- Saudi Arabia

- /

- Consumer Durables

- /

- SASE:1213

Investors Appear Satisfied With Naseej International Trading Company's (TADAWUL:1213) Prospects As Shares Rocket 32%

Despite an already strong run, Naseej International Trading Company (TADAWUL:1213) shares have been powering on, with a gain of 32% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

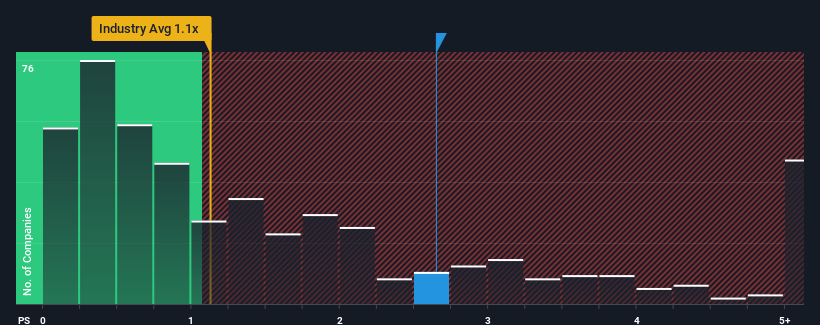

After such a large jump in price, you could be forgiven for thinking Naseej International Trading is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.6x, considering almost half the companies in Saudi Arabia's Consumer Durables industry have P/S ratios below 1.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Naseej International Trading

What Does Naseej International Trading's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Naseej International Trading's revenue has been unimpressive. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Naseej International Trading, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Naseej International Trading?

The only time you'd be truly comfortable seeing a P/S as high as Naseej International Trading's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 49% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.9% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Naseej International Trading's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Naseej International Trading's P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Naseej International Trading revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Naseej International Trading that you need to take into consideration.

If these risks are making you reconsider your opinion on Naseej International Trading, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Naseej International Trading might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1213

Naseej International Trading

Together with subsidiaries, engages in the manufacture, import, export, wholesale, and retailing of carpets and rugs in the Kingdom of Saudi Arabia.

Excellent balance sheet and overvalued.