- Japan

- /

- Healthcare Services

- /

- TSE:6099

3 Growth Companies With High Insider Ownership Growing Earnings Up To 92%

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks closing out a strong year despite recent slumps and European indices reacting to inflationary pressures, investors are keenly observing growth opportunities amid these fluctuations. In this environment, companies with high insider ownership can be particularly appealing as they often signal confidence in the company's future prospects and align management interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here's a peek at a few of the choices from the screener.

Med Life (BVB:M)

Simply Wall St Growth Rating: ★★★★★☆

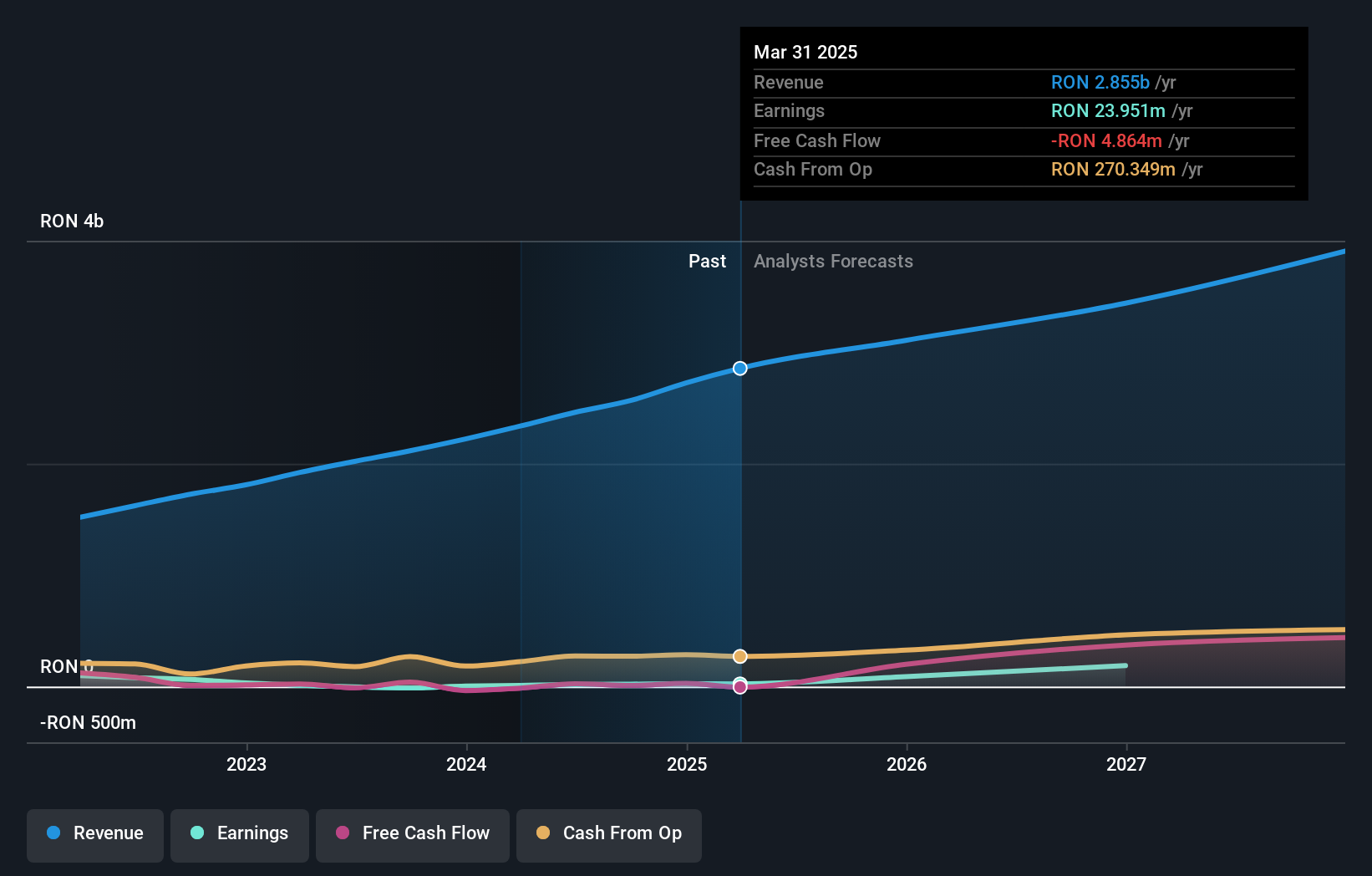

Overview: Med Life S.A. is a private healthcare provider offering services across multiple cities in Romania, with a market cap of RON3.15 billion.

Operations: The company's revenue segments include Clinics (RON964.73 million), Corporate (RON294.65 million), Dentistry (RON124.30 million), Hospitals (RON595.99 million), Pharmacies (RON64.82 million), and Laboratories (RON284.81 million).

Insider Ownership: 39.3%

Earnings Growth Forecast: 92.9% p.a.

Med Life's earnings are forecast to grow significantly, outpacing the market with an expected 92.89% annual increase, though revenue growth is slower at 11%. The company became profitable this year and trades at a substantial discount to its estimated fair value. Recent earnings for the nine months ending September 2024 showed sales of RON 1.98 billion and net income of RON 25.15 million, indicating robust financial performance despite slower revenue growth compared to profit expansion.

- Delve into the full analysis future growth report here for a deeper understanding of Med Life.

- According our valuation report, there's an indication that Med Life's share price might be on the expensive side.

Sunstone Development (SHSE:603612)

Simply Wall St Growth Rating: ★★★★★☆

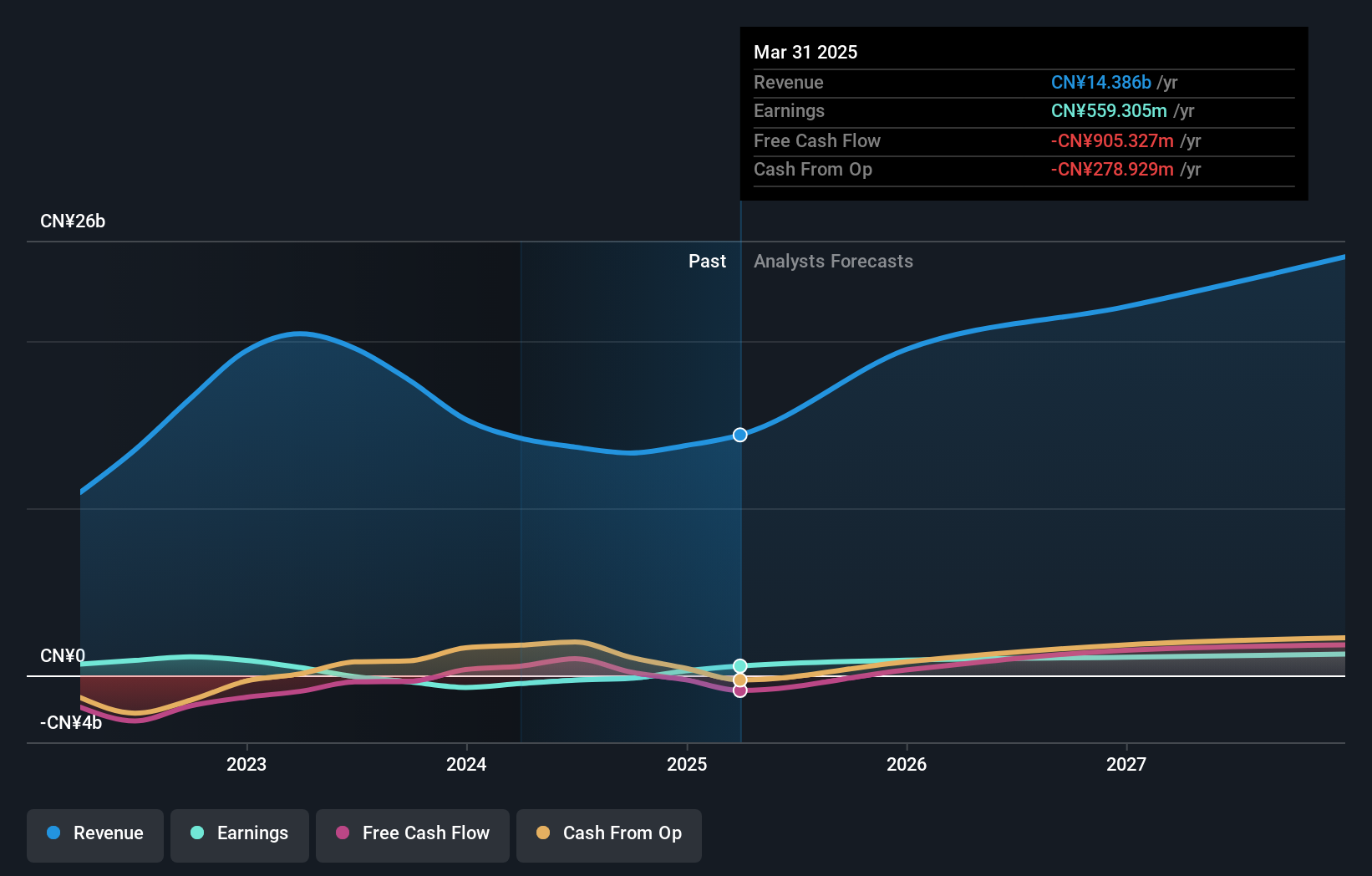

Overview: Sunstone Development Co., Ltd. focuses on the research, development, production, and sales of prebaked carbon anodes for the aluminum industry both in China and internationally, with a market cap of CN¥7.72 billion.

Operations: The company's revenue is derived from its operations in the research, development, production, and sales of prebaked carbon anodes for the aluminum industry both domestically and internationally.

Insider Ownership: 33%

Earnings Growth Forecast: 80.2% p.a.

Sunstone Development is poised for significant growth, with earnings expected to increase by 80.17% annually and revenue projected to grow at 23.6% per year, outpacing the market average. Despite trading at a substantial discount of 53.2% below its fair value estimate, the company's financial position is challenged by poorly covered interest payments. Recent financials show improved profitability with a net income of CNY 216.61 million for the first nine months of 2024, reversing last year's losses.

- Take a closer look at Sunstone Development's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Sunstone Development is priced lower than what may be justified by its financials.

Elan (TSE:6099)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elan Corporation operates in the nursing care business primarily in Japan with a market cap of ¥45.23 billion.

Operations: The company generates revenue of ¥45.85 billion from its Nursing and Medical Care Related Business segment.

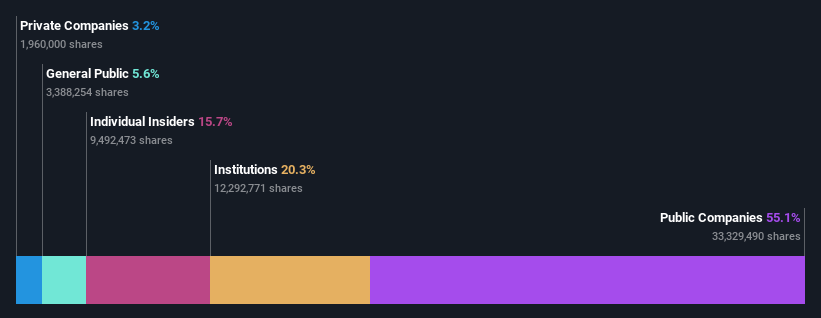

Insider Ownership: 15.7%

Earnings Growth Forecast: 16.4% p.a.

Elan Corporation is experiencing steady growth, with earnings projected to increase by 16.4% annually and revenue expected to rise by 13.7% per year, surpassing the JP market average. Despite recent executive changes and a volatile share price, the company maintains high insider ownership. The significant acquisition of a 55% stake in Elan by M3, Inc., valued at ¥35 billion, underscores its strategic importance while ensuring continued listing on the TSE Prime Market.

- Navigate through the intricacies of Elan with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Elan implies its share price may be too high.

Summing It All Up

- Delve into our full catalog of 1492 Fast Growing Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Elan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6099

Reasonable growth potential with proven track record.