- Qatar

- /

- Oil and Gas

- /

- DSM:QGTS

Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s (DSM:QGTS) Earnings Haven't Escaped The Attention Of Investors

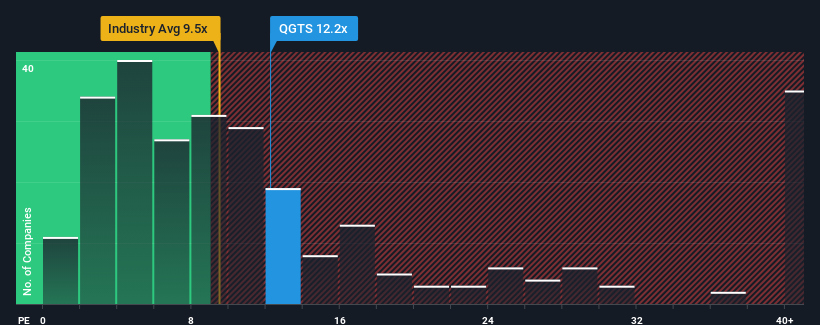

With a median price-to-earnings (or "P/E") ratio of close to 14x in Qatar, you could be forgiven for feeling indifferent about Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s (DSM:QGTS) P/E ratio of 12.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's inferior to most other companies of late, Qatar Gas Transport Company Limited (Nakilat) (QPSC) has been relatively sluggish. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Qatar Gas Transport Company Limited (Nakilat) (QPSC)

Is There Some Growth For Qatar Gas Transport Company Limited (Nakilat) (QPSC)?

In order to justify its P/E ratio, Qatar Gas Transport Company Limited (Nakilat) (QPSC) would need to produce growth that's similar to the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 28% overall rise in EPS. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the four analysts watching the company. With the market predicted to deliver 11% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Qatar Gas Transport Company Limited (Nakilat) (QPSC)'s P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Qatar Gas Transport Company Limited (Nakilat) (QPSC) maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Qatar Gas Transport Company Limited (Nakilat) (QPSC) (1 is significant!) that you should be aware of.

You might be able to find a better investment than Qatar Gas Transport Company Limited (Nakilat) (QPSC). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Qatar Gas Transport Company Limited (Nakilat) (QPSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QGTS

Qatar Gas Transport Company Limited (Nakilat) (QPSC)

Operates as a shipping and maritime company in Qatar.

Solid track record second-rate dividend payer.