- Russia

- /

- Electric Utilities

- /

- MISX:RTSB

Investors Can Find Comfort In TNS energo Rostov-on-Don's (MCX:RTSB) Earnings Quality

Soft earnings didn't appear to concern Public Joint Stock Company "TNS energo Rostov-on-Don"'s (MCX:RTSB) shareholders over the last week. We think that the softer headline numbers might be getting counterbalanced by some positive underlying factors.

See our latest analysis for TNS energo Rostov-on-Don

A Closer Look At TNS energo Rostov-on-Don's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

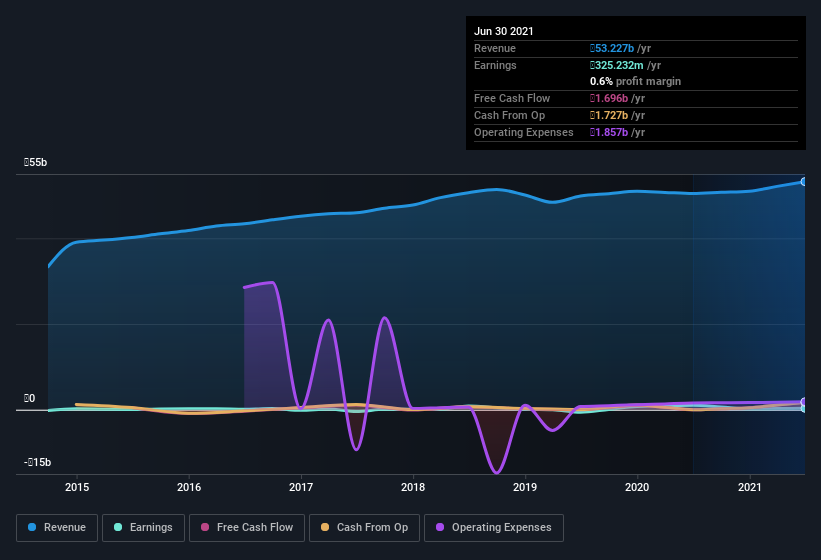

TNS energo Rostov-on-Don has an accrual ratio of -0.52 for the year to June 2021. Therefore, its statutory earnings were very significantly less than its free cashflow. In fact, it had free cash flow of ₽1.7b in the last year, which was a lot more than its statutory profit of ₽325.2m. Given that TNS energo Rostov-on-Don had negative free cash flow in the prior corresponding period, the trailing twelve month resul of ₽1.7b would seem to be a step in the right direction. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of TNS energo Rostov-on-Don.

How Do Unusual Items Influence Profit?

TNS energo Rostov-on-Don's profit was reduced by unusual items worth ₽150m in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. This is what you'd expect to see where a company has a non-cash charge reducing paper profits. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. If TNS energo Rostov-on-Don doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On TNS energo Rostov-on-Don's Profit Performance

In conclusion, both TNS energo Rostov-on-Don's accrual ratio and its unusual items suggest that its statutory earnings are probably reasonably conservative. After considering all this, we reckon TNS energo Rostov-on-Don's statutory profit probably understates its earnings potential! In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Every company has risks, and we've spotted 5 warning signs for TNS energo Rostov-on-Don (of which 2 are a bit unpleasant!) you should know about.

After our examination into the nature of TNS energo Rostov-on-Don's profit, we've come away optimistic for the company. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade TNS energo Rostov-on-Don, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TNS energo Rostov-on-Don might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:RTSB

TNS energo Rostov-on-Don

Public Joint Stock Company "TNS energo Rostov-on-Don" supplies electricity in the Rostov region, Russia.

Solid track record and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026