- Saudi Arabia

- /

- Banks

- /

- SASE:1080

Middle Eastern Dividend Stocks Including Saudi Investment Bank

Reviewed by Simply Wall St

As most Gulf bourses rise on the back of higher oil prices and global market rallies, investors in the Middle East are keeping a close watch on the U.S. Federal Reserve's policy meeting, which could influence regional markets due to currency pegs to the dollar. In this dynamic environment, dividend stocks such as those from Saudi Investment Bank offer potential stability and income generation, making them attractive options for investors seeking reliable returns amidst fluctuating economic conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.43% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.35% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.07% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.37% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.75% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.39% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.80% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.74% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.37% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.81% | ★★★★★☆ |

Click here to see the full list of 68 stocks from our Top Middle Eastern Dividend Stocks screener.

We'll examine a selection from our screener results.

Saudi Investment Bank (SASE:1030)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Saudi Investment Bank offers commercial and retail banking services to individuals, small to medium-sized businesses, and corporate and institutional clients in Saudi Arabia, with a market cap of SAR17.46 billion.

Operations: The Saudi Investment Bank's revenue is derived from its Retail Banking segment (SAR1.49 billion), Corporate Banking (SAR1.40 billion), Asset Management and Brokerage (SAR255.37 million), and Treasury and Investments, including Business Partners (SAR1.14 billion).

