As global markets grapple with rising U.S. Treasury yields, which have recently weighed on stocks, investors are increasingly seeking opportunities that can offer both value and growth. Penny stocks, a term that might seem outdated but remains relevant, often represent smaller or newer companies with the potential to outperform when backed by solid financial foundations. In this context, we will explore several penny stocks that exhibit financial strength and could present promising opportunities for those looking to invest in under-the-radar companies poised for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.565 | MYR2.81B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$514.18M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.72 | MYR124.72M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.78 | £460.72M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.54 | MYR766.84M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.04 | MYR2.09B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.025 | £400.31M | ★★★★☆☆ |

Click here to see the full list of 5,822 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Altia Consultores (BME:ALC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Altia Consultores, S.A. operates in the information and communication technologies (ICT) sector both in Spain and internationally, with a market cap of €326.72 million.

Operations: The company's revenue is derived from its business lines and geographical operations, with €122.39 million from Altia, €72.98 million from Noesis, €57.48 million from Bilbomatics, €8.98 million from Exis, and €1.43 million generated in Chile.

Market Cap: €326.72M

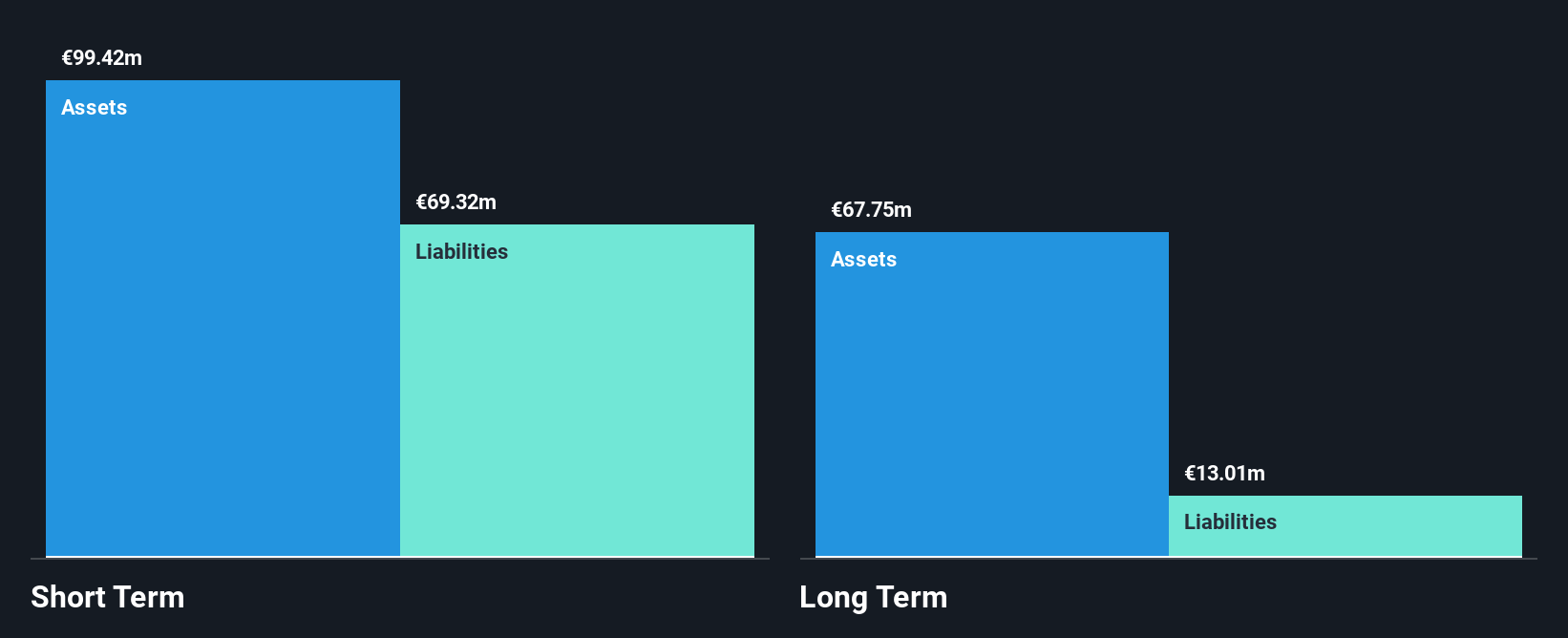

Altia Consultores, S.A. recently reported half-year earnings with revenue of €128.45 million, showing growth from €115.87 million the previous year, though net income slightly decreased to €7.01 million. The company maintains a strong financial position with cash exceeding total debt and short-term assets covering both short- and long-term liabilities comfortably. Despite high earnings quality and stable weekly volatility over the past year, Altia's share price remains highly volatile in the short term. Its return on equity is relatively low at 19.1%, while debt levels have increased over five years but remain well-covered by operating cash flow.

- Get an in-depth perspective on Altia Consultores' performance by reading our balance sheet health report here.

- Understand Altia Consultores' track record by examining our performance history report.

