- Japan

- /

- Commercial Services

- /

- TSE:7921

Undiscovered Gems with Strong Potential for December 2024

Reviewed by Simply Wall St

The global markets have recently experienced mixed performances, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs, while the Russell 2000 Index for small-cap stocks saw a decline after outperforming larger-cap peers in previous weeks. In this context of varied market dynamics and economic indicators such as job growth and potential interest rate cuts by the Federal Reserve, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to navigate these conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Anhui Ronds Science & Technology (SHSE:688768)

Simply Wall St Value Rating: ★★★★☆☆

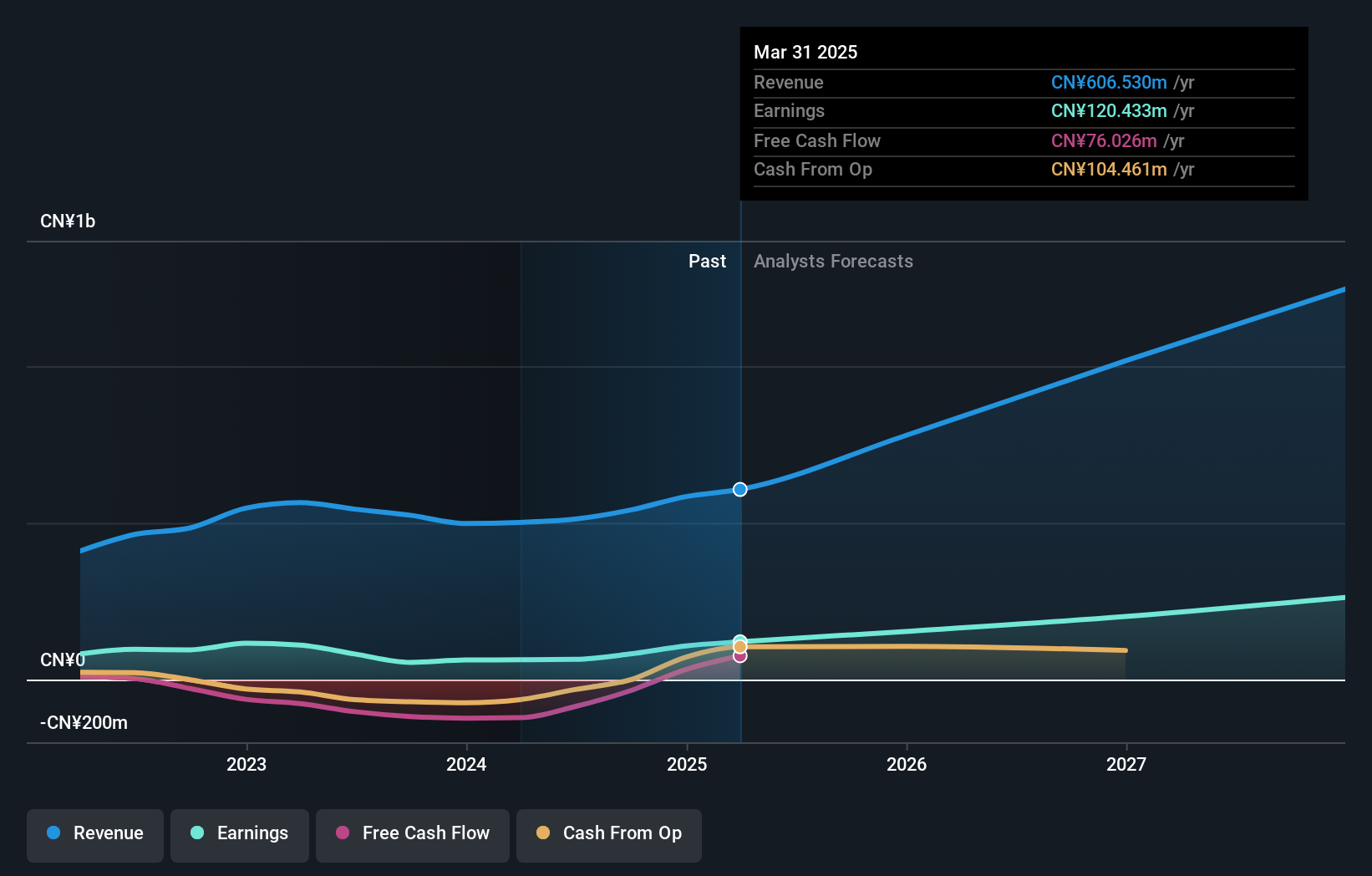

Overview: Anhui Ronds Science & Technology Incorporated Company specializes in machinery condition monitoring solutions for predictive maintenance in China, with a market cap of CN¥3.13 billion.

Operations: Ronds generates revenue primarily from its machinery condition monitoring solutions, focusing on predictive maintenance. The company's net profit margin is 15.2%, reflecting its efficiency in converting revenue into actual profit.

Anhui Ronds, a smaller player in the electronics sector, shows promise with a price-to-earnings ratio of 38.3x, undercutting the industry average of 49.3x. Despite an increase in its debt-to-equity ratio from 4% to 5% over five years, it holds more cash than total debt and covers interest payments comfortably. Recent earnings reveal growth with sales hitting CNY 342.74 million for nine months ending September 2024, up from CNY 299.94 million last year, turning a net income of CNY 2.72 million from a previous loss of CNY 16.37 million—a positive swing reflecting robust performance improvements amidst market challenges.

Jiangnan Yifan MotorLtd (SZSE:301023)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangnan Yifan Motor Co., Ltd specializes in the design, development, manufacture, and sale of gear energy storage motors and operating mechanisms for medium and high voltage switch circuit breaker equipment, with a market capitalization of CN¥3.06 billion.

Operations: Jiangnan Yifan Motor generates revenue primarily from the sale of gear energy storage motors and operating mechanisms. The company has a market capitalization of CN¥3.06 billion.

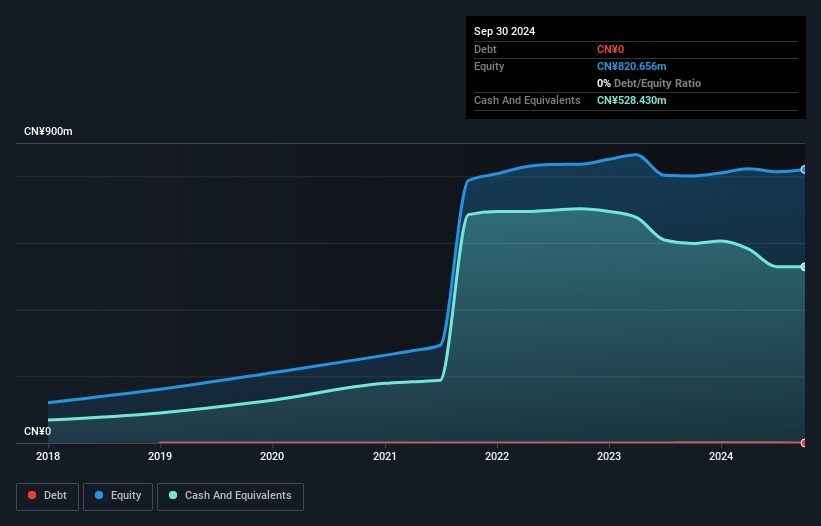

Jiangnan Yifan Motor, a nimble player in the electrical industry, has seen impressive earnings growth of 52% over the past year, outpacing the industry's modest 1.6%. Despite this recent surge, its earnings have slipped by an average of 2.3% annually over five years. The firm stands out for being debt-free and generating positive free cash flow, which adds to its financial stability. Recent announcements highlight a cash dividend plan offering CNY 5 per ten shares for Q3 2024. With high-quality non-cash earnings and no interest payment concerns due to zero debt, it offers a robust financial profile amidst market volatility.

- Click here and access our complete health analysis report to understand the dynamics of Jiangnan Yifan MotorLtd.

Understand Jiangnan Yifan MotorLtd's track record by examining our Past report.

Takara (TSE:7921)

Simply Wall St Value Rating: ★★★★★★

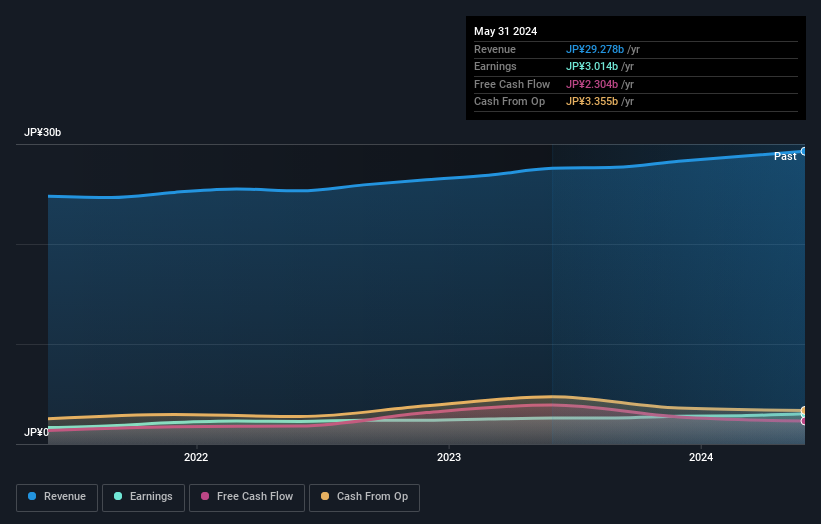

Overview: Takara & Company Ltd. engages in the production, consulting, printing, and translation of disclosure and investor relations materials both in Japan and internationally, with a market cap of ¥38.92 billion.

Operations: Takara & Company Ltd. generates revenue primarily from its Disclosure Related Business, contributing ¥21.01 billion, and its Interpretation and Translation Business, which adds ¥9.52 billion.

Takara, a modestly sized player, has demonstrated robust financial health with its debt to equity ratio dropping from 4.4% to 0.4% over the past five years, indicating effective debt management. Its earnings growth of 10% in the last year outpaced the Commercial Services industry average of 9%, showcasing strong performance in its sector. Additionally, Takara trades at a notable discount of approximately 29% below estimated fair value and maintains more cash than total debt, suggesting prudent financial planning and potential for future growth. Furthermore, recent dividend announcements reflect ongoing shareholder returns strategies.

- Navigate through the intricacies of Takara with our comprehensive health report here.

Review our historical performance report to gain insights into Takara's's past performance.

Seize The Opportunity

- Click this link to deep-dive into the 4648 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takara might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7921

Takara

Produces, consults, prints, and translates disclosure and IR-related materials in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives