- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

3 European Growth Companies With High Insider Ownership Expecting Up To 80% Earnings Growth

Reviewed by Simply Wall St

Amidst a backdrop of easing trade tensions and supportive monetary policy, European markets have recently rebounded, with the pan-European STOXX Europe 600 Index rising by 3.93% over the past week. This positive sentiment provides a fertile ground for growth companies, particularly those with high insider ownership, as they often demonstrate strong alignment between management and shareholder interests—a key factor in navigating uncertain economic landscapes.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Elicera Therapeutics (OM:ELIC) | 20.5% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Devyser Diagnostics (OM:DVYSR) | 35.7% | 96.5% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

Let's dive into some prime choices out of the screener.

Med Life (BVB:M)

Simply Wall St Growth Rating: ★★★★★☆

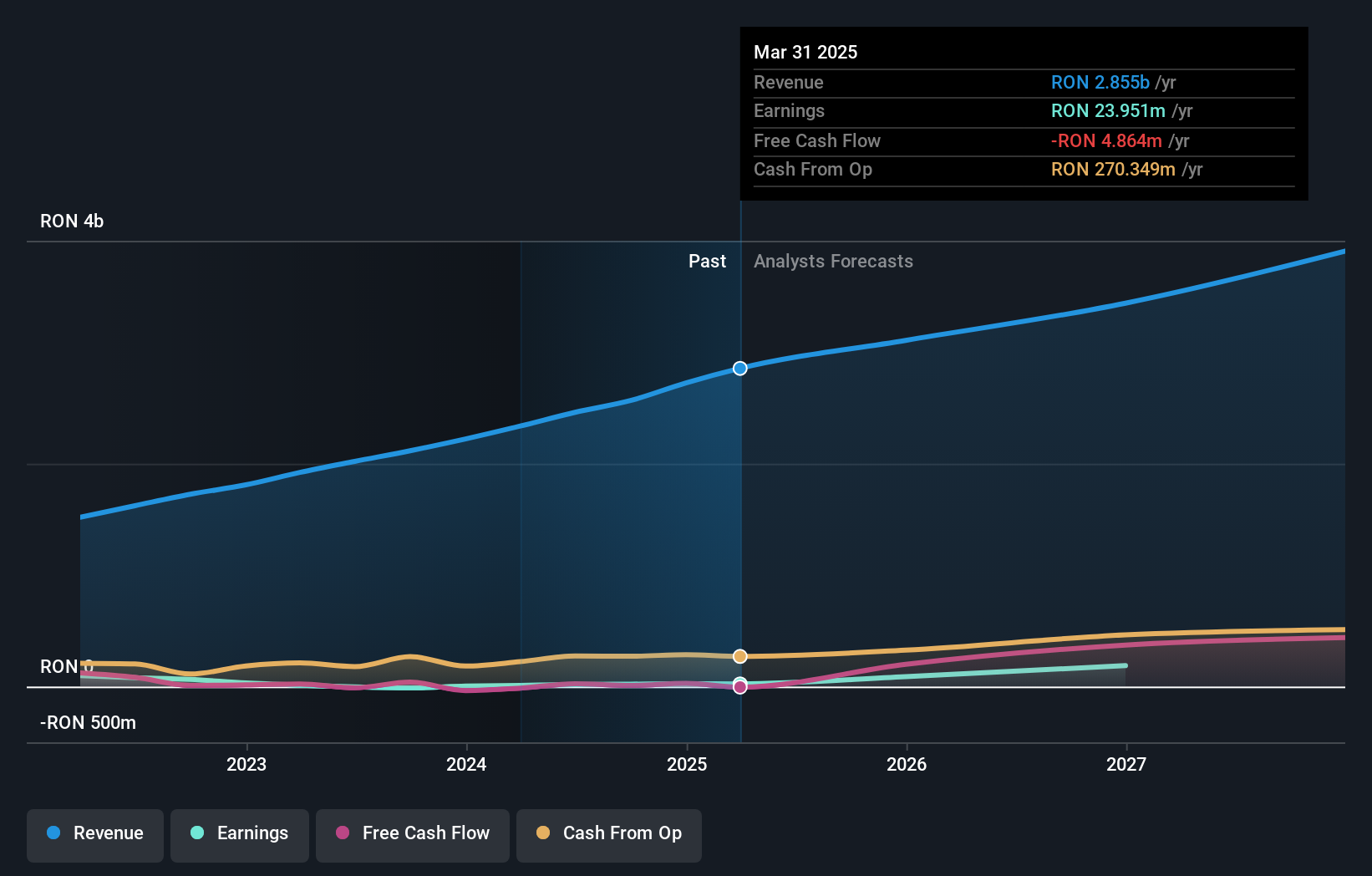

Overview: Med Life S.A. is a private healthcare provider offering services across several Romanian cities, with a market cap of RON3.29 billion.

Operations: The company's revenue segments include Clinics (RON1.02 billion), Corporate (RON296.97 million), Dentistry (RON125.52 million), Hospitals (RON661.49 million), Pharmacies (RON69.24 million), and Laboratories (RON295.35 million).

Insider Ownership: 39.3%

Earnings Growth Forecast: 80.6% p.a.

Med Life's earnings are forecast to grow substantially, outpacing the Romanian market with an expected annual growth of 80.6%. Revenue is also set to rise faster than the market at 11% per year. Despite trading significantly below estimated fair value, a concern is that interest payments aren't well covered by earnings. Recent results show strong performance with revenue reaching RON 2.72 billion and net income increasing markedly to RON 25.55 million for 2024.

- Delve into the full analysis future growth report here for a deeper understanding of Med Life.

- The valuation report we've compiled suggests that Med Life's current price could be inflated.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★★

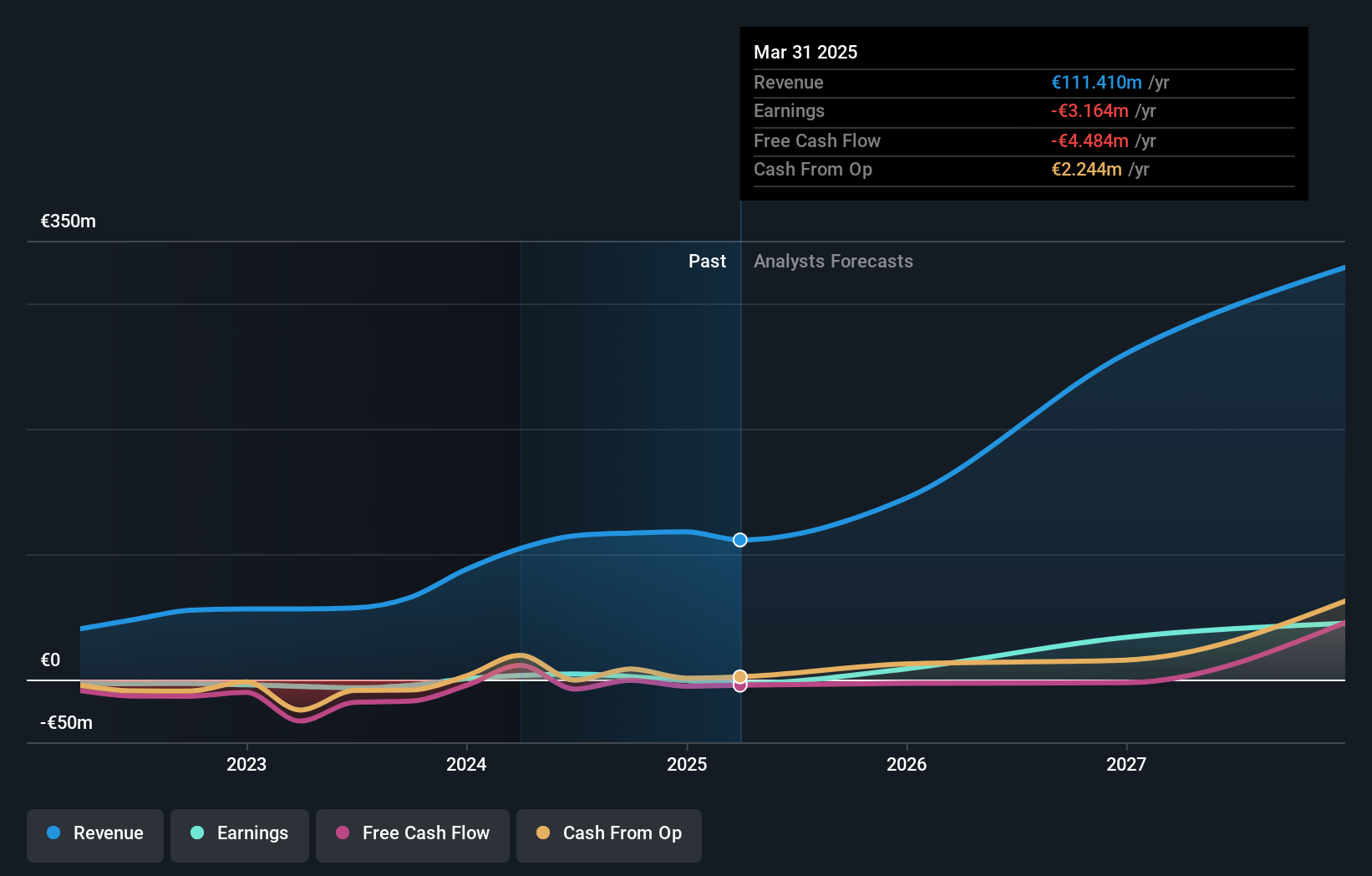

Overview: Envipco Holding N.V. is engaged in designing, developing, and servicing reverse vending machines for collecting used beverage containers across the Netherlands, North America, and Europe, with a market cap of €307.11 million.

Operations: Envipco Holding generates its revenue from the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for the collection and processing of used beverage containers across the Netherlands, North America, and Europe.

Insider Ownership: 37.7%

Earnings Growth Forecast: 71.2% p.a.

Envipco Holding's growth trajectory is underscored by a series of substantial orders for its Optima RVMs, particularly in Romania, supporting the country's deposit return scheme. The company's revenue is forecast to grow significantly faster than the Dutch market at 35.1% annually, with earnings expected to rise 71.24% per year. Despite recent volatility and lower net income in Q4 2024, Envipco trades well below its estimated fair value and anticipates profitability within three years.

- Dive into the specifics of Envipco Holding here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Envipco Holding is trading behind its estimated value.

Betsson (OM:BETS B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Betsson AB (publ) operates as an online gaming company through its subsidiaries across various regions including the Nordic countries, Latin America, and Europe, with a market capitalization of approximately SEK21.69 billion.

Operations: The company's revenue primarily comes from its Casinos & Resorts segment, which generated €1.11 billion.

Insider Ownership: 14.8%

Earnings Growth Forecast: 14.0% p.a.

Betsson's growth is supported by strong cash flow and strategic M&A plans, as highlighted by a special dividend of €0.10 per share alongside an ordinary dividend increase. The company reported Q4 2024 sales of €306.8 million, up from €251.9 million the previous year, with net income rising to €51.6 million. Trading significantly below estimated fair value, Betsson's earnings are forecast to grow faster than the Swedish market at 14% annually despite slower revenue growth projections at 7.7%.

- Click here and access our complete growth analysis report to understand the dynamics of Betsson.

- Our valuation report here indicates Betsson may be undervalued.

Where To Now?

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 216 companies by clicking here.

- Interested In Other Possibilities? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

Exceptional growth potential and good value.

Market Insights

Community Narratives