Is CTT - Correios De Portugal (ELI:CTT) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that CTT - Correios De Portugal, S.A. (ELI:CTT) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for CTT - Correios De Portugal

How Much Debt Does CTT - Correios De Portugal Carry?

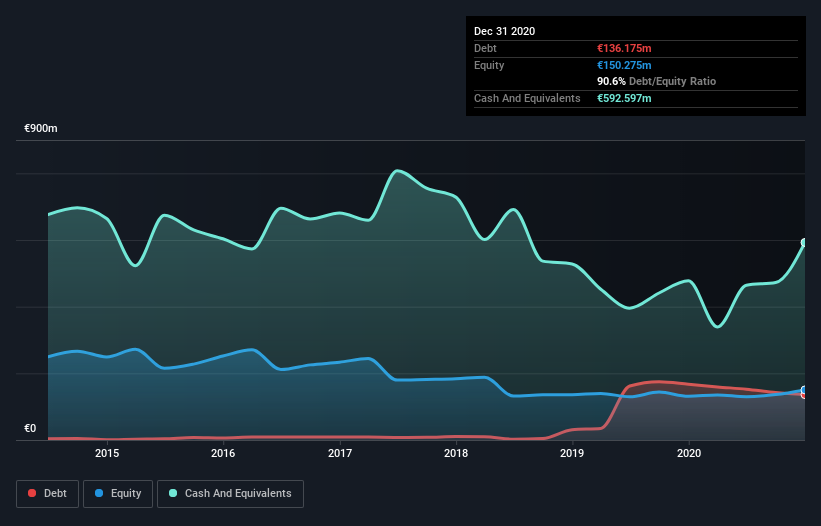

As you can see below, CTT - Correios De Portugal had €136.2m of debt at December 2020, down from €167.5m a year prior. But it also has €592.6m in cash to offset that, meaning it has €456.4m net cash.

How Healthy Is CTT - Correios De Portugal's Balance Sheet?

According to the last reported balance sheet, CTT - Correios De Portugal had liabilities of €2.25b due within 12 months, and liabilities of €493.4m due beyond 12 months. On the other hand, it had cash of €592.6m and €286.2m worth of receivables due within a year. So it has liabilities totalling €1.87b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the €582.0m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, CTT - Correios De Portugal would likely require a major re-capitalisation if it had to pay its creditors today. Given that CTT - Correios De Portugal has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

On the other hand, CTT - Correios De Portugal's EBIT dived 14%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine CTT - Correios De Portugal's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. CTT - Correios De Portugal may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, CTT - Correios De Portugal actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

Although CTT - Correios De Portugal's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €456.4m. And it impressed us with free cash flow of €245m, being 372% of its EBIT. Despite its cash we think that CTT - Correios De Portugal seems to struggle to handle its total liabilities, so we are wary of the stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 4 warning signs with CTT - Correios De Portugal , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTLS:CTT

CTT - Correios De Portugal

Provides postal and financial services worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026