- Saudi Arabia

- /

- Building

- /

- SASE:4141

Subdued Growth No Barrier To Al-Omran Industrial Trading Company (TADAWUL:4141) With Shares Advancing 25%

Those holding Al-Omran Industrial Trading Company (TADAWUL:4141) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 45% in the last twelve months.

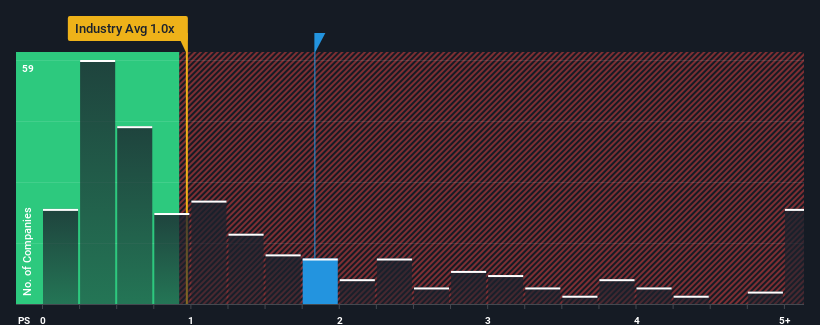

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Al-Omran Industrial Trading's P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Building industry in Saudi Arabia is also close to 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Al-Omran Industrial Trading

What Does Al-Omran Industrial Trading's Recent Performance Look Like?

The recent revenue growth at Al-Omran Industrial Trading would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on Al-Omran Industrial Trading will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Al-Omran Industrial Trading will help you shine a light on its historical performance.How Is Al-Omran Industrial Trading's Revenue Growth Trending?

In order to justify its P/S ratio, Al-Omran Industrial Trading would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.8% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 5.7% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 11% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Al-Omran Industrial Trading is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Its shares have lifted substantially and now Al-Omran Industrial Trading's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Al-Omran Industrial Trading revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 4 warning signs for Al-Omran Industrial Trading (3 don't sit too well with us!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Al-Omran Industrial Trading, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4141

Al-Omran Industrial Trading

Manufactures, imports, sells, wholesales, retails, and exports household and electronic devices and products.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives