- Saudi Arabia

- /

- Construction

- /

- SASE:9547

Rawasi Albina Investment Co.'s (TADAWUL:9547) 27% Price Boost Is Out Of Tune With Revenues

Rawasi Albina Investment Co. (TADAWUL:9547) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 13% over that time.

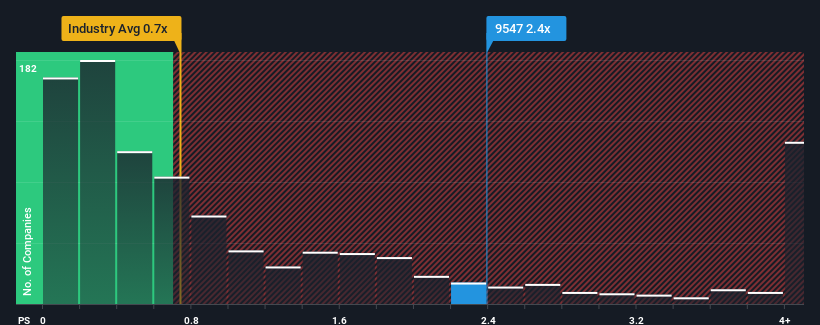

Following the firm bounce in price, you could be forgiven for thinking Rawasi Albina Investment is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in Saudi Arabia's Construction industry have P/S ratios below 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Rawasi Albina Investment

What Does Rawasi Albina Investment's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Rawasi Albina Investment over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Rawasi Albina Investment's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Rawasi Albina Investment?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Rawasi Albina Investment's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. Regardless, revenue has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 12% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it concerning that Rawasi Albina Investment is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Rawasi Albina Investment's P/S?

The large bounce in Rawasi Albina Investment's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Rawasi Albina Investment currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Rawasi Albina Investment (2 make us uncomfortable) you should be aware of.

If you're unsure about the strength of Rawasi Albina Investment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9547

Rawasi Albina Investment

Provides infrastructure works for telecom, electricity, and water projects in Saudi Arabia.

Slight with imperfect balance sheet.

Market Insights

Community Narratives