Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Med Life S.A. (BVB:M) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Med Life

What Is Med Life's Net Debt?

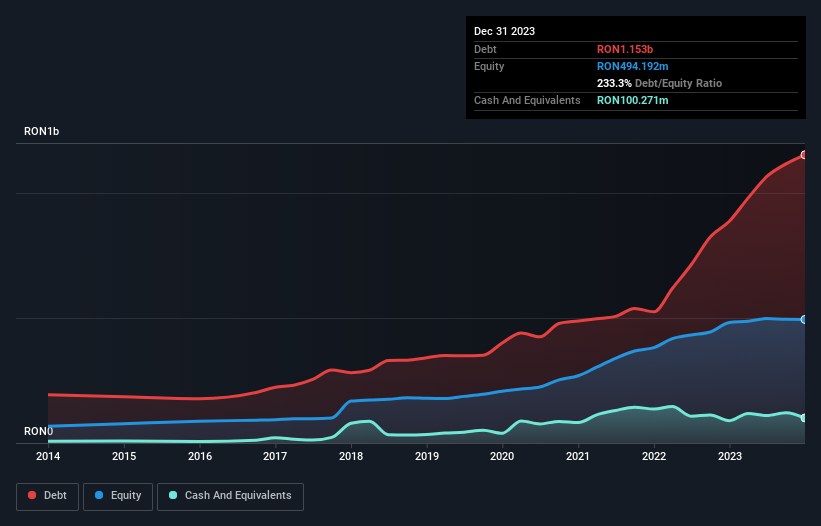

As you can see below, at the end of December 2023, Med Life had RON1.15b of debt, up from RON886.8m a year ago. Click the image for more detail. However, it also had RON100.3m in cash, and so its net debt is RON1.05b.

How Healthy Is Med Life's Balance Sheet?

According to the last reported balance sheet, Med Life had liabilities of RON699.7m due within 12 months, and liabilities of RON1.44b due beyond 12 months. On the other hand, it had cash of RON100.3m and RON274.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RON1.77b.

This deficit is considerable relative to its market capitalization of RON2.23b, so it does suggest shareholders should keep an eye on Med Life's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Med Life's net debt to EBITDA ratio of 5.0, we think its super-low interest cover of 1.4 times is a sign of high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Even more troubling is the fact that Med Life actually let its EBIT decrease by 7.3% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Med Life's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Med Life recorded free cash flow of 29% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both Med Life's net debt to EBITDA and its track record of covering its interest expense with its EBIT make us rather uncomfortable with its debt levels. And furthermore, its EBIT growth rate also fails to instill confidence. It's also worth noting that Med Life is in the Healthcare industry, which is often considered to be quite defensive. Looking at the bigger picture, it seems clear to us that Med Life's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Med Life (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:M

Med Life

A private healthcare provider, offers healthcare services in Bucharest, Cluj, Braila, Timisoara, Iasi, Galati, Ploiesti, Constanta, and Targu Mures.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives