David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Public Joint Stock Company Rosseti Volga (MCX:MRKV) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Rosseti Volga

What Is Rosseti Volga's Debt?

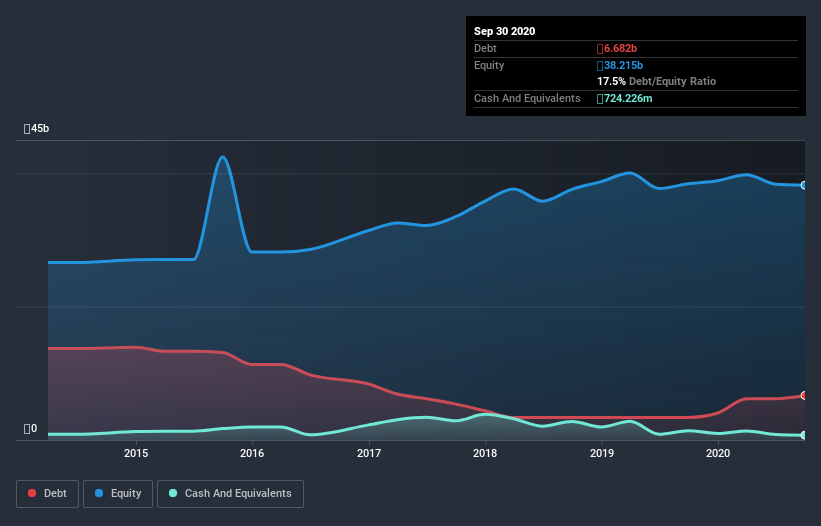

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Rosseti Volga had ₽6.68b of debt, an increase on ₽3.38b, over one year. However, because it has a cash reserve of ₽724.2m, its net debt is less, at about ₽5.96b.

How Healthy Is Rosseti Volga's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Rosseti Volga had liabilities of ₽7.82b due within 12 months and liabilities of ₽13.6b due beyond that. On the other hand, it had cash of ₽724.2m and ₽6.02b worth of receivables due within a year. So it has liabilities totalling ₽14.6b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of ₽12.5b, we think shareholders really should watch Rosseti Volga's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Rosseti Volga has net debt of just 1.0 times EBITDA, indicating that it is certainly not a reckless borrower. And it boasts interest cover of 8.0 times, which is more than adequate. In fact Rosseti Volga's saving grace is its low debt levels, because its EBIT has tanked 75% in the last twelve months. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Rosseti Volga's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Rosseti Volga created free cash flow amounting to 20% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Mulling over Rosseti Volga's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. We should also note that Electric Utilities industry companies like Rosseti Volga commonly do use debt without problems. Overall, it seems to us that Rosseti Volga's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Rosseti Volga you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Rosseti Volga or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:MRKV

Rosseti Volga

Public Joint Stock Company Rosseti Volga transmits and distributes electric power in Russia.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives