- Qatar

- /

- Oil and Gas

- /

- DSM:QGTS

Shareholders Of Qatar Gas Transport Company Limited (Nakilat) (QPSC) (DSM:QGTS) Must Be Happy With Their 159% Total Return

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Qatar Gas Transport Company Limited (Nakilat) (QPSC) (DSM:QGTS) share price has flown 120% in the last three years. How nice for those who held the stock! It's also up 17% in about a month. But the price may well have benefitted from a buoyant market, since stocks have gained 7.2% in the last thirty days.

Check out our latest analysis for Qatar Gas Transport Company Limited (Nakilat) (QPSC)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

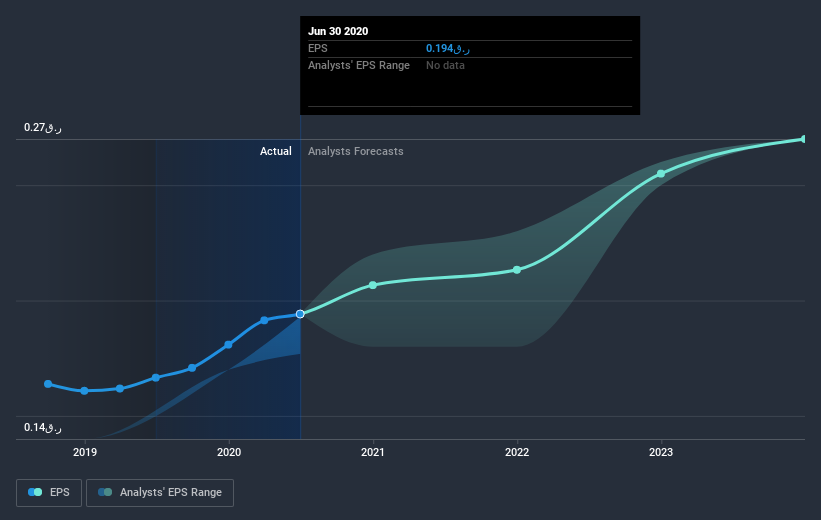

During three years of share price growth, Qatar Gas Transport Company Limited (Nakilat) (QPSC) achieved compound earnings per share growth of 7.6% per year. In comparison, the 30% per year gain in the share price outpaces the EPS growth. So it's fair to assume the market has a higher opinion of the business than it did three years ago. That's not necessarily surprising considering the three-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Qatar Gas Transport Company Limited (Nakilat) (QPSC) has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Qatar Gas Transport Company Limited (Nakilat) (QPSC) shareholders, and that cash payout contributed to why its TSR of 159%, over the last 3 years, is better than the share price return.

A Different Perspective

We're pleased to report that Qatar Gas Transport Company Limited (Nakilat) (QPSC) shareholders have received a total shareholder return of 30% over one year. That's better than the annualised return of 12% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Qatar Gas Transport Company Limited (Nakilat) (QPSC) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on QA exchanges.

If you’re looking to trade Qatar Gas Transport Company Limited (Nakilat) (QPSC), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Qatar Gas Transport Company Limited (Nakilat) (QPSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About DSM:QGTS

Qatar Gas Transport Company Limited (Nakilat) (QPSC)

Operates as a shipping and maritime company in Qatar.

Solid track record second-rate dividend payer.