Thob Al Aseel (SASE:4012)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market capitalization of SAR1.96 billion.

Operations: Thob Al Aseel Company has not reported any specific revenue segments.

Market Cap: SAR1.96B

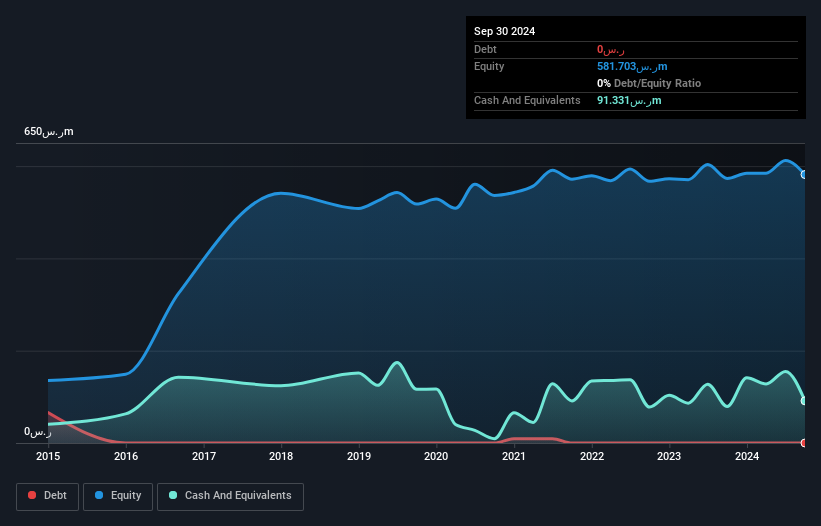

Thob Al Aseel Company has demonstrated resilience with its earnings growth of 17.7% over the past year, surpassing industry averages, despite a historical decline in earnings. The company is debt-free and maintains strong financial health, with short-term assets significantly exceeding liabilities. Recent earnings reports show increased net income for the third quarter to SAR 5.59 million from SAR 5.16 million last year, indicating steady performance improvements. However, the board's relative inexperience and an unstable dividend track record may pose challenges moving forward. Thob Al Aseel trades slightly below its estimated fair value, suggesting potential investment appeal within the penny stock segment.

- Click to explore a detailed breakdown of our findings in Thob Al Aseel's financial health report.

- Learn about Thob Al Aseel's historical performance here.

Roctec Global (SET:ROCTEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Roctec Global Public Company Limited, with a market cap of ฿9.25 billion, operates in the advertising sector across Thailand, Hong Kong, and Vietnam through its subsidiaries.

Operations: The company's revenue is primarily derived from its system installation service, accounting for ฿2.31 billion, and advertising, contributing ฿437 million.

Market Cap: THB9.25B

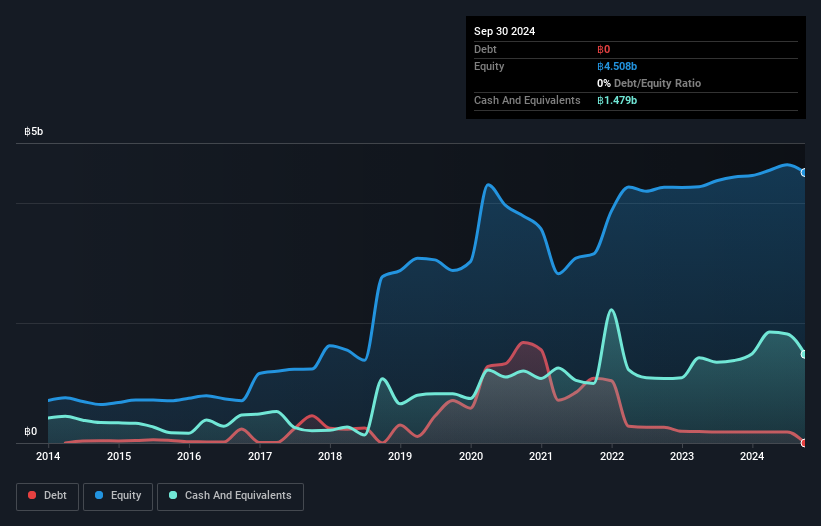

Roctec Global's financial position is robust, with short-term assets of ฿3.2 billion surpassing both long-term liabilities of ฿412.6 million and short-term liabilities of ฿2.1 billion. The company has more cash than total debt, and its debt-to-equity ratio has decreased significantly over five years. Earnings growth is impressive, with an 86.6% increase last year outpacing the media industry's average growth rate, supported by improved net profit margins from 5.3% to 9.6%. However, share price volatility remains high compared to most Thai stocks, which may concern risk-averse investors in the penny stock market segment.

- Dive into the specifics of Roctec Global here with our thorough balance sheet health report.

- Evaluate Roctec Global's historical performance by accessing our past performance report.

Seize The Opportunity

- Take a closer look at our Penny Stocks list of 5,822 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:ROCTEC

Roctec Global

Provides advertising services in Thailand, Hong Kong, and Vietnam.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives