- Russia

- /

- Metals and Mining

- /

- MISX:MAGN

Is Public Joint Stock Company Magnitogorsk Iron & Steel Works' (MCX:MAGN) Recent Stock Performance Influenced By Its Fundamentals In Any Way?

Magnitogorsk Iron & Steel Works' (MCX:MAGN) stock is up by a considerable 50% over the past three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Particularly, we will be paying attention to Magnitogorsk Iron & Steel Works' ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Magnitogorsk Iron & Steel Works

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Magnitogorsk Iron & Steel Works is:

8.7% = US$379m ÷ US$4.3b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each RUB1 of shareholders' capital it has, the company made RUB0.09 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Magnitogorsk Iron & Steel Works' Earnings Growth And 8.7% ROE

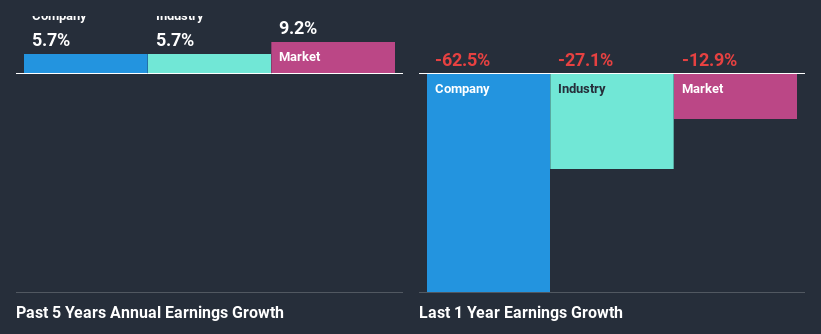

It is hard to argue that Magnitogorsk Iron & Steel Works' ROE is much good in and of itself. A comparison with the industry shows that the company's ROE is pretty similar to the average industry ROE of 9.0%. As a result, Magnitogorsk Iron & Steel Works' decent 5.7% net income growth seen over the past five years bodes well with us. Given the low ROE, it is likely that there could be some other aspects that are driving this growth as well. Such as - high earnings retention or an efficient management in place.

We then performed a comparison between Magnitogorsk Iron & Steel Works' net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 5.7% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is MAGN fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Magnitogorsk Iron & Steel Works Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 81% (or a retention ratio of 19%) for Magnitogorsk Iron & Steel Works suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

Moreover, Magnitogorsk Iron & Steel Works is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 102% over the next three years. Regardless, the future ROE for Magnitogorsk Iron & Steel Works is speculated to rise to 26% despite the anticipated increase in the payout ratio. There could probably be other factors that could be driving the future growth in the ROE.

Summary

In total, it does look like Magnitogorsk Iron & Steel Works has some positive aspects to its business. Namely, its high earnings growth. We do however feel that the earnings growth number could have been even higher, had the company been reinvesting more of its earnings and paid out less dividends. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

When trading Magnitogorsk Iron & Steel Works or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Magnitogorsk Iron & Steel Works, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:MAGN

Magnitogorsk Iron & Steel Works

Public Joint Stock Company Magnitogorsk Iron & Steel Works, together with its subsidiaries, produces and sells ferrous metal products in Russia and the CIS countries, the Middle East, South Africa, Asia, Europe, North America, and Africa.

Solid track record with excellent balance sheet and pays a dividend.