- Romania

- /

- Electrical

- /

- BVB:ECT

I Ran A Stock Scan For Earnings Growth And SC Grupul Industrial Electrocontact (BVB:ECT) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like SC Grupul Industrial Electrocontact (BVB:ECT). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for SC Grupul Industrial Electrocontact

SC Grupul Industrial Electrocontact's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that SC Grupul Industrial Electrocontact's EPS went from RON0.0011 to RON0.0036 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

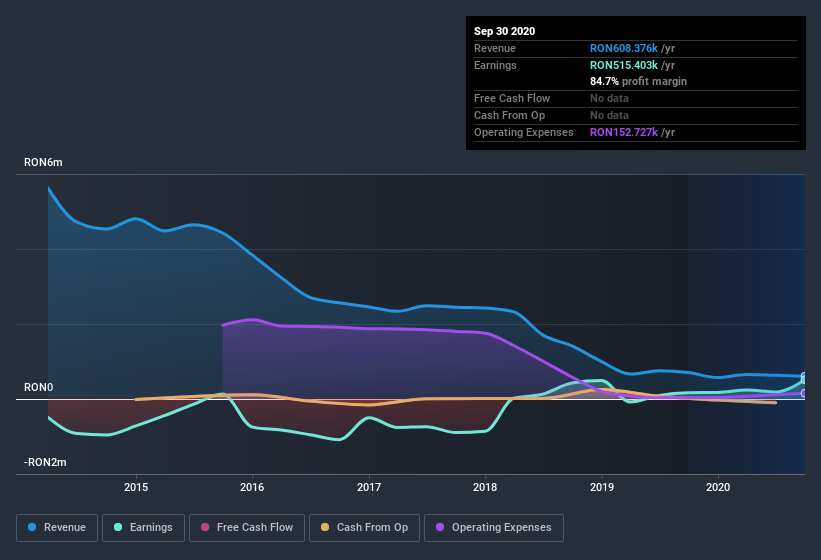

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, SC Grupul Industrial Electrocontact's revenue dropped 14% last year, but the silver lining is that EBIT margins improved from 24% to 88%. That's not ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

SC Grupul Industrial Electrocontact isn't a huge company, given its market capitalization of RON3.9m. That makes it extra important to check on its balance sheet strength.

Are SC Grupul Industrial Electrocontact Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that SC Grupul Industrial Electrocontact insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 73%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. Valued at only RON3.9m SC Grupul Industrial Electrocontact is really small for a listed company. So despite a large proportional holding, insiders only have RON2.8m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Is SC Grupul Industrial Electrocontact Worth Keeping An Eye On?

SC Grupul Industrial Electrocontact's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering SC Grupul Industrial Electrocontact for a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with SC Grupul Industrial Electrocontact .

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade SC Grupul Industrial Electrocontact, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BVB:ECT

SC Grupul Industrial Electrocontact

Designs, production, and marketing of electricity distribution and control devices in Romania.

Slight with mediocre balance sheet.