- Russia

- /

- Electric Utilities

- /

- MISX:KUBE

Is Kuban power and electrification (MCX:KUBE) A Future Multi-bagger?

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So on that note, Kuban power and electrification (MCX:KUBE) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Kuban power and electrification is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = ₽6.5b ÷ (₽76b - ₽13b) (Based on the trailing twelve months to March 2020).

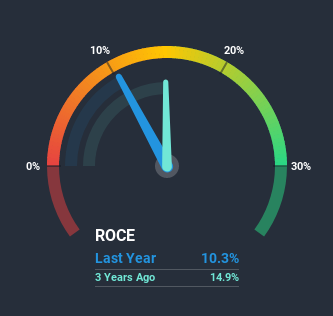

Therefore, Kuban power and electrification has an ROCE of 10%. On its own, that's a standard return, however it's much better than the 7.8% generated by the Electric Utilities industry.

See our latest analysis for Kuban power and electrification

Above you can see how the current ROCE for Kuban power and electrification compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

The Trend Of ROCE

Kuban power and electrification is displaying some positive trends. The data shows that returns on capital have increased substantially over the last five years to 10%. Basically the business is earning more per dollar of capital invested and in addition to that, 76% more capital is being employed now too. So we're very much inspired by what we're seeing at Kuban power and electrification thanks to its ability to profitably reinvest capital.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 17%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books.The Bottom Line On Kuban power and electrification's ROCE

All in all, it's terrific to see that Kuban power and electrification is reaping the rewards from prior investments and is growing its capital base. Since the stock has only returned 25% to shareholders over the last five years, the promising fundamentals may not be recognized yet by investors. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

One more thing: We've identified 2 warning signs with Kuban power and electrification (at least 1 which is a bit concerning) , and understanding these would certainly be useful.

While Kuban power and electrification may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Kuban power and electrification, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About MISX:KUBE

Rosseti Kuban PJSC

Rosseti Kuban PJSC, a grid company, engages in the transmission and distribution of electricity in Russia.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026