- Saudi Arabia

- /

- Trade Distributors

- /

- SASE:9533

The one-year shareholder returns and company earnings persist lower as Saudi Parts Center (TADAWUL:9533) stock falls a further 10% in past week

Investing in stocks comes with the risk that the share price will fall. Unfortunately, shareholders of Saudi Parts Center Company (TADAWUL:9533) have suffered share price declines over the last year. The share price has slid 56% in that time. Saudi Parts Center hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. On top of that, the share price is down 10% in the last week.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Saudi Parts Center

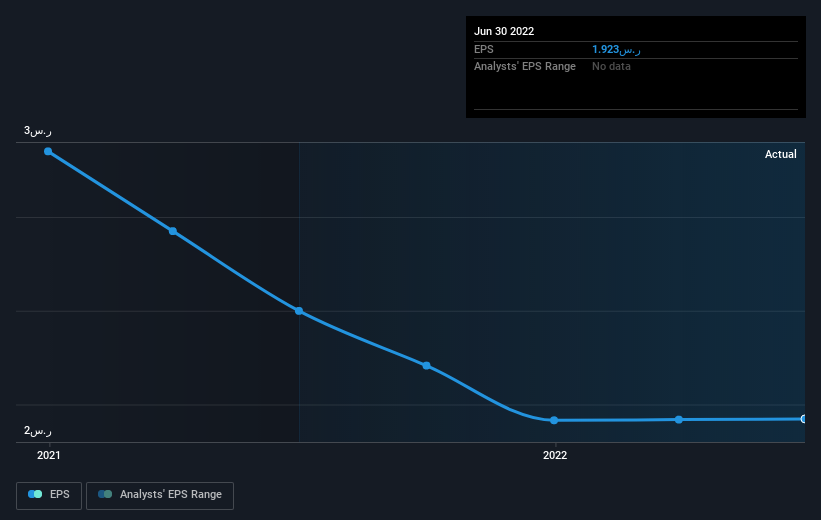

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Saudi Parts Center reported an EPS drop of 23% for the last year. This reduction in EPS is not as bad as the 56% share price fall. So it seems the market was too confident about the business, a year ago.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Saudi Parts Center shareholders are down 56% for the year, even worse than the market loss of 14%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 1.3%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for Saudi Parts Center (1 shouldn't be ignored!) that you should be aware of before investing here.

But note: Saudi Parts Center may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9533

Saudi Parts Center

Engages in the wholesale and retail trading of spare parts of trucks and heavy transport, agricultural and industrial equipment, and construction equipment and machinery in Saudi Arabia.

Adequate balance sheet low.

Market Insights

Community Narratives