- Russia

- /

- Electric Utilities

- /

- MISX:RSTI

Rosseti, Public Joint Stock Company (MCX:RSTI) Released Earnings Last Week And Analysts Lifted Their Price Target To ₽1.47

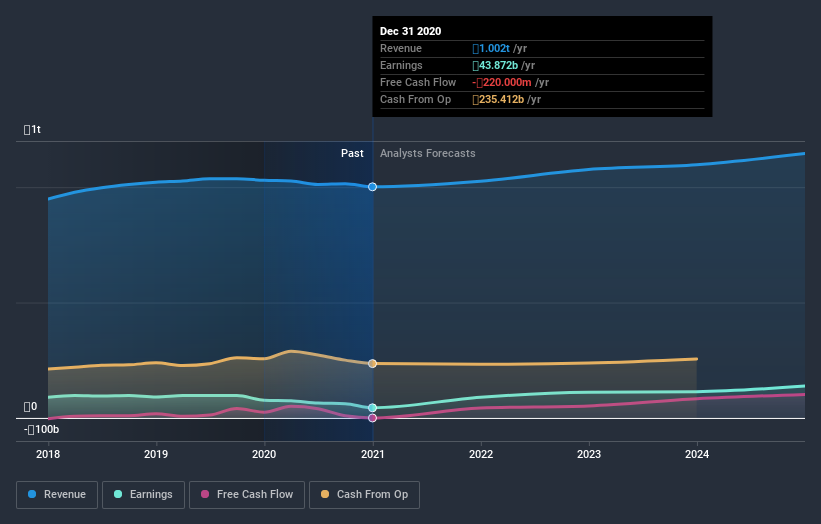

The full-year results for Rosseti, Public Joint Stock Company (MCX:RSTI) were released last week, making it a good time to revisit its performance. It was an okay result overall, with revenues coming in at ₽1.0t, roughly what the analysts had been expecting. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Rosseti

Taking into account the latest results, the consensus forecast from Rosseti's three analysts is for revenues of ₽1.03t in 2021, which would reflect an okay 2.5% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to soar 45% to ₽0.45. In the lead-up to this report, the analysts had been modelling revenues of ₽1.06t and earnings per share (EPS) of ₽0.51 in 2021. The analysts seem less optimistic after the recent results, reducing their sales forecasts and making a real cut to earnings per share numbers.

The average price target climbed 15% to ₽1.47despite the reduced earnings forecasts, suggesting that this earnings impact could be a positive for the stock, once it passes. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Rosseti, with the most bullish analyst valuing it at ₽1.70 and the most bearish at ₽1.30 per share. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Rosseti is an easy business to forecast or the the analysts are all using similar assumptions.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Rosseti's revenue growth is expected to slow, with the forecast 2.5% annualised growth rate until the end of 2021 being well below the historical 5.1% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 3.3% per year. Factoring in the forecast slowdown in growth, it seems obvious that Rosseti is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Rosseti analysts - going out to 2024, and you can see them free on our platform here.

And what about risks? Every company has them, and we've spotted 3 warning signs for Rosseti you should know about.

If you decide to trade Rosseti, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:RSTI

Rosseti

Rosseti, Public Joint Stock Company, together with its subsidiaries, provides electricity transmission and distribution services in Russia.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026