- Russia

- /

- Metals and Mining

- /

- MISX:BRZL

The Buryatzoloto (MCX:BRZL) Share Price Has Gained 27% And Shareholders Are Hoping For More

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. For example, the Public Joint Stock Company Buryatzoloto (MCX:BRZL) share price is up 27% in the last year, clearly besting the market return of around 17% (not including dividends). That's a solid performance by our standards! Zooming out, the stock is up 26% in the last three years.

Check out our latest analysis for Buryatzoloto

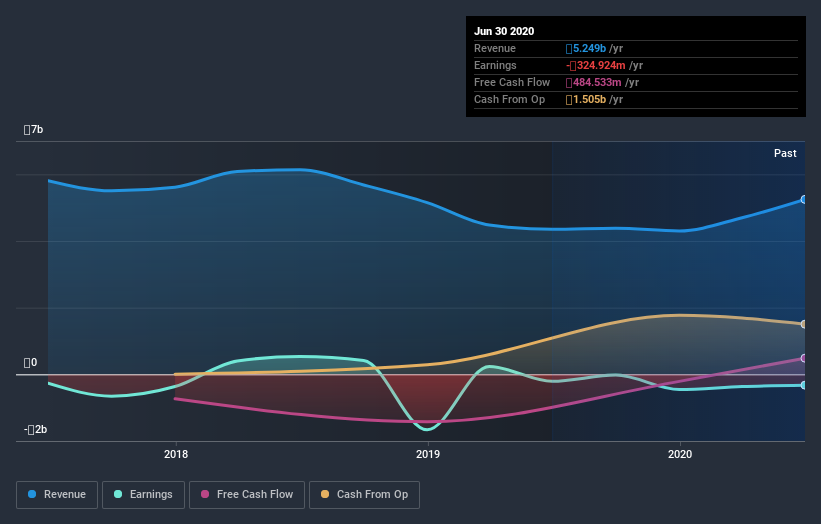

Given that Buryatzoloto didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Buryatzoloto grew its revenue by 21% last year. That's a fairly respectable growth rate. Buyers pushed the share price 27% in response, which isn't unreasonable. If the company can maintain the revenue growth, the share price could go higher still. But it's crucial to check profitability and cash flow before forming a view on the future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Buryatzoloto's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Buryatzoloto provided a TSR of 27% over the year. That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 3% over the last five years. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. It's always interesting to track share price performance over the longer term. But to understand Buryatzoloto better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Buryatzoloto (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

When trading Buryatzoloto or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Buryatzoloto, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Buryatzoloto might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:BRZL

Buryatzoloto

Public Joint Stock Company Buryatzoloto engages in the exploration and production of gold properties in the Republic of Buryatia.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives