- Saudi Arabia

- /

- Construction

- /

- SASE:2320

Al-Babtain Power and Telecommunications Company (TADAWUL:2320) Stock Catapults 26% Though Its Price And Business Still Lag The Market

Al-Babtain Power and Telecommunications Company (TADAWUL:2320) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The annual gain comes to 121% following the latest surge, making investors sit up and take notice.

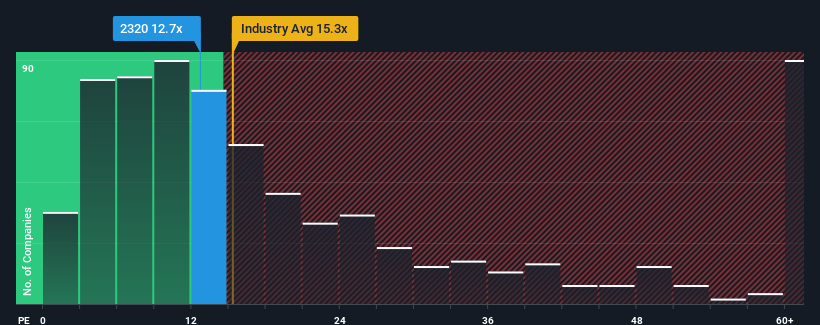

Although its price has surged higher, Al-Babtain Power and Telecommunications may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.7x, since almost half of all companies in Saudi Arabia have P/E ratios greater than 26x and even P/E's higher than 41x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Al-Babtain Power and Telecommunications has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Al-Babtain Power and Telecommunications

Is There Any Growth For Al-Babtain Power and Telecommunications?

The only time you'd be truly comfortable seeing a P/E as depressed as Al-Babtain Power and Telecommunications' is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 156%. The strong recent performance means it was also able to grow EPS by 200% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 14% as estimated by the sole analyst watching the company. That's not great when the rest of the market is expected to grow by 21%.

With this information, we are not surprised that Al-Babtain Power and Telecommunications is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Al-Babtain Power and Telecommunications' P/E

Al-Babtain Power and Telecommunications' recent share price jump still sees its P/E sitting firmly flat on the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Al-Babtain Power and Telecommunications' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 4 warning signs for Al-Babtain Power and Telecommunications that we have uncovered.

If these risks are making you reconsider your opinion on Al-Babtain Power and Telecommunications, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Al-Babtain Power and Telecommunications, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2320

Al-Babtain Power and Telecommunications

Produces lighting poles, power transmission towers and accessories in the United Arab Emirates, Saudi Arabia, and Egyptian Arabic Republic.

Proven track record with adequate balance sheet and pays a dividend.