S.C. Avicola Slobozia S.A.'s (BVB:AVSL) Shares Leap 33% Yet They're Still Not Telling The Full Story

S.C. Avicola Slobozia S.A. (BVB:AVSL) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

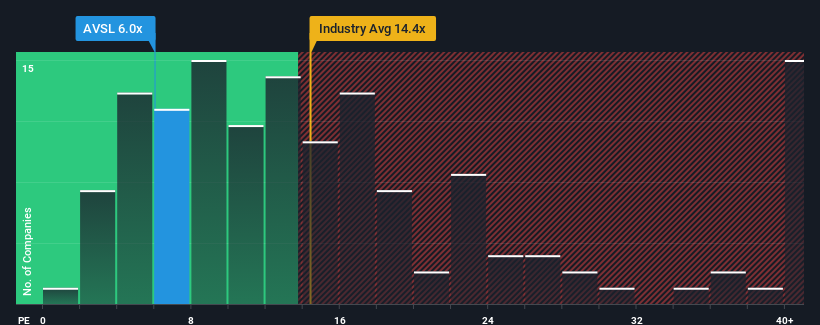

Even after such a large jump in price, given about half the companies in Romania have price-to-earnings ratios (or "P/E's") above 15x, you may still consider S.C. Avicola Slobozia as a highly attractive investment with its 6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

S.C. Avicola Slobozia certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for S.C. Avicola Slobozia

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as S.C. Avicola Slobozia's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 128% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

In contrast to the company, the rest of the market is expected to decline by 7.1% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that S.C. Avicola Slobozia's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Shares in S.C. Avicola Slobozia are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that S.C. Avicola Slobozia currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for S.C. Avicola Slobozia you should be aware of, and 1 of them is concerning.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:AVSL

Solid track record with excellent balance sheet.

Market Insights

Community Narratives