- Japan

- /

- Healthcare Services

- /

- TSE:6099

December 2024's Top Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals and geopolitical developments, growth stocks have emerged as standout performers, with major indices like the S&P 500 and Nasdaq Composite reaching record highs. Amid this backdrop, insider ownership can serve as a key indicator of confidence in a company's future prospects, making it an important factor for investors to consider when evaluating potential growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

Med Life (BVB:M)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Med Life S.A. is a private healthcare provider offering services across several Romanian cities, with a market cap of RON3.13 billion.

Operations: The company's revenue segments consist of Clinics (RON964.73 million), Corporate (RON294.65 million), Dentistry (RON124.30 million), Hospitals (RON595.99 million), Pharmacies (RON64.82 million), and Laboratories (RON284.81 million).

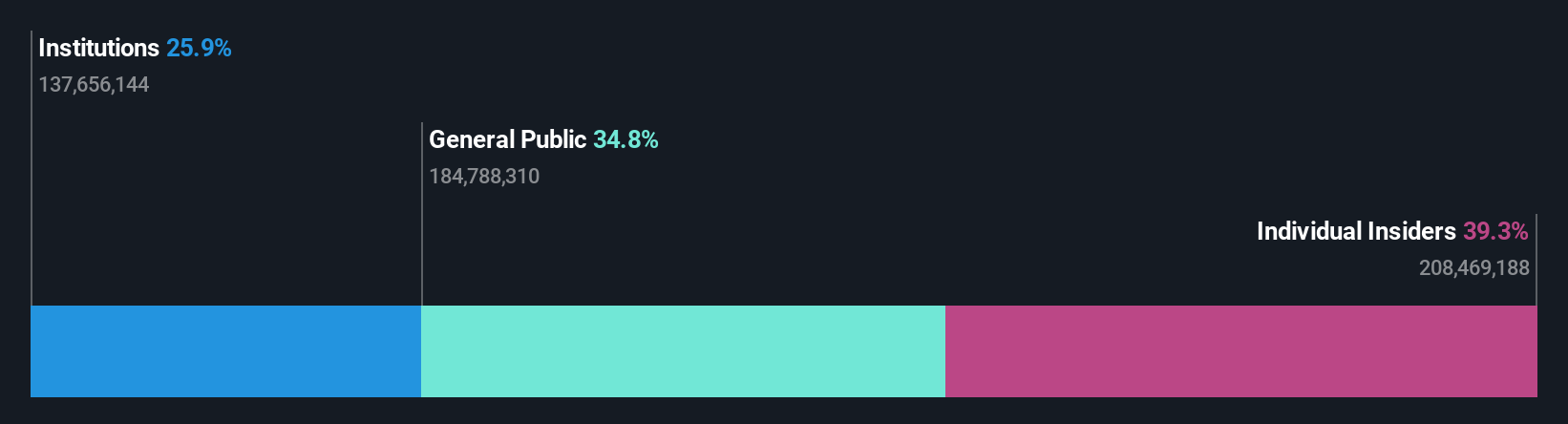

Insider Ownership: 39.3%

Med Life's earnings are forecast to grow significantly at 92.9% annually, outpacing the broader market, despite revenue growth being slower at 11.5%. The company is trading well below its estimated fair value, presenting a potential opportunity for investors. Recent results show improved financial performance with net income rising to RON 25.15 million over nine months, although interest payments remain a concern due to insufficient earnings coverage.

- Navigate through the intricacies of Med Life with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Med Life's shares may be trading at a premium.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

Overview: Auras Technology Co., Ltd. specializes in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across China, Taiwan, Ireland, Singapore, the United States, and internationally with a market cap of NT$64.34 billion.

Operations: The company generates revenue from its Electronic Components & Parts segment, amounting to NT$14.99 billion.

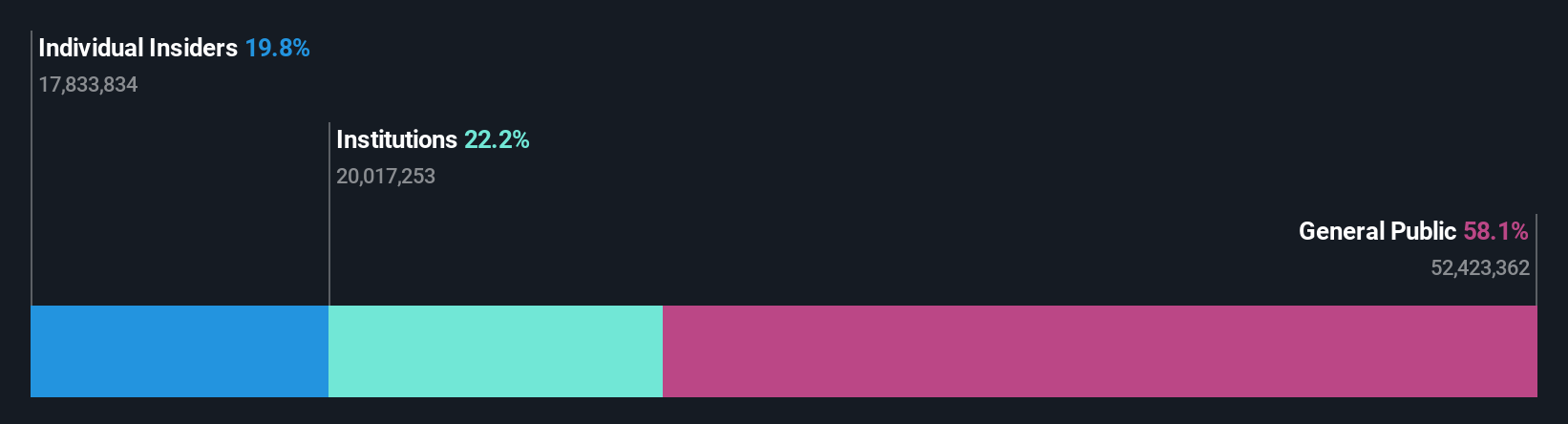

Insider Ownership: 19.8%

Auras Technology's revenue is expected to grow at 28.6% annually, surpassing the Taiwan market average. Earnings are projected to rise significantly at 43.1% per year, despite recent volatility in share price and past shareholder dilution. The company trades well below its estimated fair value, suggesting potential undervaluation. Recent earnings show increased sales but decreased quarterly net income compared to last year, highlighting the need for careful evaluation of financial health amidst growth prospects.

- Dive into the specifics of Auras Technology here with our thorough growth forecast report.

- According our valuation report, there's an indication that Auras Technology's share price might be on the cheaper side.

Elan (TSE:6099)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elan Corporation operates in the nursing care business primarily in Japan, with a market cap of ¥45.17 billion.

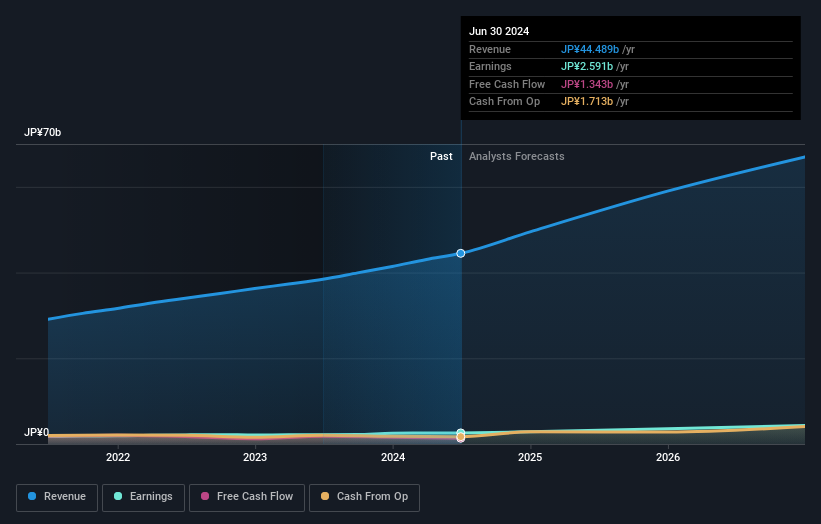

Operations: The company generates revenue of ¥45.85 billion from its Nursing and Medical Care Related Business segment.

Insider Ownership: 16%

Elan Corporation's earnings are forecast to grow by 16.4% annually, outpacing the JP market average of 7.9%, while revenue is expected to increase at a rate of 13.7%. Despite recent share price volatility, Elan has seen substantial insider ownership changes due to M3 Inc.'s acquisition of a 55% stake for approximately ¥35 billion (US$0.23 billion). This transaction positions Elan as a consolidated subsidiary, maintaining its listing on the TSE Prime Market.

- Delve into the full analysis future growth report here for a deeper understanding of Elan.

- Our expertly prepared valuation report Elan implies its share price may be too high.

Key Takeaways

- Gain an insight into the universe of 1509 Fast Growing Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Elan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6099

Reasonable growth potential with proven track record.