- Israel

- /

- Oil and Gas

- /

- TASE:NWMD

Middle Eastern Dividend Stocks To Consider In December 2025

Reviewed by Simply Wall St

As most Gulf markets experience gains driven by rising oil prices and anticipation of a U.S. Federal Reserve rate cut, the Middle East's economic landscape is buzzing with activity and optimism. In this environment, dividend stocks can be particularly appealing as they offer potential income stability amidst fluctuating market conditions, making them an attractive consideration for investors looking to balance growth with steady returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.47% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.49% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.77% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.76% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.52% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.46% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.33% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 5.98% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.90% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.00% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

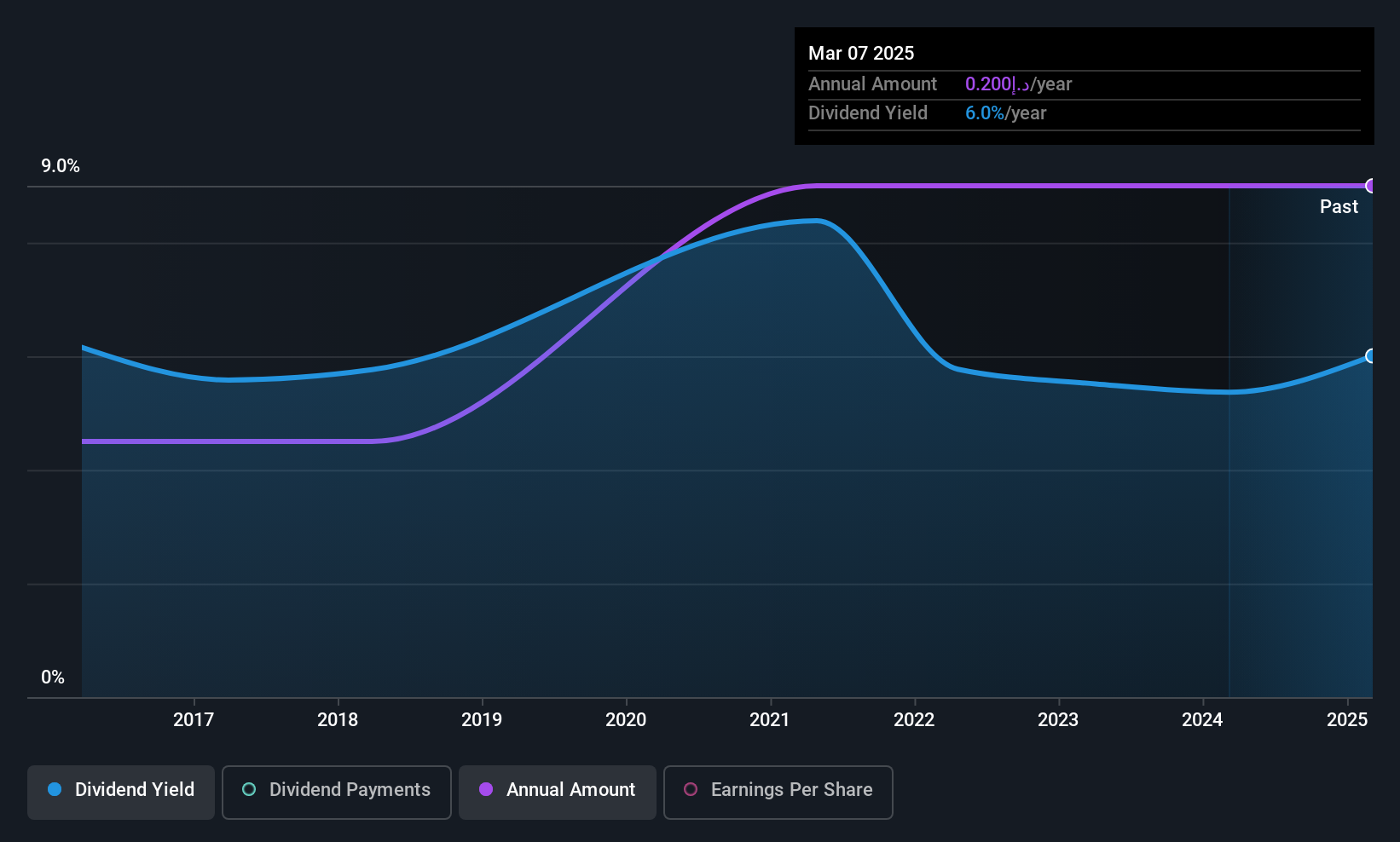

Sukoon Insurance PJSC (DFM:SUKOON)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sukoon Insurance PJSC offers insurance solutions to individuals and businesses in the United Arab Emirates, with a market cap of AED 1.66 billion.

Operations: Sukoon Insurance PJSC generates revenue from two main segments: Life Insurance at AED 212.20 million and Non-Life Insurance at AED 5.04 billion.

Dividend Yield: 5.6%

Sukoon Insurance PJSC offers a compelling dividend profile with a low payout ratio of 26.5%, ensuring dividends are well covered by both earnings and cash flows (cash payout ratio at 11.6%). Despite its attractive price-to-earnings ratio of 4.8x, below the AE market average, its dividend history is marked by volatility and unreliability over the past decade. Recent earnings show significant growth, with Q3 net income rising to AED 64.55 million from AED 46.5 million year-on-year, indicating robust financial performance amidst leadership changes.

- Unlock comprehensive insights into our analysis of Sukoon Insurance PJSC stock in this dividend report.

- Our valuation report unveils the possibility Sukoon Insurance PJSC's shares may be trading at a premium.

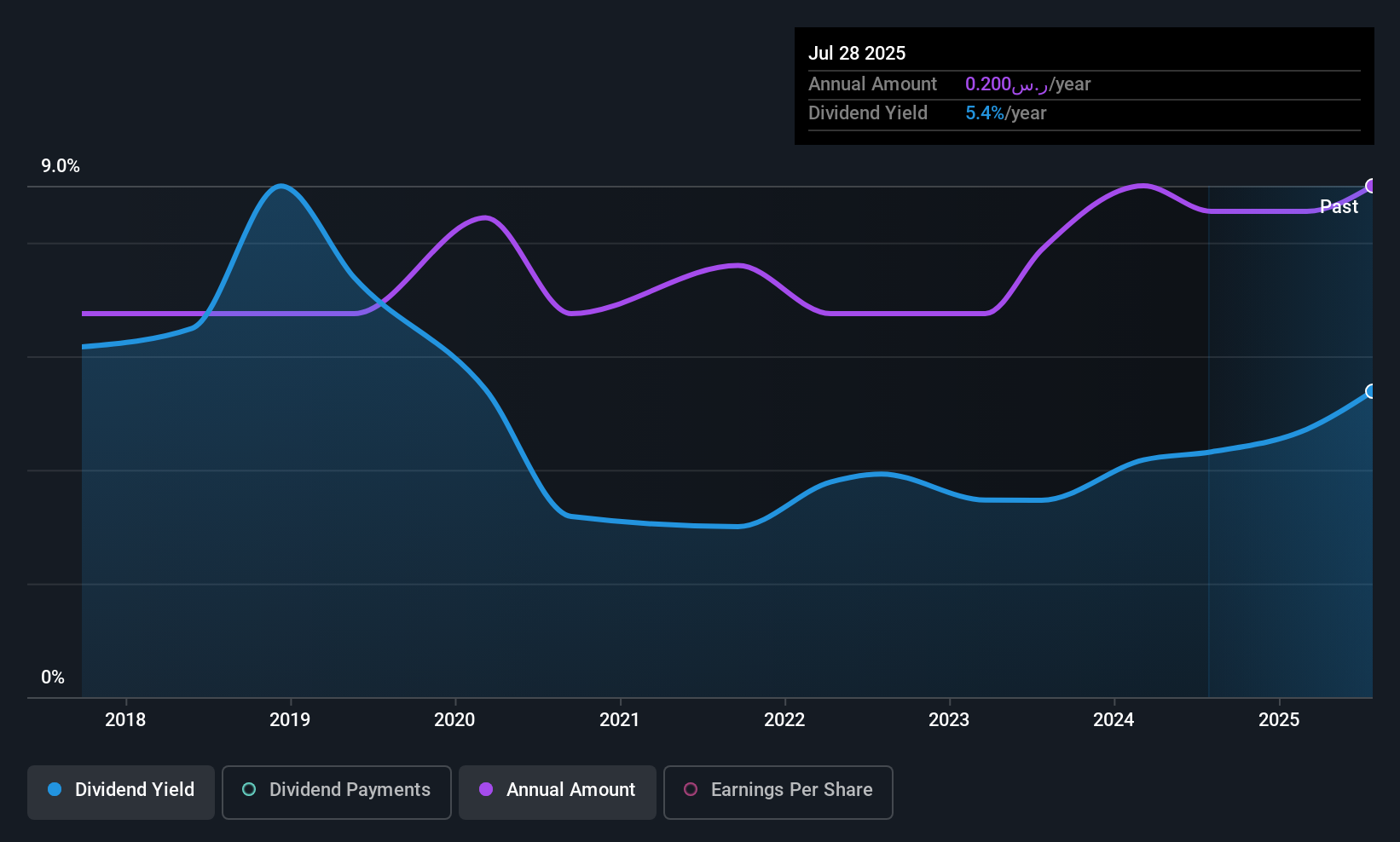

Thob Al Aseel (SASE:4012)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market cap of SAR1.34 billion.

Operations: Thob Al Aseel Company's revenue is primarily derived from Thobs, contributing SAR369.43 million, and Fabrics, adding SAR129.35 million.

Dividend Yield: 6%

Thob Al Aseel's dividend profile is characterized by volatility, having been paid for only 8 years with fluctuations over 20%. Despite this, dividends are well covered by cash flows (33.6% payout ratio) and earnings (89.1% payout ratio). The company trades at a significant discount to its estimated fair value. Recent financials show modest growth in net income for Q3 at SAR 5.99 million from SAR 5.59 million year-on-year, reflecting stable operational performance amidst fluctuating sales figures.

- Dive into the specifics of Thob Al Aseel here with our thorough dividend report.

- The valuation report we've compiled suggests that Thob Al Aseel's current price could be quite moderate.

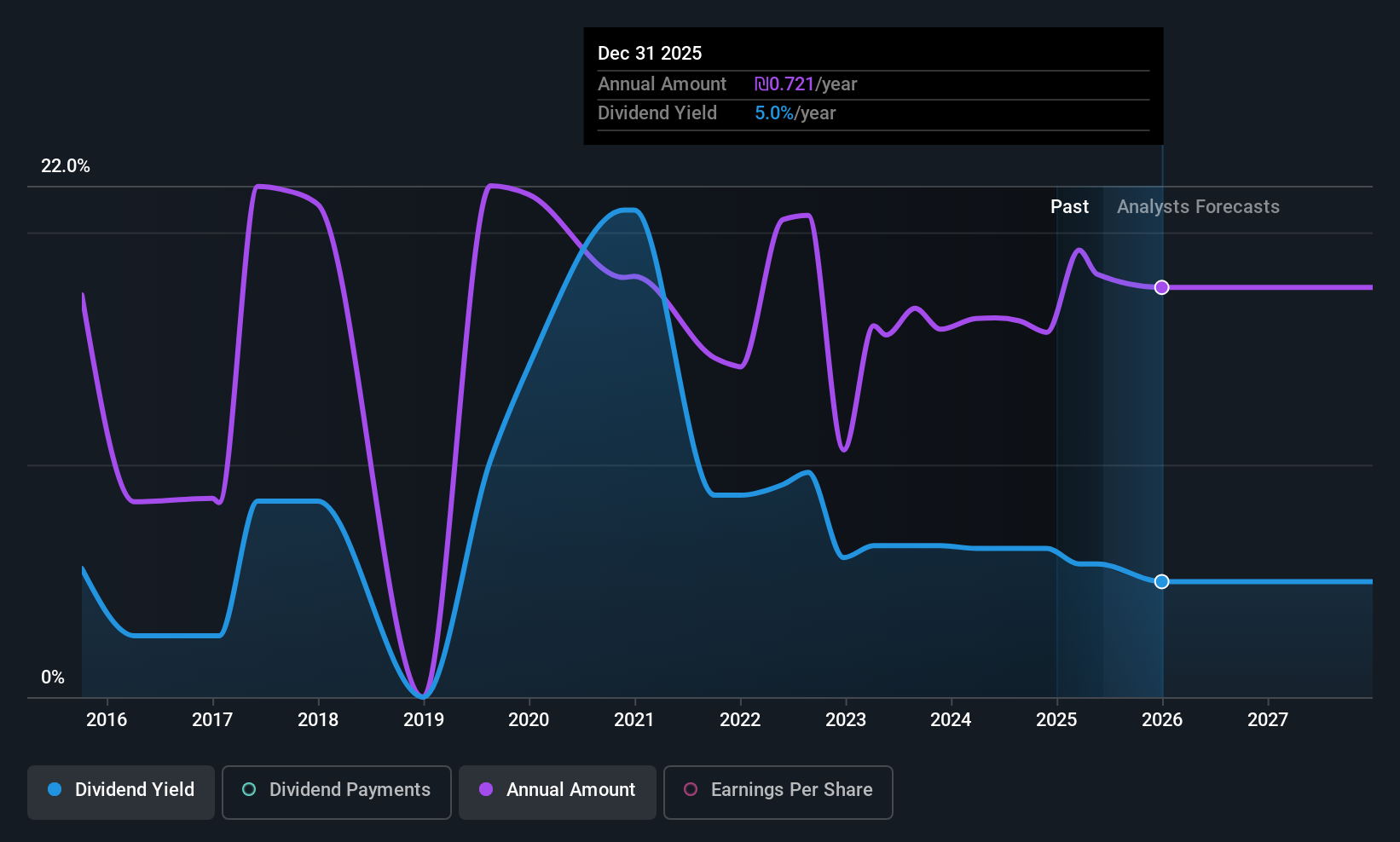

NewMed Energy - Limited Partnership (TASE:NWMD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NewMed Energy - Limited Partnership is involved in the exploration, development, production, and sale of petroleum, natural gas, and condensate across Israel, Jordan, and Egypt with a market cap of ₪19.83 billion.

Operations: NewMed Energy - Limited Partnership generates revenue of $875.20 million from its oil and gas exploration and production activities.

Dividend Yield: 4.1%

NewMed Energy's dividend history is marked by volatility, with payments fluctuating over 20% annually in the past decade. Despite this instability, dividends are covered by earnings (53.8% payout ratio) and cash flows (75.6% cash payout ratio). The company faces high debt levels and offers a lower dividend yield (4.09%) compared to top-tier market payers. Recent Q3 results show decreased revenue at US$238.9 million from US$267.6 million year-on-year, impacting net income and EPS figures negatively.

- Click to explore a detailed breakdown of our findings in NewMed Energy - Limited Partnership's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of NewMed Energy - Limited Partnership shares in the market.

Summing It All Up

- Click this link to deep-dive into the 59 companies within our Top Middle Eastern Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewMed Energy - Limited Partnership might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NWMD

NewMed Energy - Limited Partnership

Engages in the exploration, development, production, and sale of petroleum, natural gas, and condensate in Israel, Jordan and Egypt.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion