- Saudi Arabia

- /

- Consumer Durables

- /

- SASE:2130

The five-year returns have been favorable for Saudi Industrial Development (TADAWUL:2130) shareholders despite underlying losses increasing

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Saudi Industrial Development share price has climbed 43% in five years, easily topping the market return of 27% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 10% in the last year.

The past week has proven to be lucrative for Saudi Industrial Development investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Saudi Industrial Development

Given that Saudi Industrial Development didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade Saudi Industrial Development's revenue has actually been trending down at about 5.4% per year. Even though revenue hasn't increased, the stock actually gained 7%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

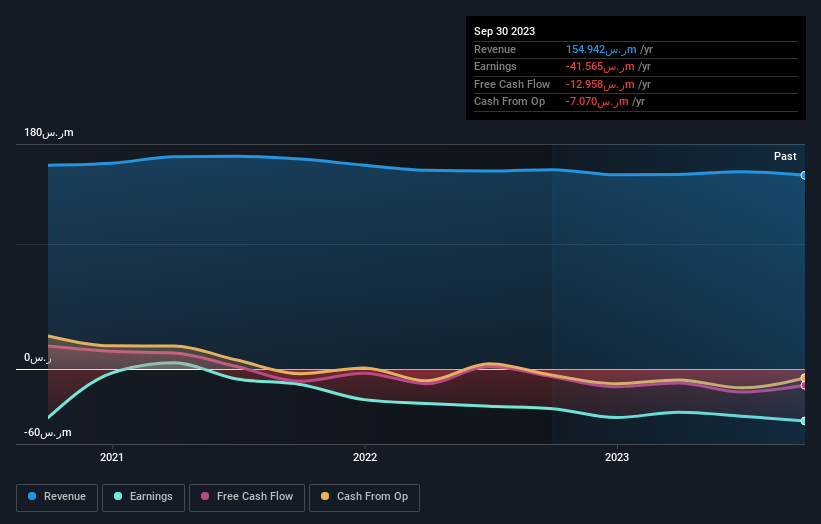

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Saudi Industrial Development stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Saudi Industrial Development shareholders gained a total return of 10% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 7% over half a decade It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Saudi Industrial Development you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2130

Saudi Industrial Development

Manufactures and sells sanitary wares and sponge products in the Kingdom of Saudi Arabia and the Arab Republic of Egypt.

Imperfect balance sheet very low.