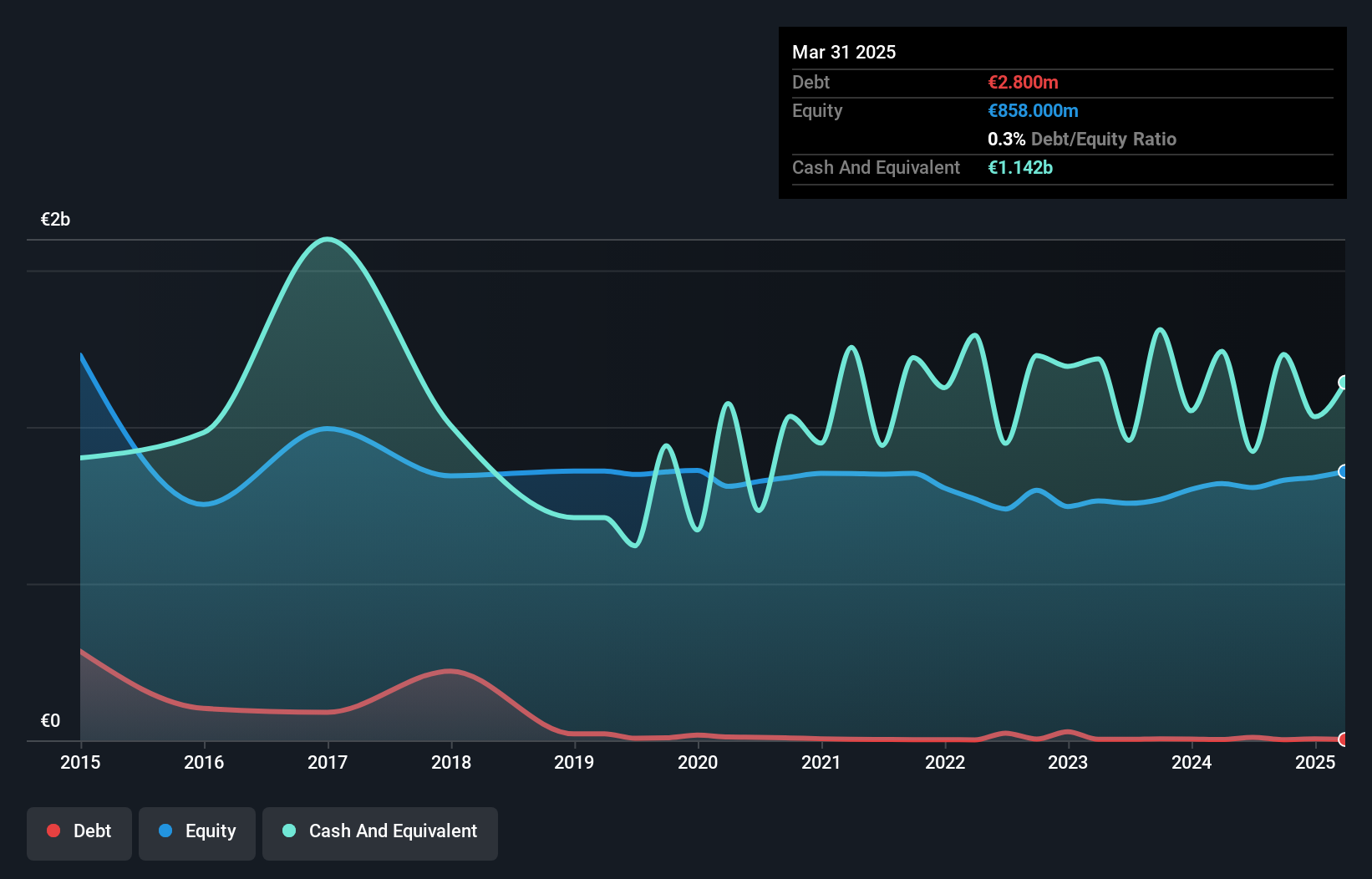

Addiko Bank, with assets of €6.3 billion and equity of €830 million, showcases a solid financial foundation. Its total deposits stand at €5.2 billion against loans of €3.6 billion, reflecting a healthy balance sheet structure. Despite a high level of bad loans at 4%, the bank has a sufficient allowance covering 120% for these non-performing assets, indicating prudent risk management. Earnings grew by an impressive 34% last year, outpacing the industry growth rate of 13%. The price-to-earnings ratio is attractively low at 7.8x compared to the Austrian market's average of 13x, suggesting potential value for investors seeking opportunities in smaller financial entities.

- Take a closer look at Addiko Bank's potential here in our health report.

Evaluate Addiko Bank's historical performance by accessing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 4637 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Company for Glass Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2150

National Company for Glass Industries

Produces and sells returnable and non-returnable glass bottles and float glass.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives