If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. Having said that, after a brief look, Comelf (BVB:CMF) we aren't filled with optimism, but let's investigate further.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Comelf, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0093 = RON818k ÷ (RON146m - RON58m) (Based on the trailing twelve months to September 2020).

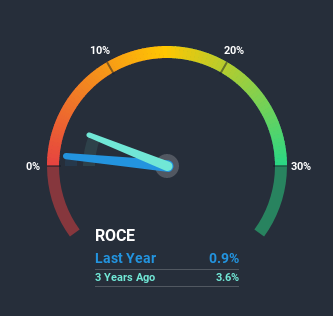

So, Comelf has an ROCE of 0.9%. Ultimately, that's a low return and it under-performs the Machinery industry average of 1.6%.

View our latest analysis for Comelf

Historical performance is a great place to start when researching a stock so above you can see the gauge for Comelf's ROCE against it's prior returns. If you're interested in investigating Comelf's past further, check out this free graph of past earnings, revenue and cash flow.

So How Is Comelf's ROCE Trending?

The trend of returns that Comelf is generating are raising some concerns. Unfortunately, returns have declined substantially over the last five years to the 0.9% we see today. In addition to that, Comelf is now employing 22% less capital than it was five years ago. The fact that both are shrinking is an indication that the business is going through some tough times. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

The Bottom Line

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. And, the stock has remained flat over the last five years, so investors don't seem too impressed either. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you'd like to know more about Comelf, we've spotted 4 warning signs, and 3 of them are a bit unpleasant.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade Comelf, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BVB:CMF

Comelf

Manufactures and sells engines and turbines in Romania and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A fully integrated LNG business seems to be ignored by the market.

Hims & Hers Health aims for three dimensional revenue expansion

A Quality Compounder Marked Down on Overblown Fears

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale