- Qatar

- /

- Healthcare Services

- /

- DSM:MCGS

Should You Use Medicare Group Q.P.S.C's (DSM:MCGS) Statutory Earnings To Analyse It?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Medicare Group Q.P.S.C (DSM:MCGS).

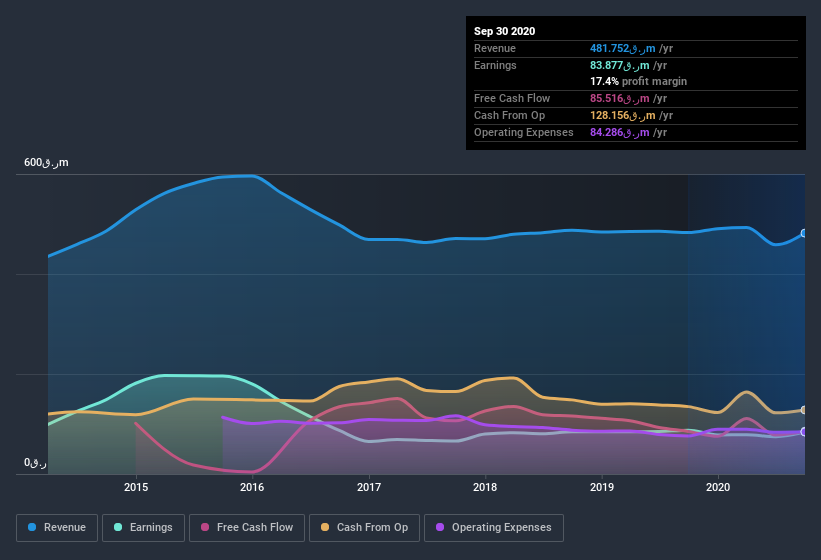

While Medicare Group Q.P.S.C was able to generate revenue of ر.ق481.8m in the last twelve months, we think its profit result of ر.ق83.9m was more important. In the chart below, you can see that its profit and revenue have both grown over the last three years, although its profit has slipped in the last twelve months.

Check out our latest analysis for Medicare Group Q.P.S.C

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Medicare Group Q.P.S.C's Profit Performance

Therefore, it seems possible to us that Medicare Group Q.P.S.C's true underlying earnings power is actually less than its statutory profit. So while earnings quality is important, it's equally important to consider the risks facing Medicare Group Q.P.S.C at this point in time. To help with this, we've discovered 2 warning signs (1 shouldn't be ignored!) that you ought to be aware of before buying any shares in Medicare Group Q.P.S.C.

Our examination of Medicare Group Q.P.S.C has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Medicare Group Q.P.S.C or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:MCGS

Medicare Group Q.P.S.C

Provides healthcare and treatment services in Qatar.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026