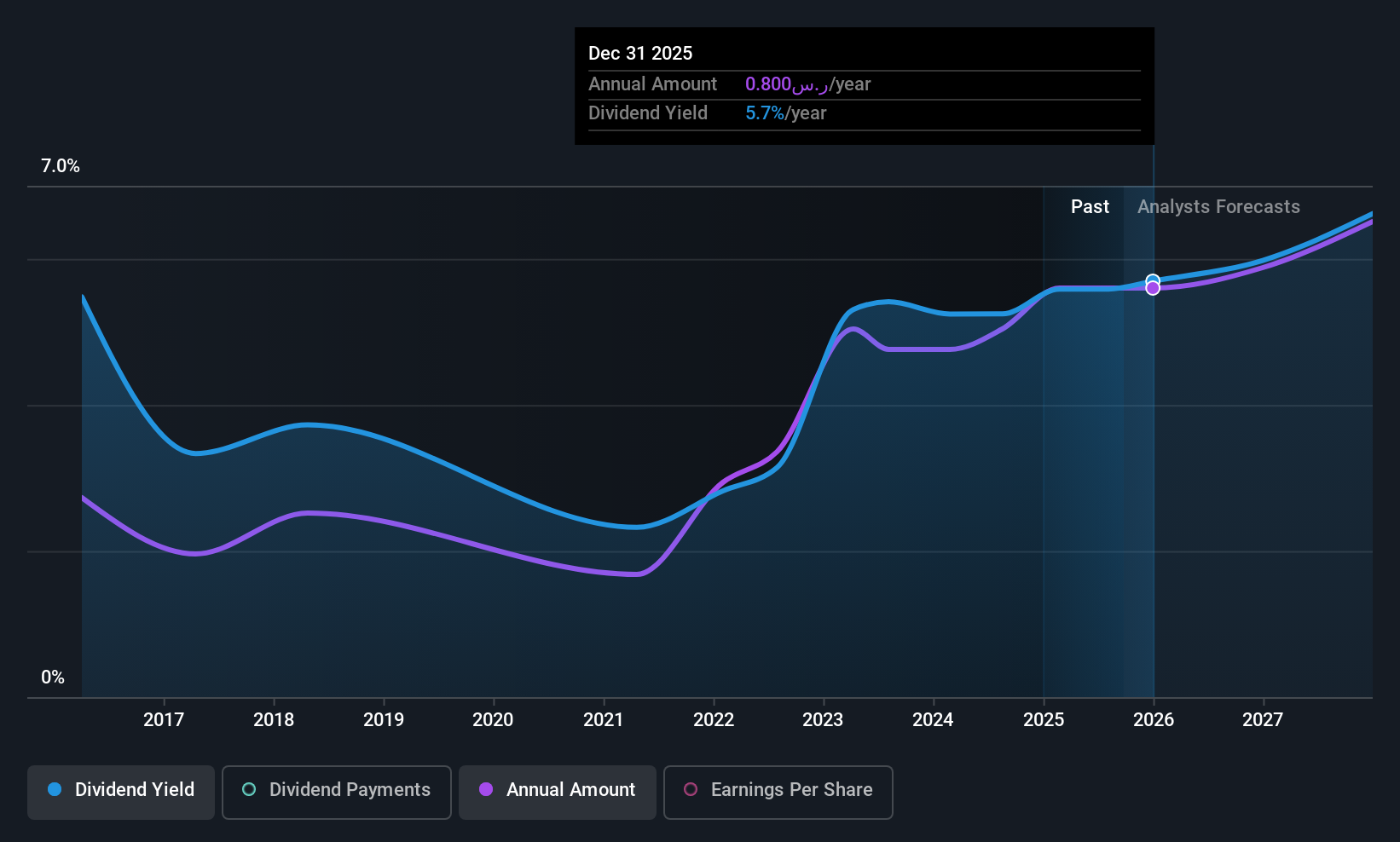

Dividend Yield: 5.7%

Saudi Investment Bank offers a compelling dividend yield of 5.71%, ranking it in the top 25% of dividend payers in Saudi Arabia, with dividends currently covered by earnings at a payout ratio of 55.7%. However, its dividend history has been volatile over the past decade, marked by significant drops exceeding 20%. Recent Q3 earnings show stable net income at SAR 518.41 million, indicating consistent financial performance despite past volatility in dividends.

- Dive into the specifics of Saudi Investment Bank here with our thorough dividend report.

- Our expertly prepared valuation report Saudi Investment Bank implies its share price may be too high.

Arab National Bank (SASE:1080)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arab National Bank offers a range of banking products and services across the Kingdom of Saudi Arabia, other GCC countries, the Middle East, Europe, North America, Latin America, Southeast Asia, and globally with a market cap of SAR48.88 billion.

Operations: Arab National Bank's revenue segments include banking products and services provided across various regions, including the Kingdom of Saudi Arabia, other GCC countries, the Middle East, Europe, North America, Latin America, Southeast Asia, and internationally.

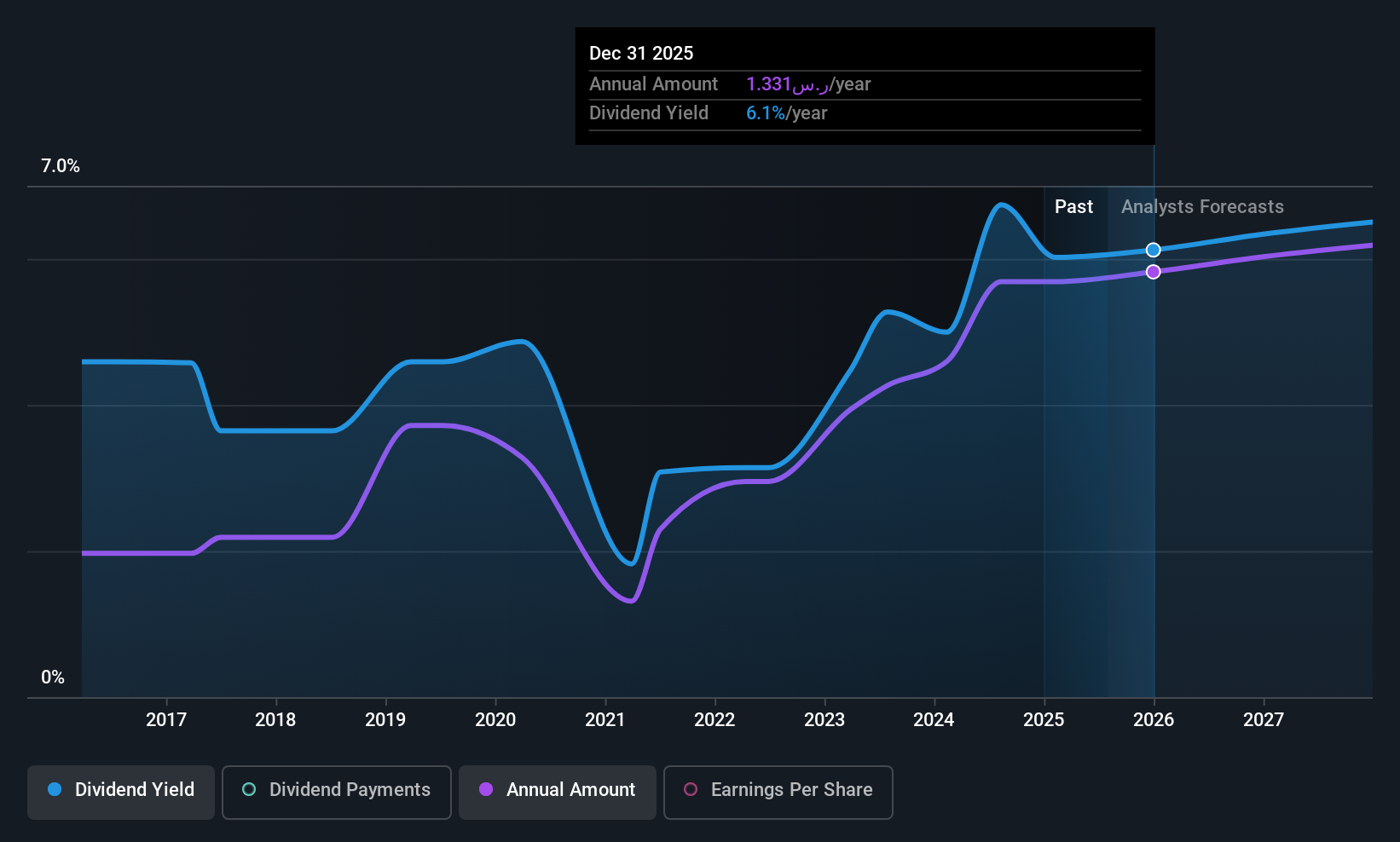

Dividend Yield: 5.3%

Arab National Bank's dividend yield of 5.26% is slightly below the top 25% in the Saudi market, with a current payout ratio of 49.6%, indicating dividends are well covered by earnings. Despite past volatility and unreliability in its dividend history, recent earnings growth and a forecasted stable payout ratio suggest potential for future stability. The bank's strategic financial moves include redeeming USD 750 million Tier 2 Sukuk early, reflecting strong fiscal management amidst evolving market conditions.

- Click here and access our complete dividend analysis report to understand the dynamics of Arab National Bank.

- Upon reviewing our latest valuation report, Arab National Bank's share price might be too pessimistic.

Computer Direct Group (TASE:CMDR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Computer Direct Group Ltd. operates in the computing and software industry in Israel with a market cap of ₪1.68 billion.

Operations: Computer Direct Group Ltd. generates revenue from three main segments: Infrastructure and Computing (₪1.28 billion), Outsourcing of Business Processes and Technology Support Centers (₪365.75 million), and Technological Solutions and Services, Management Consulting, and Value-Added Services (₪2.68 billion).

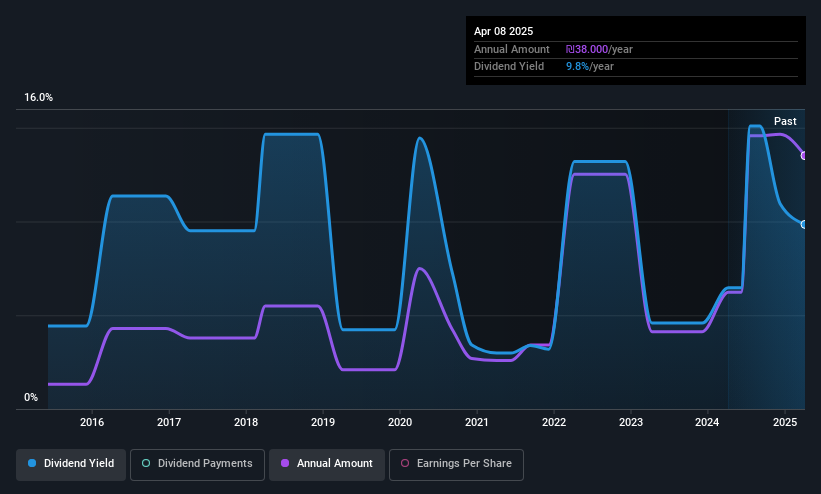

Dividend Yield: 7.7%

Computer Direct Group's dividend yield of 7.74% ranks in the top 25% of dividend payers in the Israeli market, with a payout ratio of 59.5%, indicating dividends are well supported by earnings and cash flows. Despite past volatility and unreliability, recent growth in earnings—16.3% annually over five years—and an undervaluation at 63.7% below estimated fair value suggest potential for improvement, although its unstable dividend track record remains a concern for investors seeking consistent returns.

- Click here to discover the nuances of Computer Direct Group with our detailed analytical dividend report.

- Our valuation report here indicates Computer Direct Group may be undervalued.

Turning Ideas Into Actions

- Click here to access our complete index of 68 Top Middle Eastern Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1080

Arab National Bank

Provides various banking products and services in the Kingdom of Saudi Arabia, Other GCC and the Middle East, Europe, North America, Latin America, Southeast Asia, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives