As global markets navigate a mixed start to the year, with indices like the S&P 500 and Nasdaq Composite showing strong annual gains despite recent volatility, investors are keenly watching economic indicators such as the Chicago PMI and GDP forecasts for signs of future trends. Amidst this backdrop, identifying stocks that exhibit resilience and growth potential can be particularly rewarding; these qualities often emerge in companies that maintain robust fundamentals even when broader market sentiment is uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

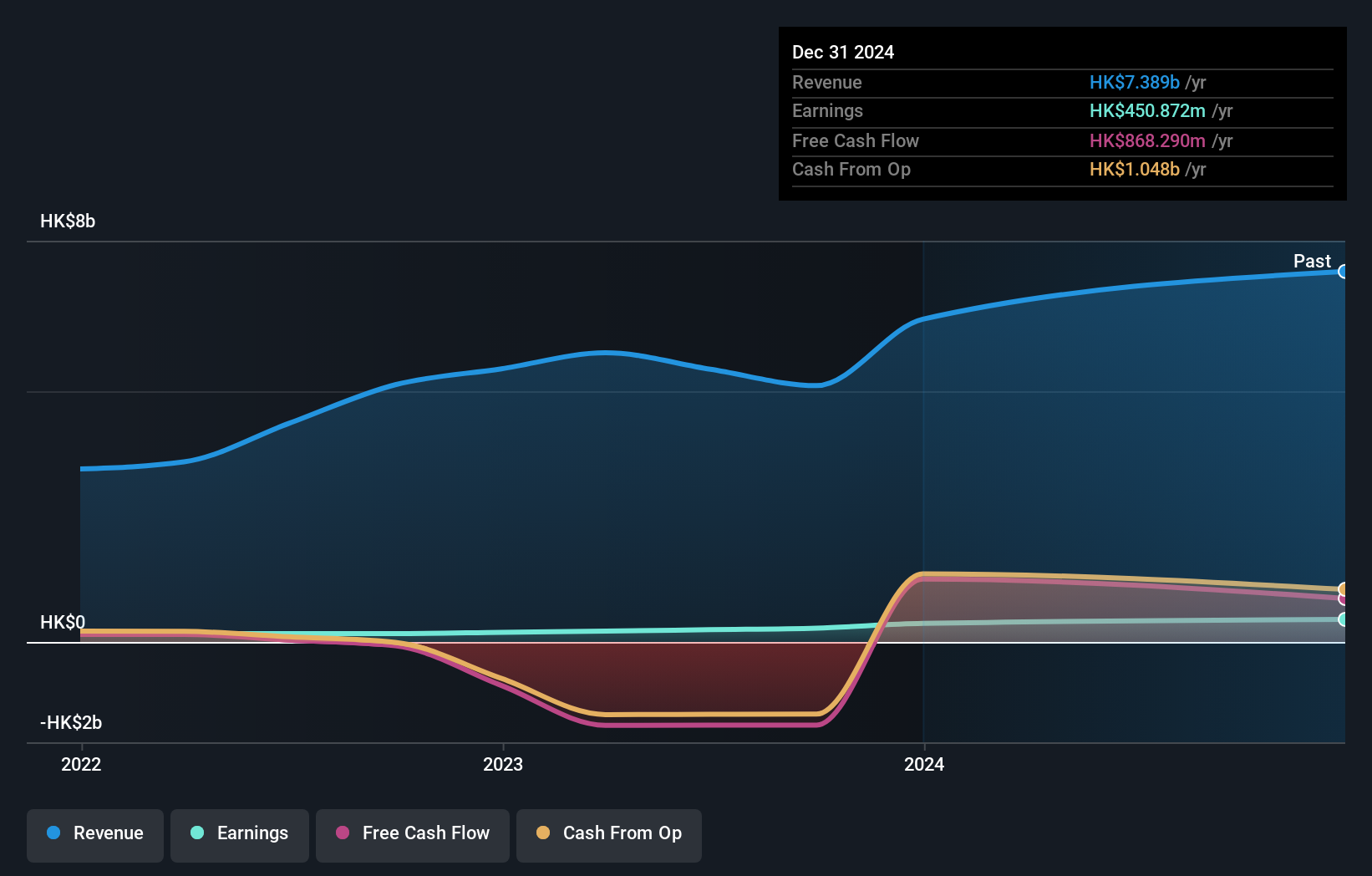

Overview: Time Interconnect Technology Limited is an investment holding company that manufactures and sells cable assembly and networking cable products across various international markets, with a market cap of HK$8.13 billion.

Operations: The company generates revenue primarily from server products (HK$2.98 billion), cable assembly (HK$2.31 billion), and digital cable (HK$1.18 billion).

Time Interconnect Technology, a smaller player in the tech arena, has shown impressive earnings growth of 93% over the past year, outpacing the Electrical industry's 7.7%. Despite this surge, its debt to equity ratio has ballooned from 9% to 212.5% over five years, indicating high leverage with a net debt to equity ratio at 184.9%. However, interest payments are well covered by EBIT at nine times coverage. Trading significantly below its fair value estimate by about 88%, Time Interconnect seems undervalued but carries financial risks due to its elevated debt levels.

- Dive into the specifics of Time Interconnect Technology here with our thorough health report.

Understand Time Interconnect Technology's track record by examining our Past report.

ZYF Lopsking Aluminum (SZSE:002333)

