- Saudi Arabia

- /

- Building

- /

- SASE:4141

If You Had Bought Al-Omran Industrial Trading (TADAWUL:4141) Stock Three Years Ago, You Could Pocket A 564% Gain Today

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. Not every pick can be a winner, but when you pick the right stock, you can win big. One bright shining star stock has been Al-Omran Industrial Trading Co. (TADAWUL:4141), which is 564% higher than three years ago. Also pleasing for shareholders was the 44% gain in the last three months.

It really delights us to see such great share price performance for investors.

View our latest analysis for Al-Omran Industrial Trading

While Al-Omran Industrial Trading made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years Al-Omran Industrial Trading has grown its revenue at 2.9% annually. Considering the company is losing money, we think that rate of revenue growth is uninspiring. Therefore, we're a little surprised to see the share price gain has been so strong, at 88% per year, compound, over three years. A win is a win, even if the revenue growth doesn't really explain it, in our view). The company will need to continue to execute on its business strategy to justify this rise.

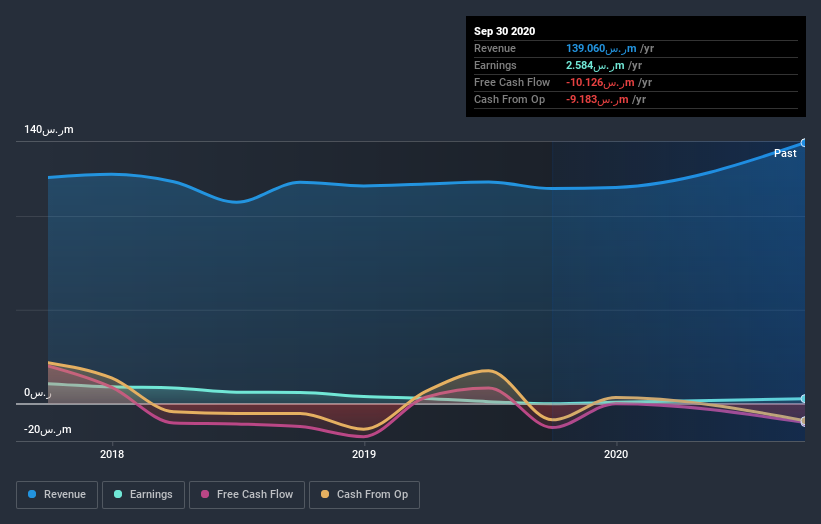

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Al-Omran Industrial Trading shareholders have gained 125% (in total) over the last year. That gain actually surpasses the 88% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. It's always interesting to track share price performance over the longer term. But to understand Al-Omran Industrial Trading better, we need to consider many other factors. For instance, we've identified 3 warning signs for Al-Omran Industrial Trading (2 are significant) that you should be aware of.

Of course Al-Omran Industrial Trading may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

When trading Al-Omran Industrial Trading or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4141

Al-Omran Industrial Trading

Manufactures, imports, sells, wholesales, retails, and exports household and electronic devices and products.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives