- Saudi Arabia

- /

- Machinery

- /

- SASE:9568

Mayar Holding Company (TADAWUL:9568) Might Not Be As Mispriced As It Looks

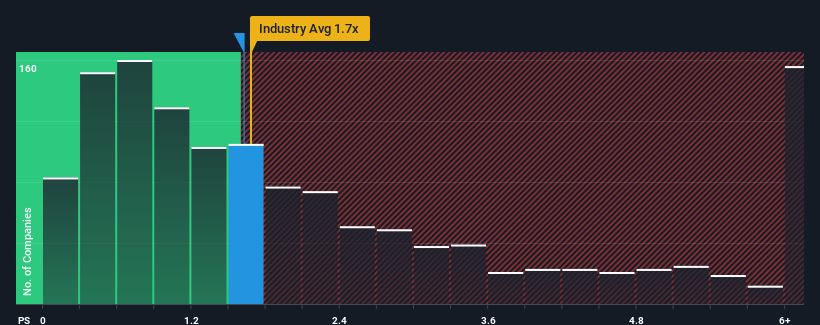

With a median price-to-sales (or "P/S") ratio of close to 1.7x in the Machinery industry in Saudi Arabia, you could be forgiven for feeling indifferent about Mayar Holding Company's (TADAWUL:9568) P/S ratio of 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Mayar Holding

How Mayar Holding Has Been Performing

For example, consider that Mayar Holding's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Mayar Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Mayar Holding's Revenue Growth Trending?

Mayar Holding's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. Still, the latest three year period has seen an excellent 191% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 17% shows it's noticeably more attractive.

In light of this, it's curious that Mayar Holding's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Mayar Holding's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We didn't quite envision Mayar Holding's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Having said that, be aware Mayar Holding is showing 4 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Mayar Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9568

Mayar Holding

Engages in the manufacturing, selling, trading, installing, and maintaining of elevators and escalators, and their spare parts in Saudi Arabia.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives