Santierul Naval Constanta S.A. (BVB:SNC) Stocks Pounded By 25% But Not Lagging Market On Growth Or Pricing

Santierul Naval Constanta S.A. (BVB:SNC) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

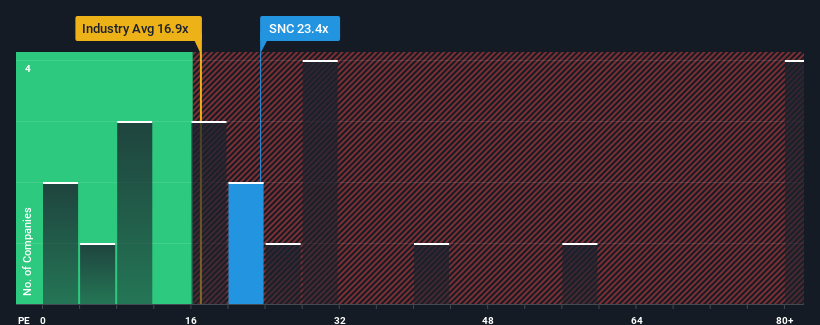

Even after such a large drop in price, Santierul Naval Constanta may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 23.4x, since almost half of all companies in Romania have P/E ratios under 14x and even P/E's lower than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For instance, Santierul Naval Constanta's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Santierul Naval Constanta

How Is Santierul Naval Constanta's Growth Trending?

In order to justify its P/E ratio, Santierul Naval Constanta would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 59%. Still, the latest three year period has seen an excellent 219% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 7.6% shows it's a great look while it lasts.

With this information, we can see why Santierul Naval Constanta is trading at a high P/E compared to the market. Investors are willing to pay more for a stock they hope will buck the trend of the broader market going backwards. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

What We Can Learn From Santierul Naval Constanta's P/E?

Santierul Naval Constanta's shares may have retreated, but its P/E is still flying high. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Santierul Naval Constanta revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Santierul Naval Constanta you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might also be able to find a better stock than Santierul Naval Constanta. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:SNC

Santierul Naval Constanta

Provides ship building and repairing services to ship owners and managers in Romania and internationally.

Adequate balance sheet very low.

Market Insights

Community Narratives