- Saudi Arabia

- /

- Commercial Services

- /

- SASE:9540

The Market Doesn't Like What It Sees From National Environmental Recycling Company's (TADAWUL:9540) Earnings Yet As Shares Tumble 27%

National Environmental Recycling Company (TADAWUL:9540) shares have had a horrible month, losing 27% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 16% share price drop.

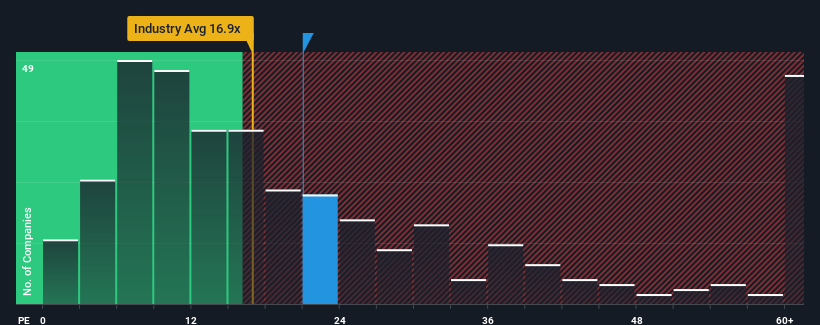

Although its price has dipped substantially, National Environmental Recycling may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 21x, since almost half of all companies in Saudi Arabia have P/E ratios greater than 27x and even P/E's higher than 42x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for National Environmental Recycling as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for National Environmental Recycling

Does Growth Match The Low P/E?

In order to justify its P/E ratio, National Environmental Recycling would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 32%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why National Environmental Recycling is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

The softening of National Environmental Recycling's shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that National Environmental Recycling maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for National Environmental Recycling (2 make us uncomfortable!) that you should be aware of.

If you're unsure about the strength of National Environmental Recycling's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if National Environmental Recycling might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9540

National Environmental Recycling

National Environmental Recycling Company recycles electronic and electrical equipment in the Kingdom of Saudi Arabia and the United Arab Emirates.

Adequate balance sheet very low.