- Russia

- /

- Electric Utilities

- /

- MISX:KUBE

Here's Why Kuban power and electrification (MCX:KUBE) Has A Meaningful Debt Burden

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Kuban power and electrification public joint stock company (MCX:KUBE) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Kuban power and electrification

What Is Kuban power and electrification's Debt?

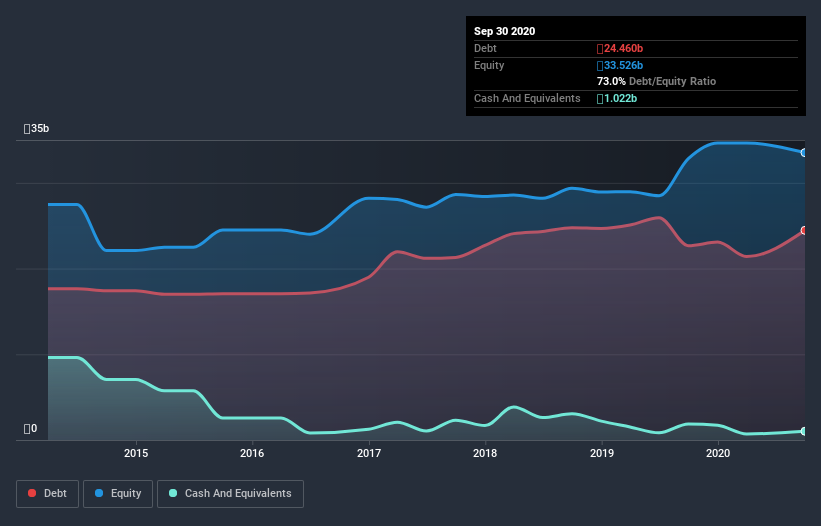

As you can see below, at the end of September 2020, Kuban power and electrification had ₽24.5b of debt, up from ₽22.7b a year ago. Click the image for more detail. However, it does have ₽1.02b in cash offsetting this, leading to net debt of about ₽23.4b.

A Look At Kuban power and electrification's Liabilities

The latest balance sheet data shows that Kuban power and electrification had liabilities of ₽16.7b due within a year, and liabilities of ₽26.5b falling due after that. On the other hand, it had cash of ₽1.02b and ₽9.06b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₽33.1b.

Given this deficit is actually higher than the company's market capitalization of ₽24.2b, we think shareholders really should watch Kuban power and electrification's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about Kuban power and electrification's net debt to EBITDA ratio of 2.7, we think its super-low interest cover of 2.3 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. On the other hand, Kuban power and electrification grew its EBIT by 22% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Kuban power and electrification can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Kuban power and electrification saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Kuban power and electrification's level of total liabilities and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But at least it's pretty decent at growing its EBIT; that's encouraging. It's also worth noting that Kuban power and electrification is in the Electric Utilities industry, which is often considered to be quite defensive. We're quite clear that we consider Kuban power and electrification to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Kuban power and electrification that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Kuban power and electrification, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:KUBE

Rosseti Kuban PJSC

Rosseti Kuban PJSC, a grid company, engages in the transmission and distribution of electricity in Russia.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026