Simply Wall St Value Rating: ★★★★☆☆

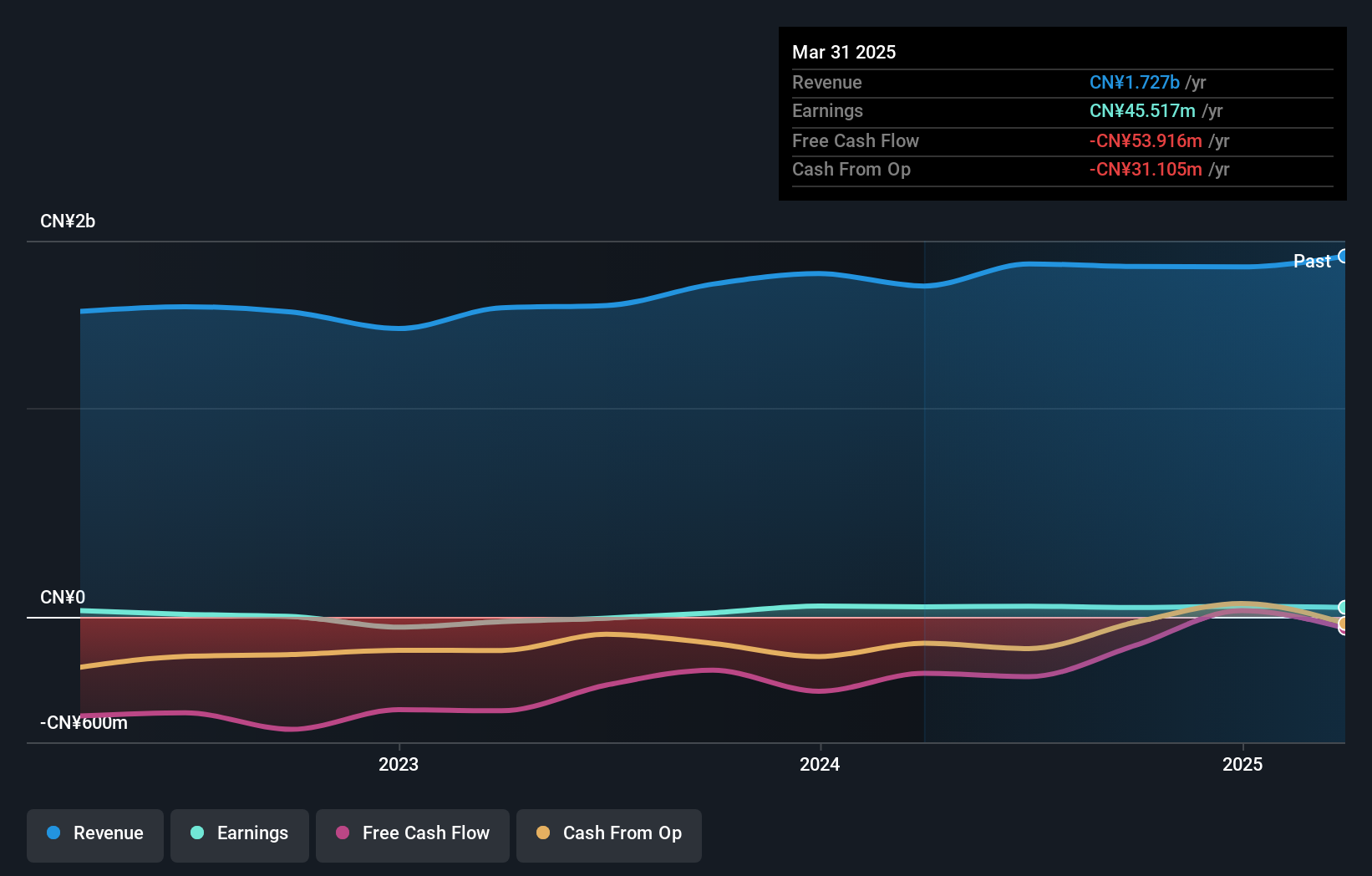

Overview: ZYF Lopsking Aluminum Co., Ltd. specializes in providing aluminum extrusion profiles both domestically and internationally, with a market cap of CN¥3.54 billion.

Operations: The company's primary revenue stream comes from the sale of aluminum extrusion profiles in both domestic and international markets.

Lopsking Aluminum, a smaller player in the metals sector, has shown notable growth with earnings surging by 136.6% over the past year, outpacing an industry that saw a -2.3% change. However, its net income for the nine months ended September 2024 was CN¥44.77 million, down from CN¥52.34 million the previous year due to one-off gains of CN¥11.5 million impacting results. The company's debt-to-equity ratio climbed to 30%, yet remains satisfactory with interest payments well-covered at 5x EBIT. A special shareholders meeting is scheduled for Dec 27th to discuss future transactions with related parties.

C.UyemuraLtd (TSE:4966)

Simply Wall St Value Rating: ★★★★★★

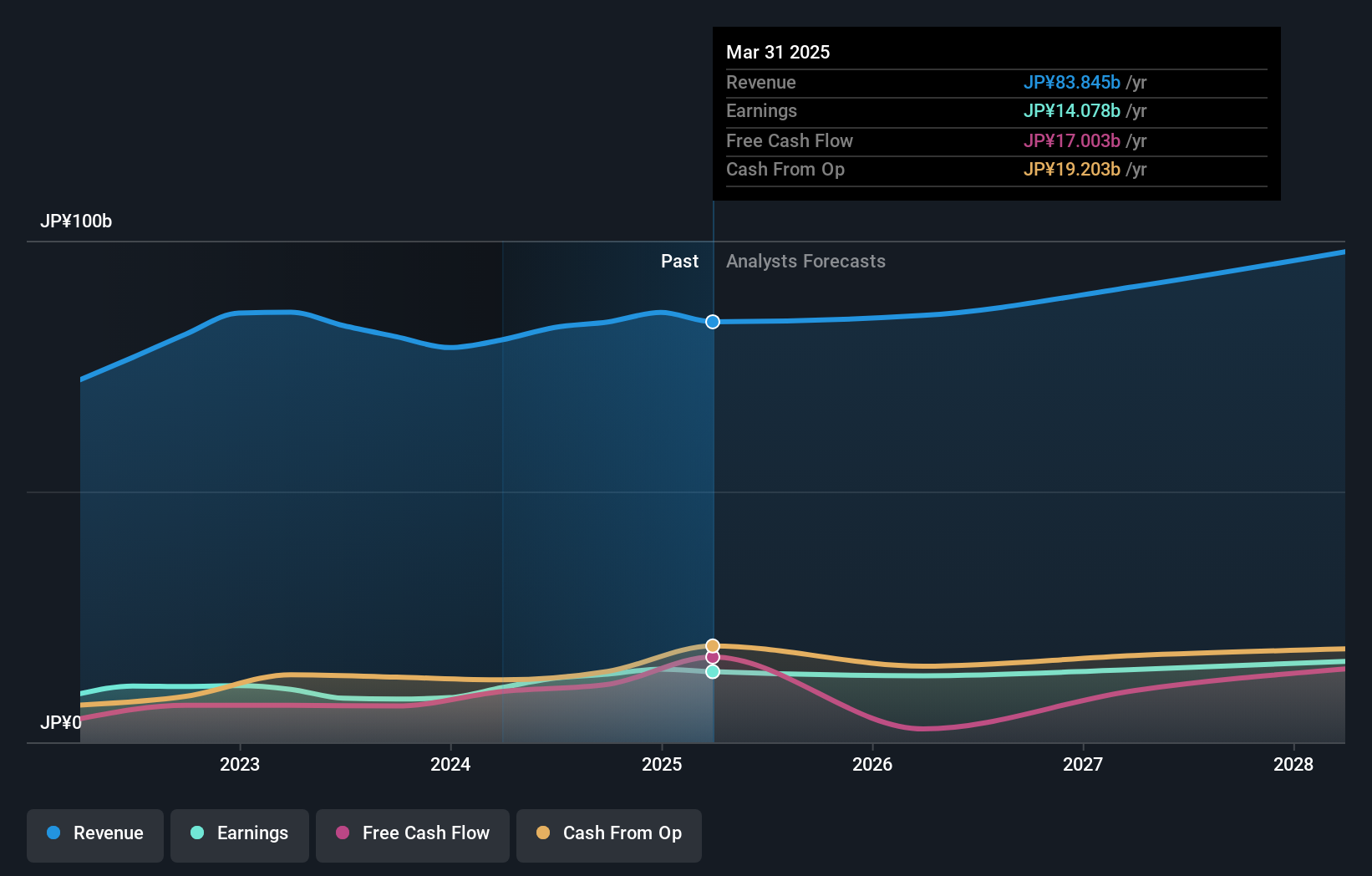

Overview: C.Uyemura & Co., Ltd. is engaged in the research, development, manufacturing, and sale of plating chemicals, industrial chemicals, and non-ferrous metals both domestically in Japan and internationally; it has a market cap of approximately ¥179.38 billion.

Operations: C.Uyemura Ltd. generates revenue primarily from its Surface Treatment Materials Business, which accounts for ¥66.01 billion, and the Surface Treatment Machinery Business, contributing ¥12.61 billion. The Plating Processing Business and Real Estate Leasing Segment add further to the revenue with ¥4.32 billion and ¥0.83 billion respectively, reflecting a diverse income stream across different segments.

Earnings for C.Uyemura Ltd. have surged by 57% over the past year, outpacing the Chemicals industry average of 14%. The company trades at a significant discount, approximately 36% below its estimated fair value, suggesting potential upside. Despite a volatile share price in recent months, Uyemura's financial health remains robust with more cash than total debt and a reduced debt-to-equity ratio from 0.8 to 0.4 over five years. With high-quality earnings and free cash flow positivity, it seems well-positioned for steady growth projected at around 6% annually in the foreseeable future.

- Navigate through the intricacies of C.UyemuraLtd with our comprehensive health report here.

Review our historical performance report to gain insights into C.UyemuraLtd's's past performance.

Where To Now?

- Get an in-depth perspective on all 4667 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4966

C.UyemuraLtd

Researches, develops, manufactures, and sells plating chemicals, industrial chemicals, non-ferrous metals, and other products in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives