- Qatar

- /

- Telecom Services and Carriers

- /

- DSM:ORDS

Ooredoo Q.P.S.C (DSM:ORDS) Has More To Do To Multiply In Value Going Forward

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. However, after briefly looking over the numbers, we don't think Ooredoo Q.P.S.C (DSM:ORDS) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Ooredoo Q.P.S.C:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

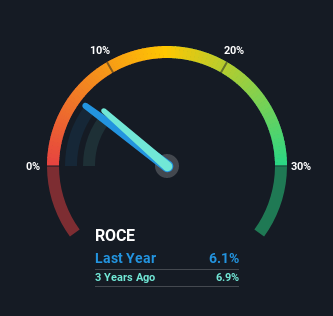

0.061 = ر.ق3.7b ÷ (ر.ق80b - ر.ق20b) (Based on the trailing twelve months to March 2021).

So, Ooredoo Q.P.S.C has an ROCE of 6.1%. In absolute terms, that's a low return and it also under-performs the Telecom industry average of 9.6%.

See our latest analysis for Ooredoo Q.P.S.C

In the above chart we have measured Ooredoo Q.P.S.C's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Ooredoo Q.P.S.C.

So How Is Ooredoo Q.P.S.C's ROCE Trending?

Things have been pretty stable at Ooredoo Q.P.S.C, with its capital employed and returns on that capital staying somewhat the same for the last five years. This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. So don't be surprised if Ooredoo Q.P.S.C doesn't end up being a multi-bagger in a few years time. This probably explains why Ooredoo Q.P.S.C is paying out 55% of its income to shareholders in the form of dividends. Given the business isn't reinvesting in itself, it makes sense to distribute a portion of earnings among shareholders.

The Bottom Line

In summary, Ooredoo Q.P.S.C isn't compounding its earnings but is generating stable returns on the same amount of capital employed. Unsurprisingly then, the total return to shareholders over the last five years has been flat. On the whole, we aren't too inspired by the underlying trends and we think there may be better chances of finding a multi-bagger elsewhere.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 4 warning signs for Ooredoo Q.P.S.C (of which 1 is a bit concerning!) that you should know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:ORDS

Ooredoo Q.P.S.C

Provides telecommunications services in Qatar, rest of the Middle East, Asia, and North Africa region.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives