- Germany

- /

- Electrical

- /

- DB:H2O

European Market Insights: Pininfarina And 2 Other Resilient Penny Stocks

Reviewed by Simply Wall St

As the European market navigates through mixed signals, with the STOXX Europe 600 Index remaining relatively flat and varying performances across major indices, investors are keenly watching trade developments and economic indicators. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—still present intriguing opportunities for growth. By focusing on stocks with solid financial foundations, investors can potentially uncover value in these lesser-known entities.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.95 | €14.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.47 | €45.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.496 | RON16.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.86 | €60.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.86M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.265 | SEK3.1B | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.32 | €10.53M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.13 | €293.39M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €32.91M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 331 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Pininfarina (BIT:PINF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pininfarina S.p.A., along with its subsidiaries, offers design and engineering services and sells prototypes and special cars globally, with a market cap of €63.24 million.

Operations: The company's revenue is primarily derived from its Design segment, which accounts for €75.89 million, and its Engineering segment, contributing €14.99 million.

Market Cap: €63.24M

Pininfarina S.p.A., with a market cap of €63.24 million, remains unprofitable but has significantly reduced its losses over the past five years. Its cash position is strong, covering both short-term and long-term liabilities, and it holds more cash than total debt. However, recent auditor concerns about its ability to continue as a going concern highlight financial instability risks. Despite this, Pininfarina's strategic collaborations in design could enhance brand value. The management team is experienced with an average tenure of 4.4 years, yet the board's relative inexperience may impact strategic direction amidst ongoing challenges in revenue growth and profitability improvements.

- Click here to discover the nuances of Pininfarina with our detailed analytical financial health report.

- Explore historical data to track Pininfarina's performance over time in our past results report.

TTS (Transport Trade Services) (BVB:TTS)

Simply Wall St Financial Health Rating: ★★★★★☆

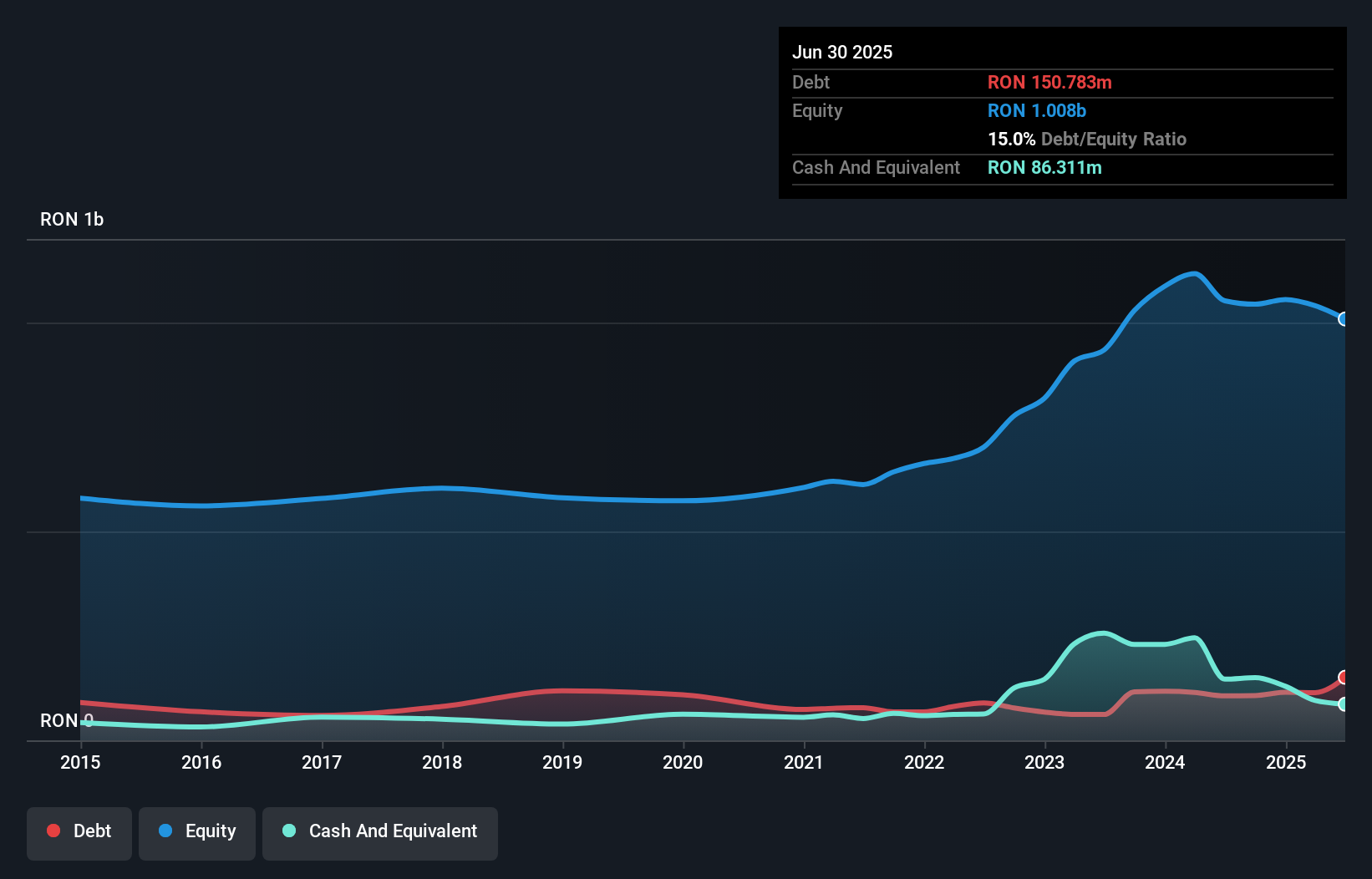

Overview: TTS (Transport Trade Services) S.A. is a Romanian company that specializes in providing freight forwarding services, with a market capitalization of RON903.60 million.

Operations: The company's revenue is primarily derived from its forwarding segment at RON461.75 million, followed by river transport at RON300.68 million and port operations contributing RON140.69 million.

Market Cap: RON903.6M

Transport Trade Services S.A., with a market cap of RON903.60 million, faces challenges as it remains unprofitable despite reducing losses by 14.3% annually over five years. The company reported a net loss of RON13.51 million for Q1 2025, shifting from a profit the previous year, with sales declining to RON160.5 million from RON239.38 million. While short-term assets cover both short and long-term liabilities, its dividend is not well supported by earnings or cash flow. Positively, TTS's debt management is sound with satisfactory net debt levels and operating cash flow covering its debt obligations effectively at 48%.

- Click here and access our complete financial health analysis report to understand the dynamics of TTS (Transport Trade Services).

- Gain insights into TTS (Transport Trade Services)'s future direction by reviewing our growth report.

Enapter (DB:H2O)

Simply Wall St Financial Health Rating: ★★★★☆☆

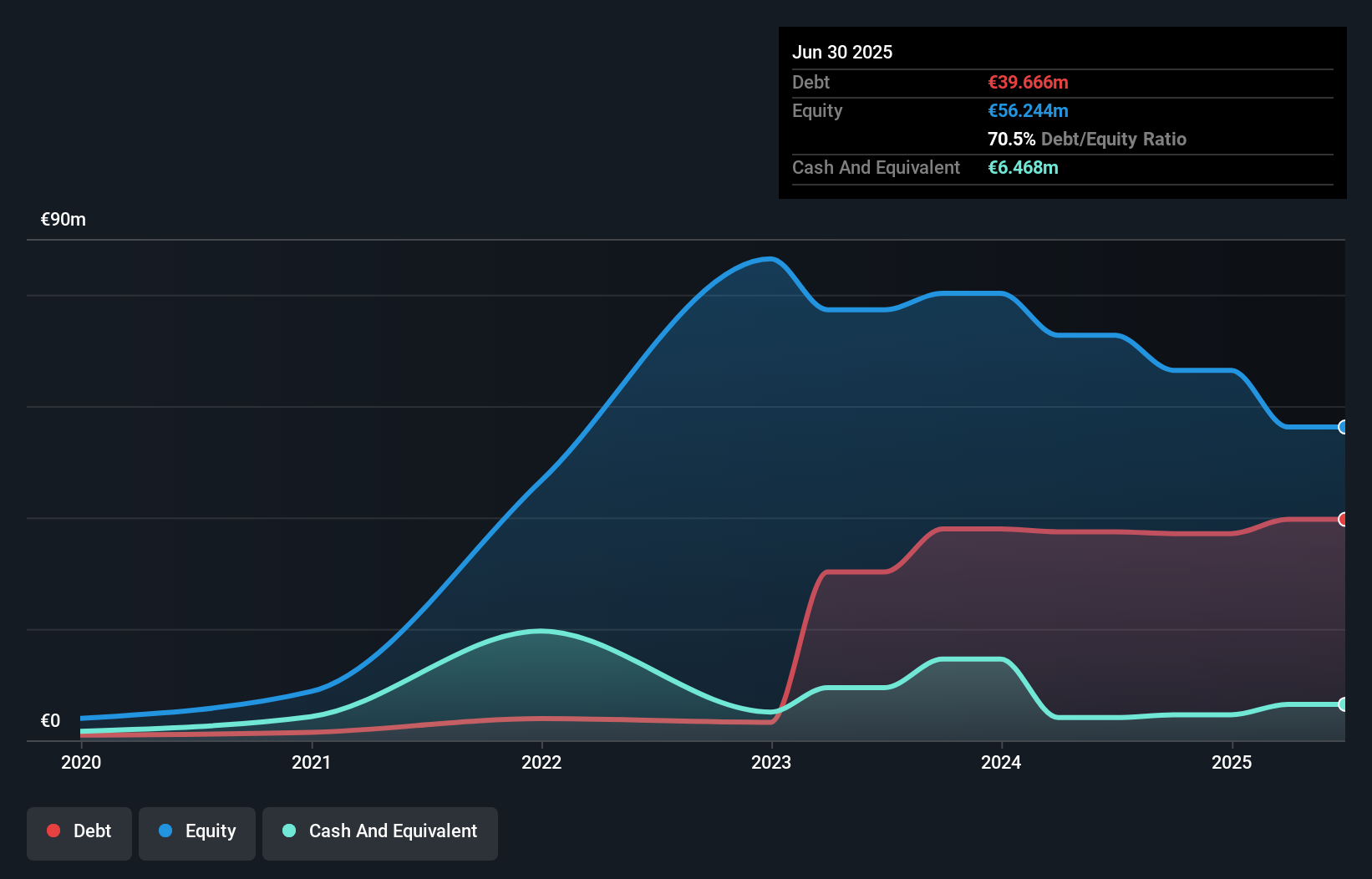

Overview: Enapter AG designs, manufactures, and sells hydrogen generators with a market cap of €73.26 million.

Operations: The company generates revenue of €24.82 million from its hydrogen generator design and production segment.

Market Cap: €73.26M

Enapter AG, with a market cap of €73.26 million, faces financial challenges as it reported a net loss of €20.73 million for 2024, despite generating €24.82 million in revenue from hydrogen generators. Its recent product innovations include the Nexus 2500 multicore electrolyzer, aimed at industrial-scale hydrogen production and energy storage solutions. However, concerns persist regarding its ability to continue as a going concern due to high debt levels and limited cash runway despite raising additional capital through equity offerings. The company's stock remains highly volatile but analysts suggest potential price appreciation based on current valuations.

- Click to explore a detailed breakdown of our findings in Enapter's financial health report.

- Review our growth performance report to gain insights into Enapter's future.

Next Steps

- Click through to start exploring the rest of the 328 European Penny Stocks now.

- Seeking Other Investments? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enapter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:H2O

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives