- Russia

- /

- Auto Components

- /

- MISX:CHKZ

Chelyabinsk Forge-and-Press Plant (MCX:CHKZ) Seems To Be Using A Lot Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Chelyabinsk Forge-and-Press Plant, Public Joint Stock Company (MCX:CHKZ) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Chelyabinsk Forge-and-Press Plant

What Is Chelyabinsk Forge-and-Press Plant's Debt?

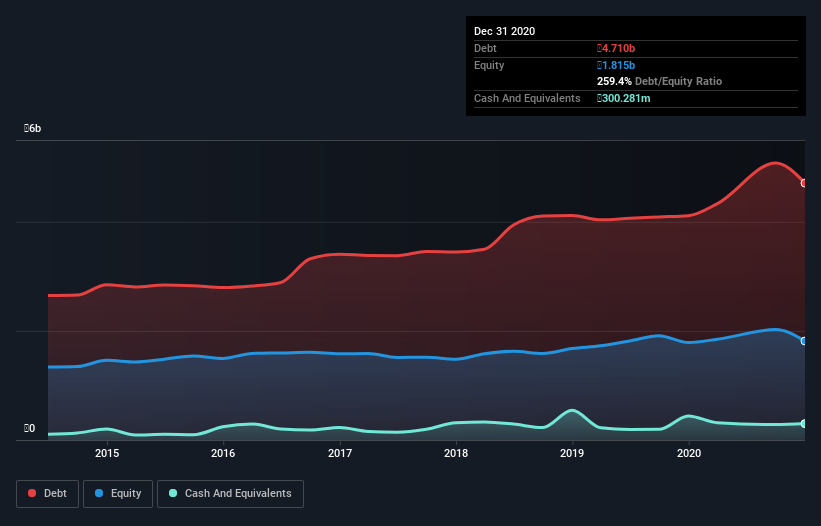

As you can see below, at the end of December 2020, Chelyabinsk Forge-and-Press Plant had ₽4.71b of debt, up from ₽4.11b a year ago. Click the image for more detail. However, it does have ₽300.3m in cash offsetting this, leading to net debt of about ₽4.41b.

A Look At Chelyabinsk Forge-and-Press Plant's Liabilities

Zooming in on the latest balance sheet data, we can see that Chelyabinsk Forge-and-Press Plant had liabilities of ₽8.46b due within 12 months and liabilities of ₽1.82b due beyond that. Offsetting this, it had ₽300.3m in cash and ₽1.11b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₽8.87b.

The deficiency here weighs heavily on the ₽3.57b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Chelyabinsk Forge-and-Press Plant would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Chelyabinsk Forge-and-Press Plant's debt is 3.6 times its EBITDA, and its EBIT cover its interest expense 3.1 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. However, one redeeming factor is that Chelyabinsk Forge-and-Press Plant grew its EBIT at 12% over the last 12 months, boosting its ability to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Chelyabinsk Forge-and-Press Plant will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Chelyabinsk Forge-and-Press Plant barely recorded positive free cash flow, in total. While many companies do operate at break-even, we prefer see substantial free cash flow, especially if a it already has dead.

Our View

Mulling over Chelyabinsk Forge-and-Press Plant's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, it seems to us that Chelyabinsk Forge-and-Press Plant's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Chelyabinsk Forge-and-Press Plant (1 makes us a bit uncomfortable) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Chelyabinsk Forge-and-Press Plant or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:CHKZ

Chelyabinsk Forge-and-Press Plant

Chelyabinsk Forge-and-Press Plant, Public Joint Stock Company operates as a forging company in Russia and internationally.

Solid track record and good value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.