- Russia

- /

- Metals and Mining

- /

- MISX:AMEZ

Investors Who Bought Ashinskiy metallurgical works (MCX:AMEZ) Shares Five Years Ago Are Now Up 83%

The Public Joint Stock Company "Ashinskiy metallurgical works" (MCX:AMEZ) share price has had a bad week, falling 17%. But the silver lining is the stock is up over five years. However we are not very impressed because the share price is only up 83%, less than the market return of 129%.

Check out our latest analysis for Ashinskiy metallurgical works

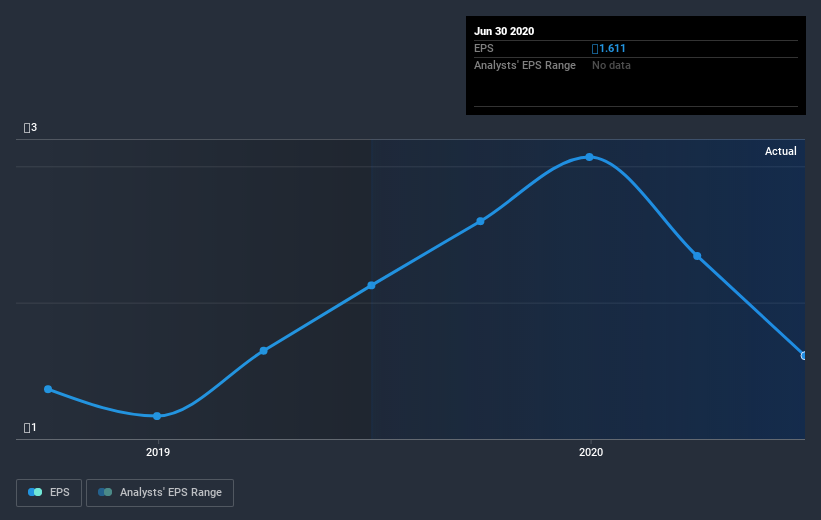

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the five years of share price growth, Ashinskiy metallurgical works moved from a loss to profitability. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Ashinskiy metallurgical works' earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Ashinskiy metallurgical works shareholders have received a total shareholder return of 50% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 13% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Ashinskiy metallurgical works better, we need to consider many other factors. Even so, be aware that Ashinskiy metallurgical works is showing 3 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

When trading Ashinskiy metallurgical works or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:AMEZ

Ashinskiy metallurgical works

Public Joint Stock Company 'Ashinskiy metallurgical works' operates as a metallurgical company in Russia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives