Qatari Investors Group Q.S.C. (DSM:QIGD) stock is about to trade ex-dividend in 3 days. If you purchase the stock on or after the 23rd of February, you won't be eligible to receive this dividend, when it is paid on the 1st of January.

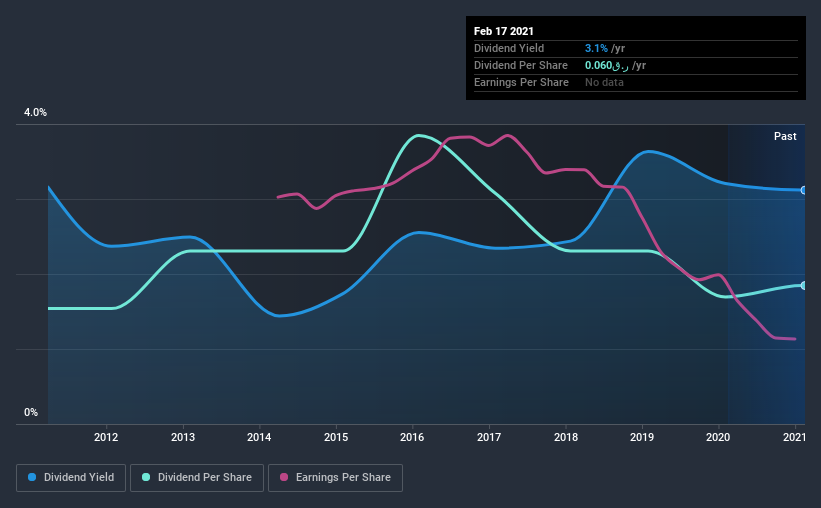

Qatari Investors Group Q.S.C's next dividend payment will be ر.ق0.06 per share. Last year, in total, the company distributed ر.ق0.06 to shareholders. Last year's total dividend payments show that Qatari Investors Group Q.S.C has a trailing yield of 3.1% on the current share price of QAR1.924. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Qatari Investors Group Q.S.C

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. It paid out 88% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline. A useful secondary check can be to evaluate whether Qatari Investors Group Q.S.C generated enough free cash flow to afford its dividend. The good news is it paid out just 16% of its free cash flow in the last year.

It's positive to see that Qatari Investors Group Q.S.C's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Qatari Investors Group Q.S.C paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're discomforted by Qatari Investors Group Q.S.C's 20% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Qatari Investors Group Q.S.C has delivered an average of 1.8% per year annual increase in its dividend, based on the past 10 years of dividend payments.

The Bottom Line

Should investors buy Qatari Investors Group Q.S.C for the upcoming dividend? The payout ratios are within a reasonable range, implying the dividend may be sustainable. Declining earnings are a serious concern, however, and could pose a threat to the dividend in future. Overall, it's not a bad combination, but we feel that there are likely more attractive dividend prospects out there.

If you want to look further into Qatari Investors Group Q.S.C, it's worth knowing the risks this business faces. Be aware that Qatari Investors Group Q.S.C is showing 4 warning signs in our investment analysis, and 2 of those make us uncomfortable...

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Qatari Investors Group Q.S.C or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Qatari Investors Group Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:QIGD

Qatari Investors Group Q.P.S.C

Operates as a diversified conglomerate company in Qatar.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026