Investors one-year returns in Societatea Comerciala Unisem (BVB:UNISEM) have not grown faster than the company's underlying earnings growth

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Societatea Comerciala Unisem S.A. (BVB:UNISEM) share price slid 14% over twelve months. That contrasts poorly with the market return of 15%. Societatea Comerciala Unisem may have better days ahead, of course; we've only looked at a one year period. It's down 18% in about a month.

After losing 17% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Societatea Comerciala Unisem

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

The last year saw Societatea Comerciala Unisem's EPS really take off. We don't think the growth guide to the sustainable growth rate in this case, but we do think this sort of increase is impressive. So we are surprised the share price is down. So it's worth taking a look at some other metrics.

Societatea Comerciala Unisem's dividend seems healthy to us, so we doubt that the yield is a concern for the market. We'd be more worried about the fact that revenue fell 11% year on year. The market may be extrapolating the decline, leading to questions around the sustainability of the EPS.

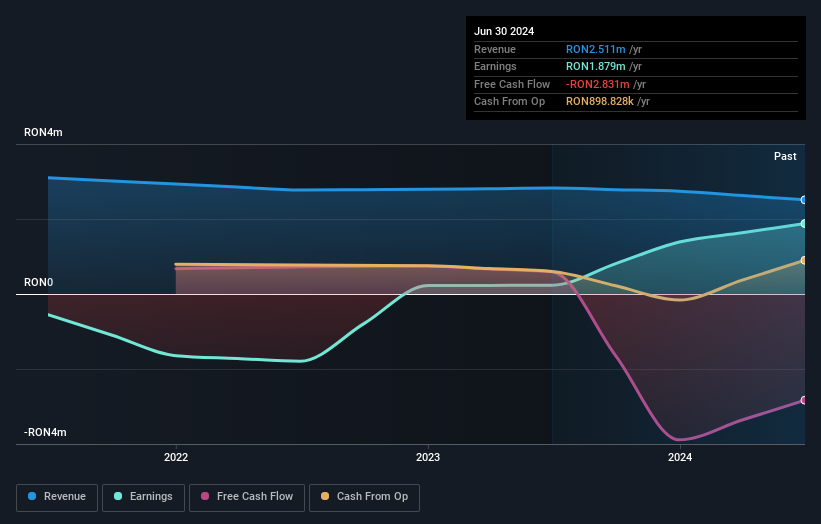

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Societatea Comerciala Unisem's TSR for the last 1 year was 11%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Societatea Comerciala Unisem shareholders have gained 11% for the year (even including dividends). While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 15%. We regret to inform any shareholders that the share price dropped another 15% in the last three months. It's possible that this is just a short term share price setback. If the business executes and delivers key metric growth, it could definitely be worth putting on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Societatea Comerciala Unisem (including 3 which are a bit unpleasant) .

But note: Societatea Comerciala Unisem may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Romanian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:UNISEM

Societatea Comerciala Unisem

Engages in the production, wholesale, retail, packaging, and storage of agricultural products.

Flawless balance sheet moderate.