Should You Be Adding Banca Transilvania (BVB:TLV) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Banca Transilvania (BVB:TLV). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Banca Transilvania

Banca Transilvania's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Banca Transilvania's EPS has grown 22% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

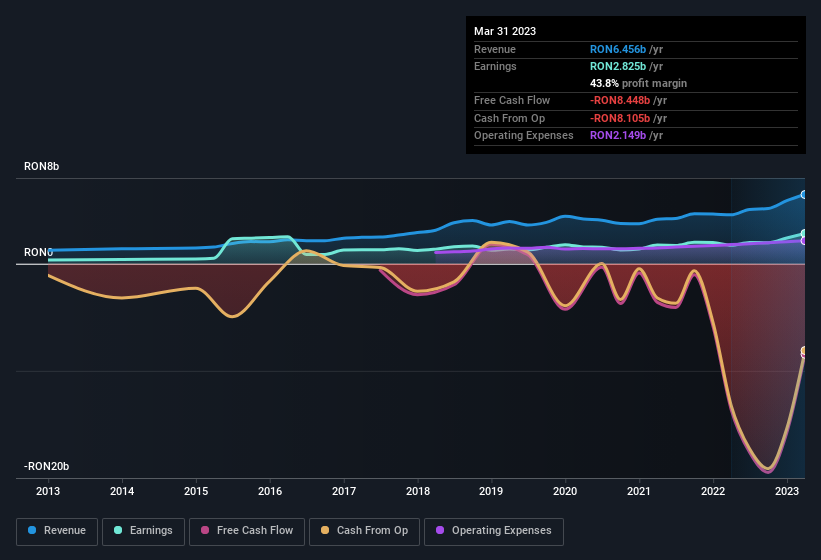

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Banca Transilvania's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Banca Transilvania achieved similar EBIT margins to last year, revenue grew by a solid 41% to RON6.5b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Banca Transilvania's future EPS 100% free.

Are Banca Transilvania Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Banca Transilvania shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at RON839m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Does Banca Transilvania Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Banca Transilvania's strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Banca Transilvania is trading on a high P/E or a low P/E, relative to its industry.

Although Banca Transilvania certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Banca Transilvania might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:TLV

Outstanding track record and undervalued.