- Romania

- /

- Oil and Gas

- /

- BVB:SNP

European Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As European markets navigate a mixed landscape with the pan-European STOXX Europe 600 Index edging higher, investors are keenly observing economic indicators and policy signals that could influence future growth. In this context, dividend stocks stand out as potentially attractive options for those seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.34% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.20% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.78% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.56% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.10% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.14% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.61% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.66% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.55% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 6.00% | ★★★★★☆ |

Click here to see the full list of 220 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

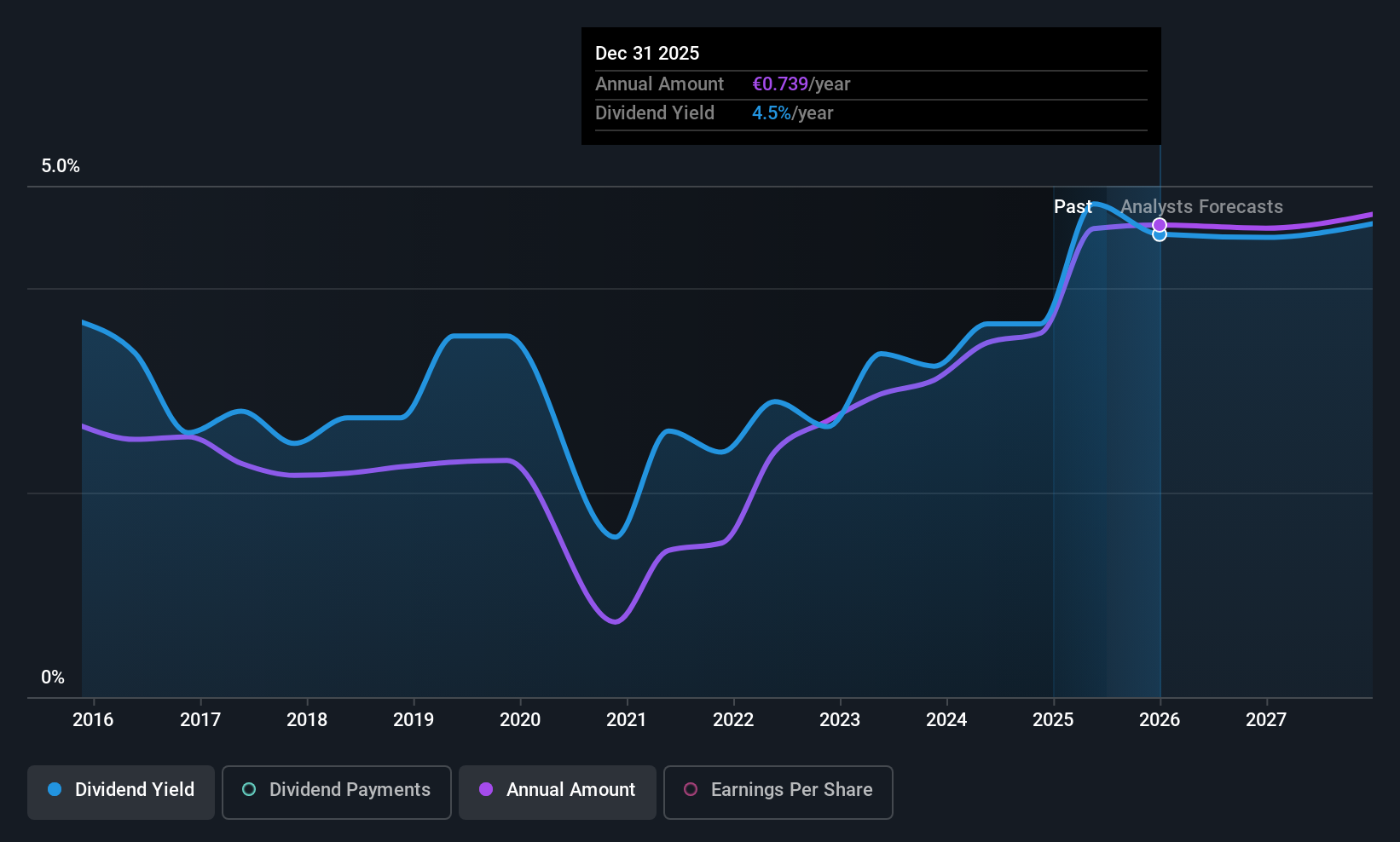

Tenaris (BIT:TEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tenaris S.A. manufactures and supplies steel pipe products and related services for the energy industry and other industrial applications across multiple regions, with a market cap of €16.31 billion.

Operations: Tenaris S.A.'s revenue from its Tubes segment amounts to $11.17 billion.

Dividend Yield: 4.6%

Tenaris offers a mixed outlook for dividend investors. While its dividends are well-covered by earnings and cash flows, with payout ratios of 30.5% and 46.3% respectively, the company's dividend history is volatile, showing instability over the past decade. Despite this, Tenaris trades at good value relative to peers and industry standards, though its current dividend yield of 4.55% is slightly below Italy's top quartile payers at 4.69%. Recent buybacks indicate strong capital management but earnings are forecasted to decline modestly in the coming years.

- Click here to discover the nuances of Tenaris with our detailed analytical dividend report.

- The analysis detailed in our Tenaris valuation report hints at an deflated share price compared to its estimated value.

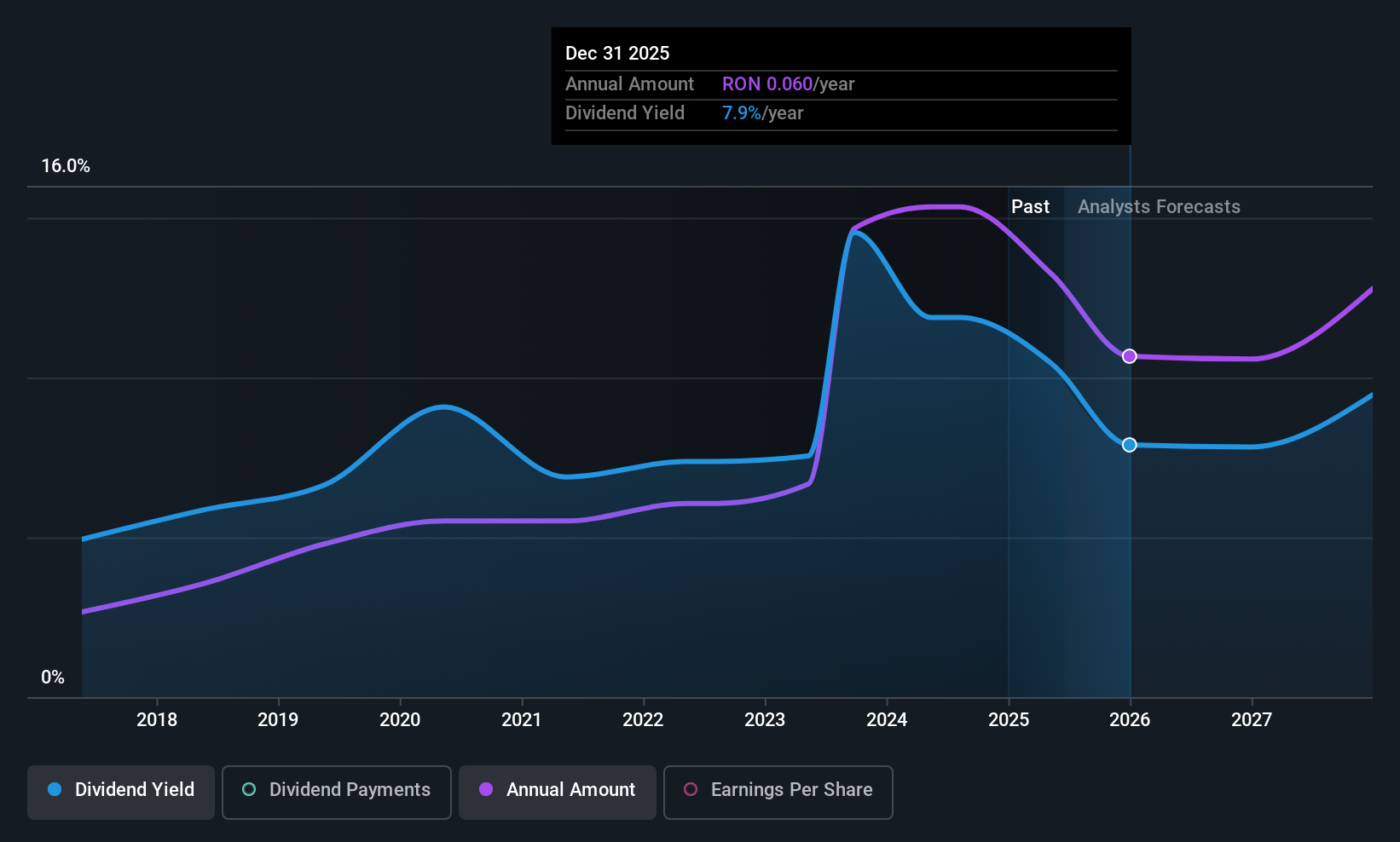

OMV Petrom (BVB:SNP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OMV Petrom S.A. is an energy company involved in the exploration and production of oil and gas in Southeastern Europe, with a market cap of RON57.64 billion.

Operations: OMV Petrom S.A. generates revenue primarily through its Refining and Marketing segment at RON24.86 billion, followed by Exploration and Production at RON10.24 billion, and Gas and Power at RON11.07 billion.

Dividend Yield: 8%

OMV Petrom's dividend yield of 8.04% ranks in the top 25% of Romanian payers, yet its sustainability is questionable due to a high cash payout ratio of over 1000%, indicating dividends are not well supported by free cash flow. While trading at a significant discount to estimated fair value, its profit margins have declined from last year and earnings are not fully covering dividends. Recent approval for a special dividend could appeal to income-focused investors despite historical volatility in payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of OMV Petrom.

- Our comprehensive valuation report raises the possibility that OMV Petrom is priced lower than what may be justified by its financials.

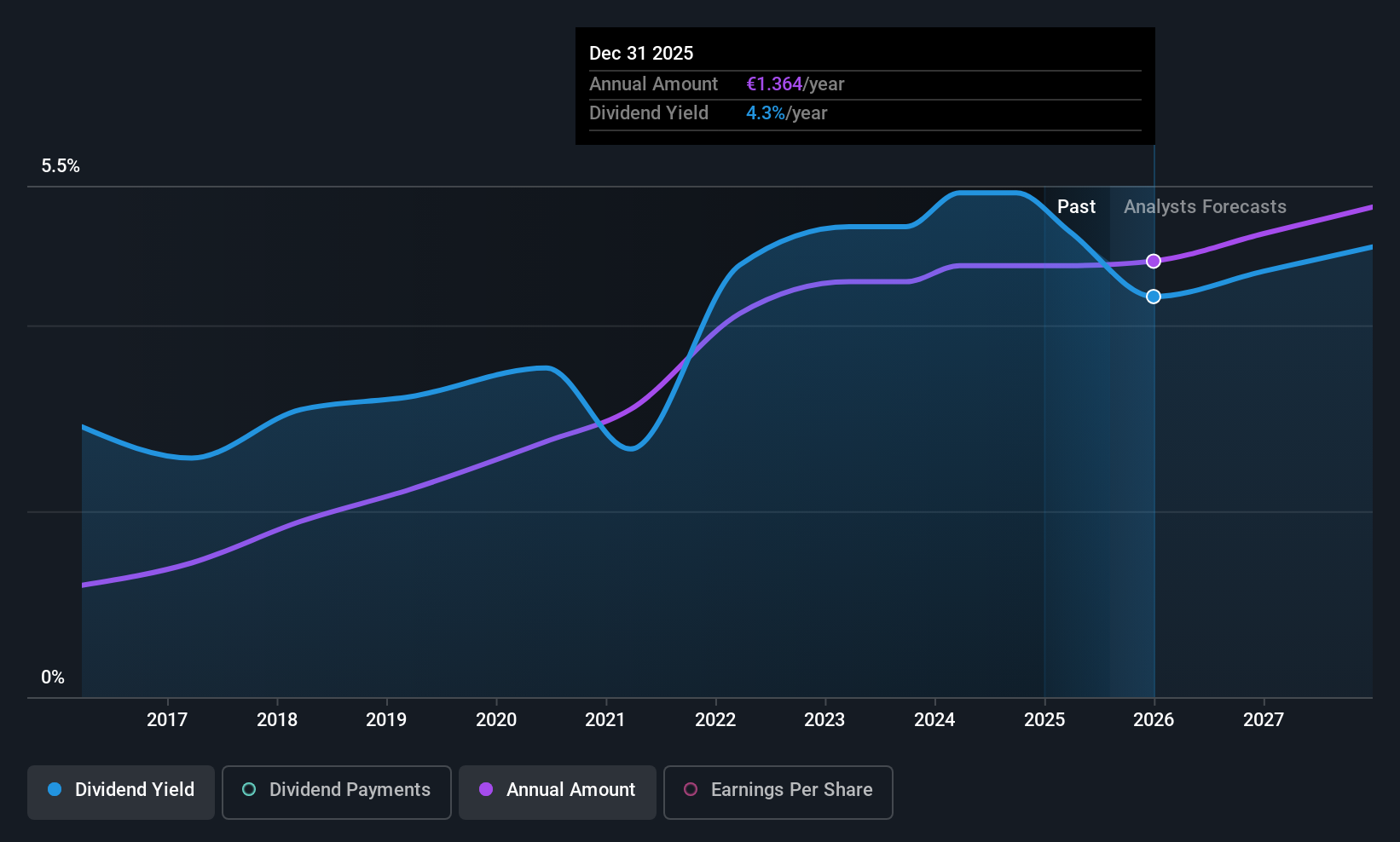

Valmet Oyj (HLSE:VALMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various regions including North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of €5.31 billion.

Operations: Valmet Oyj's revenue is derived from three main segments: Services (€1.91 billion), Automation (€1.49 billion), and Process Technologies (€1.85 billion).

Dividend Yield: 4.7%

Valmet Oyj's dividend yield of 4.68% is below the top quartile in Finland and not well covered by earnings, with a high payout ratio of 97.5%. However, dividends are supported by cash flows with a reasonable cash payout ratio of 52%, and they have been stable over the past decade. Recent projects like the EUR 25-30 million evaporation line for Altri Biotek indicate ongoing business growth, potentially supporting future dividend stability despite current coverage challenges.

- Dive into the specifics of Valmet Oyj here with our thorough dividend report.

- Our valuation report unveils the possibility Valmet Oyj's shares may be trading at a discount.

Seize The Opportunity

- Take a closer look at our Top European Dividend Stocks list of 220 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:SNP

OMV Petrom

An energy company, engages in the exploration and production of oil and gas in Southeastern Europe.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives