- Saudi Arabia

- /

- Commercial Services

- /

- SASE:1832

Did You Miss Al-Samaani Factory For Metal Industries' (TADAWUL:1832) Whopping 354% Share Price Gain?

It might be of some concern to shareholders to see the Al-Samaani Factory For Metal Industries Co. (TADAWUL:1832) share price down 13% in the last month. But that doesn't displace its brilliant performance over three years. The longer term view reveals that the share price is up 354% in that period. As long term investors the recent fall doesn't detract all that much from the longer term story. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Al-Samaani Factory For Metal Industries

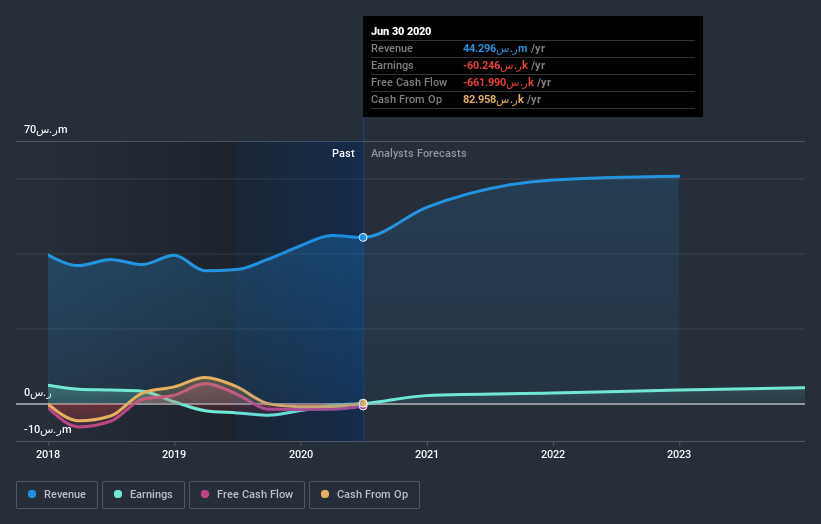

Al-Samaani Factory For Metal Industries isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Al-Samaani Factory For Metal Industries' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Al-Samaani Factory For Metal Industries, it has a TSR of 371% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Al-Samaani Factory For Metal Industries shareholders have gained 131% (in total) over the last year. That includes the value of the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 68%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Al-Samaani Factory For Metal Industries better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Al-Samaani Factory For Metal Industries you should be aware of.

Of course Al-Samaani Factory For Metal Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

When trading Al-Samaani Factory For Metal Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Sadr Logistics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:1832

Sadr Logistics

Manufactures and supplies storage, warehousing, handling, pallets, and office solutions in Saudi Arabia.

Adequate balance sheet very low.