- South Korea

- /

- Electrical

- /

- KOSDAQ:A033100

Undiscovered Gems And 2 Other Promising Small Caps To Consider

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced challenges with the Russell 2000 Index underperforming against larger indices such as the S&P 500. Despite this, opportunities remain for discerning investors as economic indicators suggest potential rate cuts that could provide a more favorable environment for smaller companies to thrive. Identifying promising small-cap stocks often involves looking for those with solid fundamentals and growth potential, especially in sectors resilient to broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Tureks Turizm Tasimacilik Anonim Sirketi (IBSE:TUREX)

Simply Wall St Value Rating: ★★★★★★

Overview: Tureks Turizm Tasimacilik Anonim Sirketi offers transportation services to public and private institutions in Turkey, with a market capitalization of TRY16.04 billion.

Operations: The company's revenue streams primarily involve providing transportation services to public and private institutions in Turkey. It has a market capitalization of TRY16.04 billion, reflecting its significant presence in the industry.

Tureks Turizm Tasimacilik Anonim Sirketi, a smaller player in the transportation sector, has exhibited robust earnings growth of 59% annually over the past five years. Despite a volatile share price recently, its debt to equity ratio impressively decreased from 74.2% to 4.7%, indicating strong financial management. The company's EBIT covers interest payments five times over, underscoring its solid operational performance. However, recent earnings reports show a dip in net income for the third quarter at TRY 80 million compared to TRY 125 million last year, suggesting potential challenges ahead despite high-quality past earnings and satisfactory debt levels.

Cheryong ElectricLtd (KOSDAQ:A033100)

Simply Wall St Value Rating: ★★★★★★

Overview: Cheryong Electric Co., Ltd. manufactures and sells power electric equipment in South Korea, with a market cap of ₩728.43 billion.

Operations: Cheryong Electric Co., Ltd. generates revenue primarily from the sale of power electric equipment within South Korea. The company's financial performance is highlighted by a gross profit margin trend that shows variability over recent periods, reflecting changes in production efficiency and cost management.

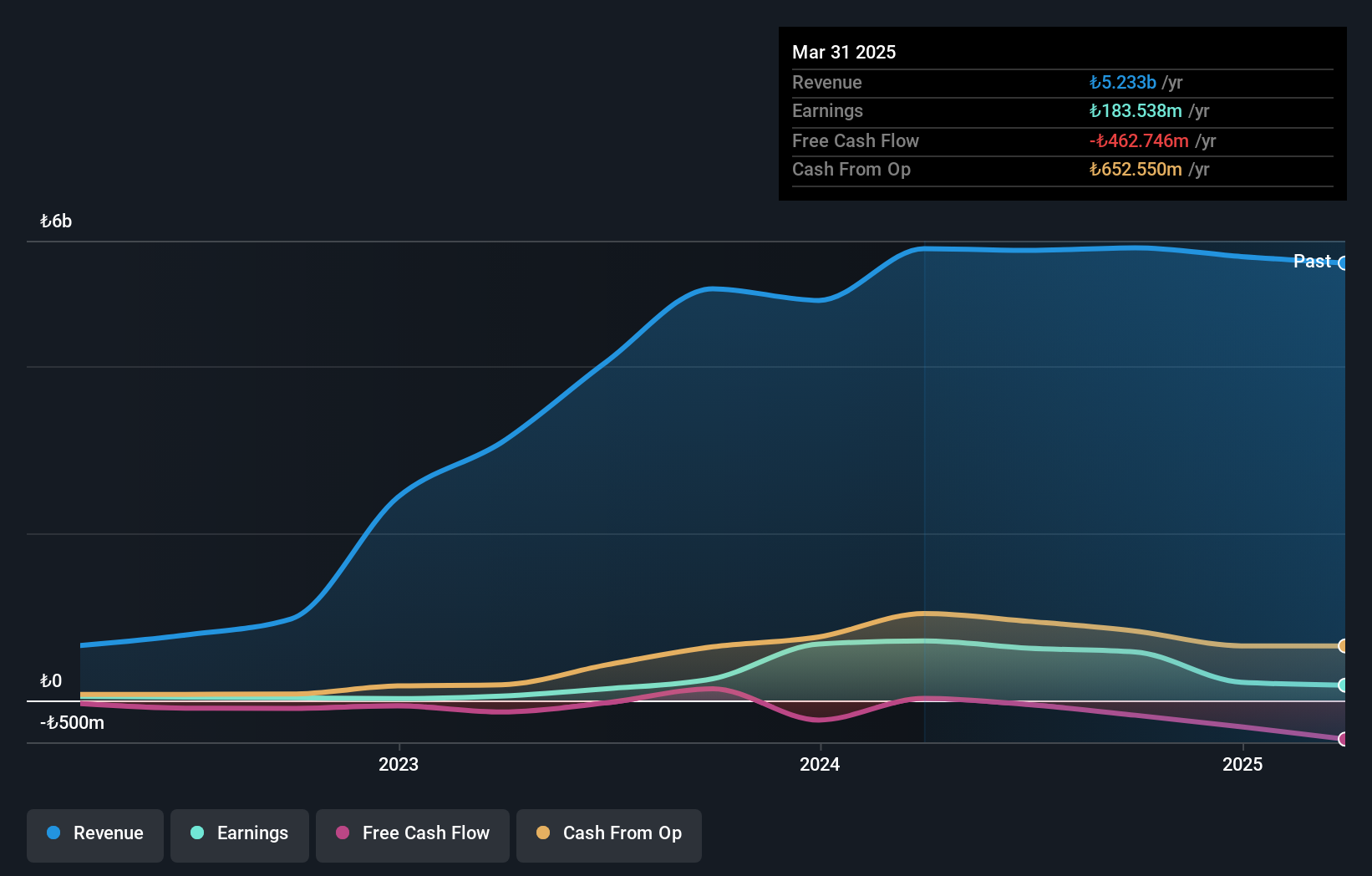

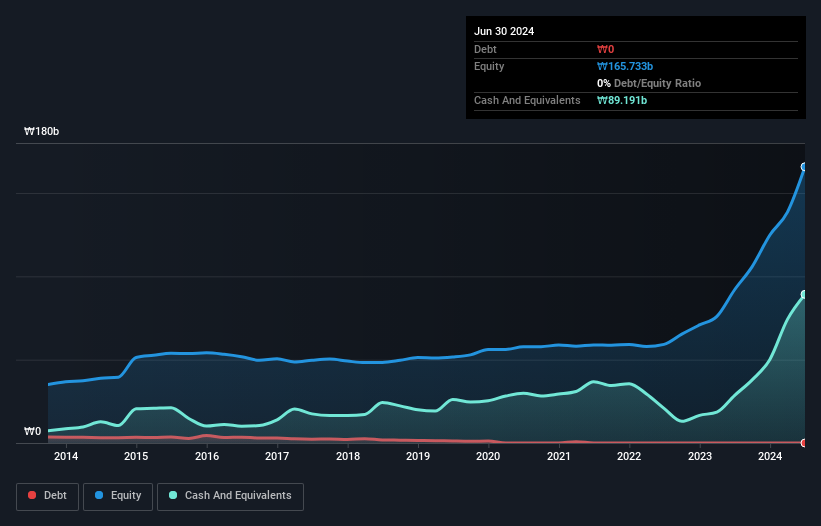

Cheryong Electric Ltd., a nimble player in the electrical industry, has caught attention with its impressive earnings growth of 106% over the past year, surpassing the industry's 14%. The company trades at an attractive value, reportedly 92% below fair value estimates. Despite recent share price volatility, Cheryong's high-quality earnings and debt-free status add to its appeal. Over five years, it has successfully eliminated debt from a previous ratio of 2%, enhancing financial stability. With positive free cash flow and profitability ensuring a solid cash runway, future prospects seem promising as earnings are projected to grow annually by around 8%.

Bawan (SASE:1302)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bawan Company specializes in manufacturing and selling metal and steel works in the Kingdom of Saudi Arabia, with a market capitalization of SAR3.13 billion.

Operations: Bawan generates revenue primarily from three segments: Metal and Wood (SAR2.12 billion), Electrical (SAR571.18 million), and Plastic (SAR365.98 million).

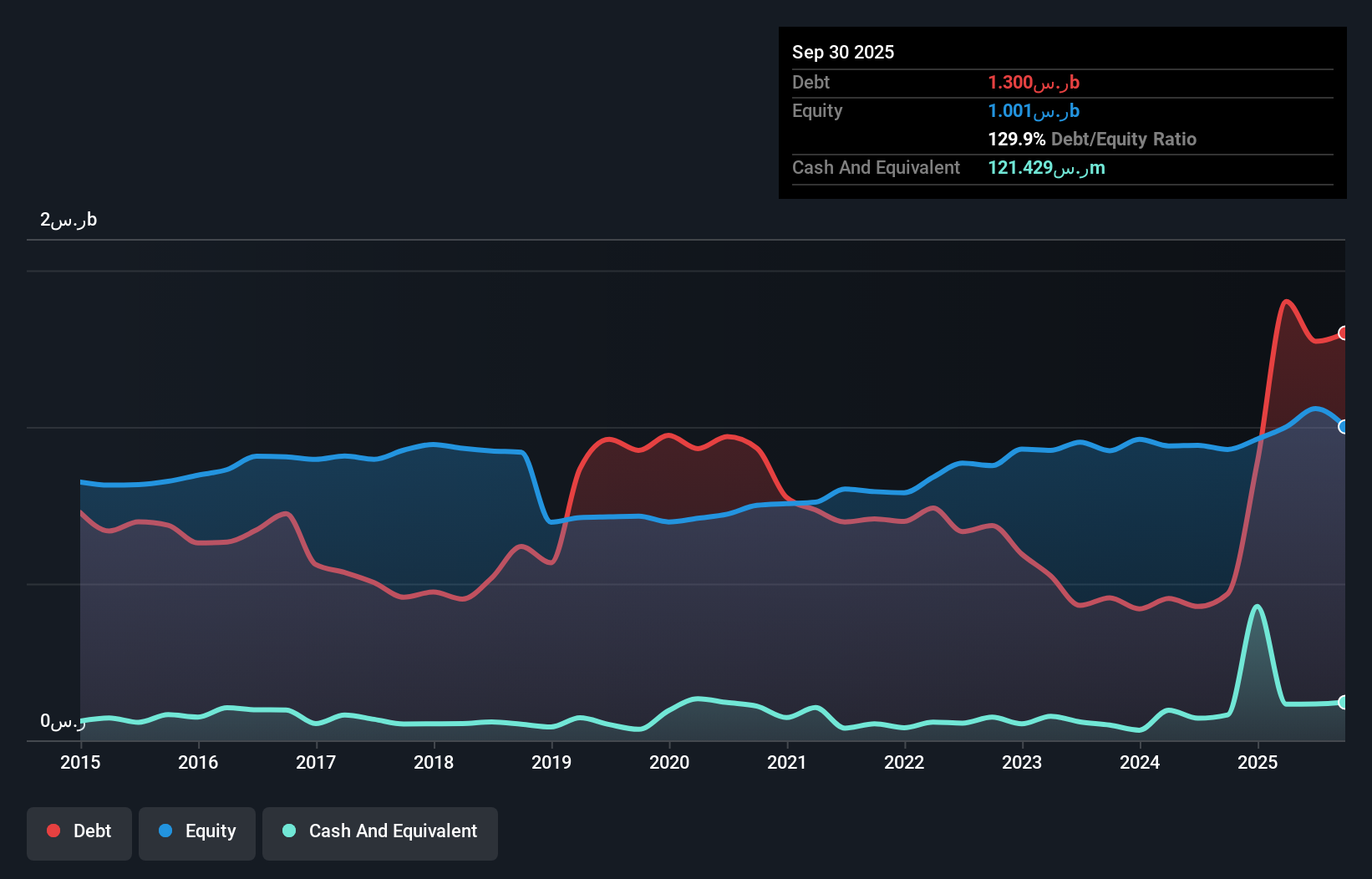

Bawan, a relatively small player in the construction sector, has shown resilience despite facing challenges. Over the past year, earnings growth was negative at -6.1%, yet this outperformed the industry average of -11.6%. The company reported third-quarter sales of SAR 682.6 million and net income of SAR 23.45 million, reflecting a decrease from last year's figures but still maintaining profitability with basic earnings per share at SAR 0.39. Bawan's net debt to equity ratio stands at a high 41.6%, though it has significantly reduced its debt from 129% to 50% over five years, indicating improved financial health and potential for future growth with forecasted earnings increase of about 17% annually.

- Delve into the full analysis health report here for a deeper understanding of Bawan.

Evaluate Bawan's historical performance by accessing our past performance report.

Where To Now?

- Investigate our full lineup of 4495 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A033100

Cheryong ElectricLtd

Manufactures and sells power electric equipment in South Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives