- Saudi Arabia

- /

- Professional Services

- /

- SASE:1831

Maharah for Human Resources Company (TADAWUL:1831) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Maharah for Human Resources Company (TADAWUL:1831) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Longer-term, the stock has been solid despite a difficult 30 days, gaining 15% in the last year.

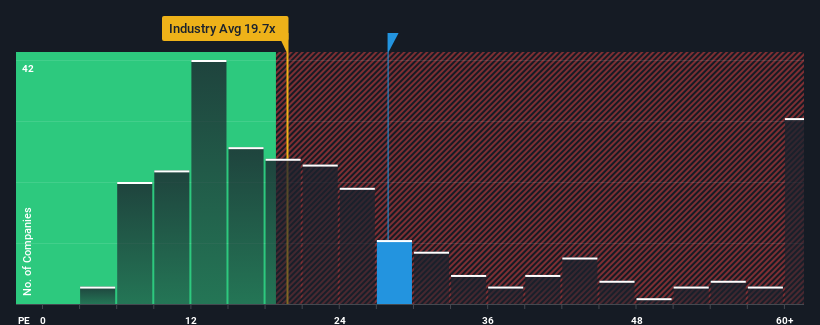

Although its price has dipped substantially, there still wouldn't be many who think Maharah for Human Resources' price-to-earnings (or "P/E") ratio of 27.9x is worth a mention when the median P/E in Saudi Arabia is similar at about 28x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Maharah for Human Resources could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Maharah for Human Resources

How Is Maharah for Human Resources' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Maharah for Human Resources' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. The last three years don't look nice either as the company has shrunk EPS by 45% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 215% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 19% growth forecast for the broader market.

With this information, we find it interesting that Maharah for Human Resources is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Maharah for Human Resources' P/E

Maharah for Human Resources' plummeting stock price has brought its P/E right back to the rest of the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Maharah for Human Resources currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Maharah for Human Resources that you should be aware of.

If you're unsure about the strength of Maharah for Human Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1831

Maharah for Human Resources

Provides manpower services to public and private sectors in Saudi Arabia and the United Arab Emirates.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives