- Russia

- /

- Electric Utilities

- /

- MISX:MRKP

These 4 Measures Indicate That Interregional Distribution Grid Company of Center and Volga Region (MCX:MRKP) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Interregional Distribution Grid Company of Center and Volga Region, Public Joint Stock Company (MCX:MRKP) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Interregional Distribution Grid Company of Center and Volga Region

How Much Debt Does Interregional Distribution Grid Company of Center and Volga Region Carry?

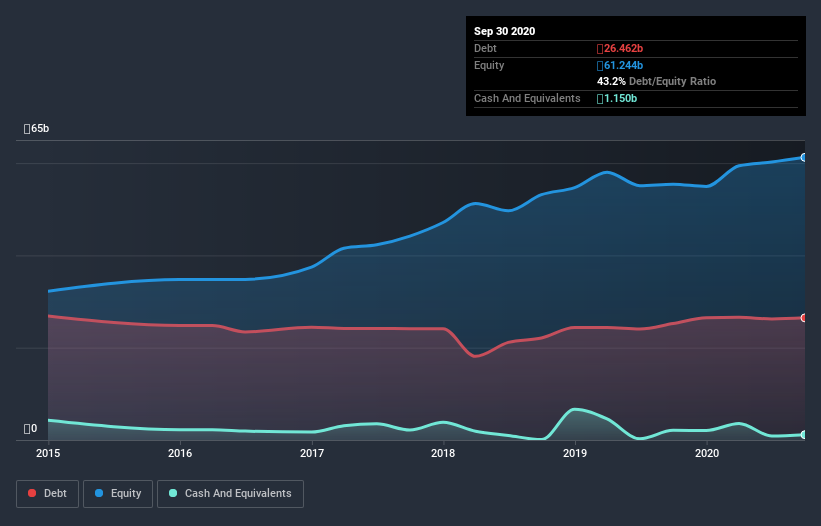

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Interregional Distribution Grid Company of Center and Volga Region had ₽26.5b of debt, an increase on ₽25.2b, over one year. However, because it has a cash reserve of ₽1.15b, its net debt is less, at about ₽25.3b.

How Strong Is Interregional Distribution Grid Company of Center and Volga Region's Balance Sheet?

The latest balance sheet data shows that Interregional Distribution Grid Company of Center and Volga Region had liabilities of ₽24.1b due within a year, and liabilities of ₽30.9b falling due after that. Offsetting these obligations, it had cash of ₽1.15b as well as receivables valued at ₽28.4b due within 12 months. So it has liabilities totalling ₽25.4b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of ₽29.1b, so it does suggest shareholders should keep an eye on Interregional Distribution Grid Company of Center and Volga Region's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Looking at its net debt to EBITDA of 1.4 and interest cover of 5.9 times, it seems to us that Interregional Distribution Grid Company of Center and Volga Region is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Sadly, Interregional Distribution Grid Company of Center and Volga Region's EBIT actually dropped 8.7% in the last year. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Interregional Distribution Grid Company of Center and Volga Region can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Interregional Distribution Grid Company of Center and Volga Region created free cash flow amounting to 18% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

On this analysis Interregional Distribution Grid Company of Center and Volga Region's level of total liabilities and EBIT growth rate both make us a little nervous. But the good news is that its solid net debt to EBITDA gives us reason for some optimism. We should also note that Electric Utilities industry companies like Interregional Distribution Grid Company of Center and Volga Region commonly do use debt without problems. Once we consider all the factors above, together, it seems to us that Interregional Distribution Grid Company of Center and Volga Region's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Interregional Distribution Grid Company of Center and Volga Region is showing 1 warning sign in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Interregional Distribution Grid Company of Center and Volga Region, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:MRKP

Rosseti Centre and Volga region

Public Joint stock company Rosseti Centre and Volga region, together with its subsidiaries, engages in the transmission and distribution of electricity in Russia.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.