- Saudi Arabia

- /

- Construction

- /

- SASE:2320

Taking A Look At Al-Babtain Power and Telecommunication Co.'s (TADAWUL:2320) ROE

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. To keep the lesson grounded in practicality, we'll use ROE to better understand Al-Babtain Power and Telecommunication Co. (TADAWUL:2320).

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for Al-Babtain Power and Telecommunication

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Al-Babtain Power and Telecommunication is:

9.7% = ر.س80m ÷ ر.س832m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every SAR1 worth of shareholders' equity, the company generated SAR0.10 in profit.

Does Al-Babtain Power and Telecommunication Have A Good Return On Equity?

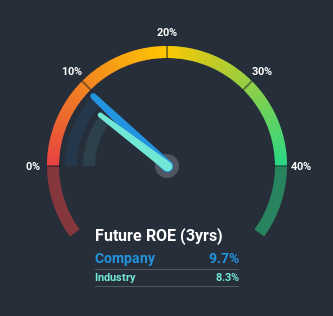

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. However, this method is only useful as a rough check, because companies do differ quite a bit within the same industry classification. The image below shows that Al-Babtain Power and Telecommunication has an ROE that is roughly in line with the Construction industry average (8.3%).

That isn't amazing, but it is respectable. Even if the ROE is respectable when compared to the industry, its worth checking if the firm's ROE is being aided by high debt levels. If a company takes on too much debt, it is at higher risk of defaulting on interest payments. Our risks dashboardshould have the 3 risks we have identified for Al-Babtain Power and Telecommunication.

How Does Debt Impact Return On Equity?

Virtually all companies need money to invest in the business, to grow profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the use of debt will improve the returns, but will not change the equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Al-Babtain Power and Telecommunication's Debt And Its 9.7% ROE

It's worth noting the high use of debt by Al-Babtain Power and Telecommunication, leading to its debt to equity ratio of 1.13. Its ROE is quite low, even with the use of significant debt; that's not a good result, in our opinion. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it.

Conclusion

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have the same ROE, then I would generally prefer the one with less debt.

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. You can see how the company has grow in the past by looking at this FREE detailed graph of past earnings, revenue and cash flow.

Of course Al-Babtain Power and Telecommunication may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

If you decide to trade Al-Babtain Power and Telecommunication, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2320

Al-Babtain Power and Telecommunications

Produces lighting poles, power transmission towers and accessories in the United Arab Emirates, Saudi Arabia, and Egyptian Arabic Republic.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives