- Saudi Arabia

- /

- Building

- /

- SASE:9531

Al Obeikan Glass Company's (TADAWUL:9531) Shares Not Telling The Full Story

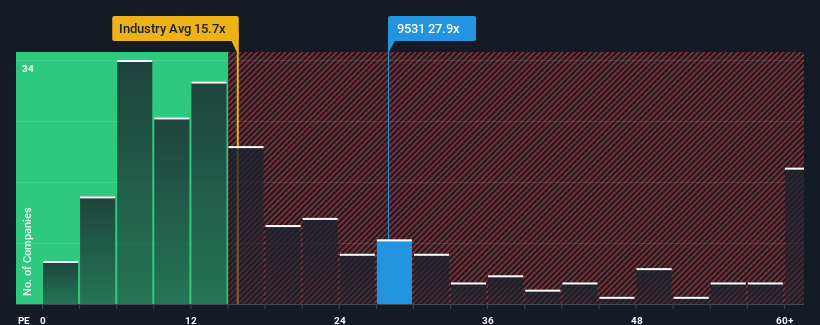

There wouldn't be many who think Al Obeikan Glass Company's (TADAWUL:9531) price-to-earnings (or "P/E") ratio of 27.9x is worth a mention when the median P/E in Saudi Arabia is similar at about 26x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Al Obeikan Glass over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Al Obeikan Glass

How Is Al Obeikan Glass' Growth Trending?

In order to justify its P/E ratio, Al Obeikan Glass would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 62%. Even so, admirably EPS has lifted 291% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is only predicted to deliver 19% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's curious that Al Obeikan Glass' P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Al Obeikan Glass currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Al Obeikan Glass that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9531

Al Obeikan Glass

Engages in wholesale and retail sale of chemicals and glass panels in Saudi Arabia and internationally.

Excellent balance sheet slight.

Market Insights

Community Narratives