- Italy

- /

- Energy Services

- /

- BIT:TEN

3 European Dividend Stocks Yielding Up To 4.3%

Reviewed by Simply Wall St

As European markets experience a boost from easing geopolitical tensions and potential economic stimulus, the pan-European STOXX Europe 600 Index has seen a notable rise of 1.32%. Amid this backdrop, investors are increasingly drawn to dividend stocks as they seek stable income streams in an environment where economic growth remains muted. In this context, identifying stocks with solid dividend yields can provide a reliable source of returns while navigating the current market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.51% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.29% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.81% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.21% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.48% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 3.96% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.72% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.52% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

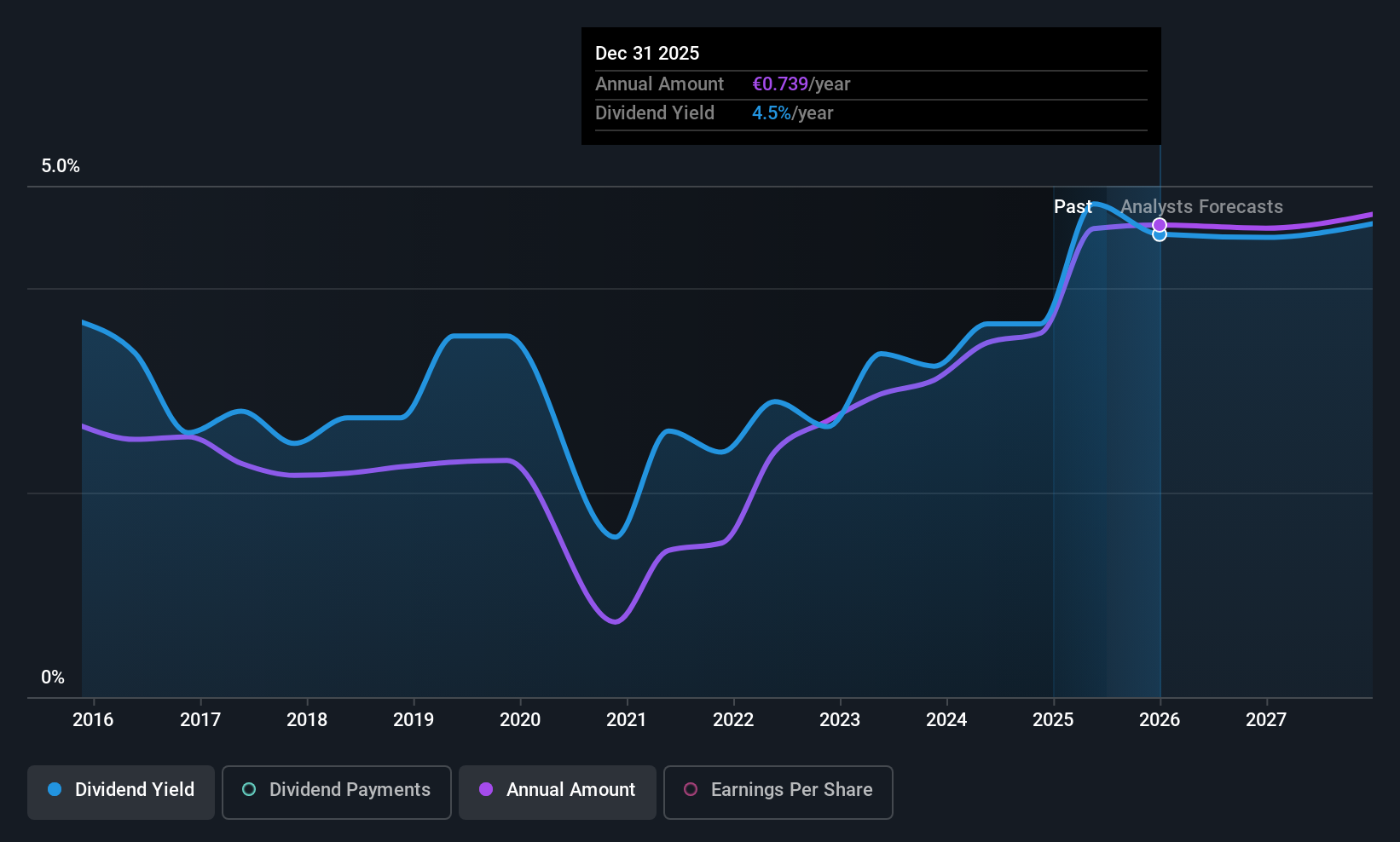

Tenaris (BIT:TEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tenaris S.A. is a global manufacturer and supplier of steel pipe products and related services for the energy industry and other industrial applications, with a market cap of approximately €17.20 billion.

Operations: Tenaris generates revenue primarily from its Tubes segment, which accounted for $11.38 billion.

Dividend Yield: 4.3%

Tenaris offers a mixed dividend profile for investors. The company's dividends are covered by both earnings and cash flows, with a payout ratio of 50.9% and a cash payout ratio of 41.9%, respectively, indicating sustainability. However, the dividend yield of 4.33% is lower than the top tier in Italy's market. Tenaris has an unstable dividend history over the past decade but recently increased its annual dividend to US$0.83 per share while initiating a significant share buyback program worth up to $1.2 billion, which could potentially enhance shareholder value through reduced share count and increased earnings per share over time.

- Navigate through the intricacies of Tenaris with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Tenaris is trading behind its estimated value.

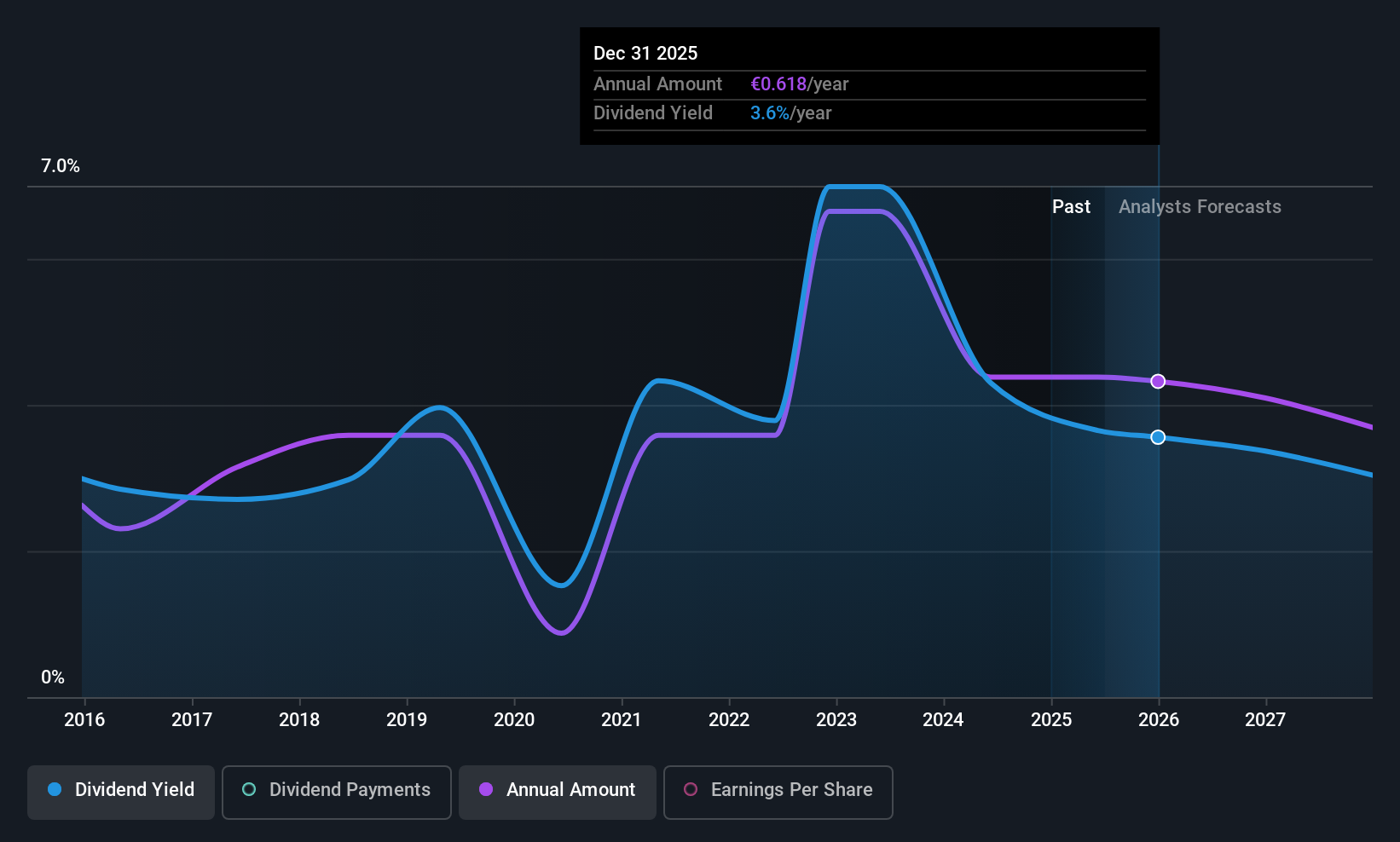

Semapa - Sociedade de Investimento e Gestão SGPS (ENXTLS:SEM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Semapa - Sociedade de Investimento e Gestão SGPS operates through its subsidiaries to produce and sell pulp, printing and writing papers, and tissues across various regions including Portugal, Europe, the United States, Africa, Asia, and Oceania; it has a market cap of approximately €1.37 billion.

Operations: Semapa - Sociedade de Investimento e Gestão SGPS generates revenue primarily from its Pulp and Paper segment, amounting to €2.08 billion, and its Cement segment, which contributes €710.24 million.

Dividend Yield: 3.7%

Semapa's dividend payments are well covered by both earnings and cash flows, with payout ratios of 22.3% and 20%, respectively, suggesting sustainability despite a volatile history over the past decade. The recent announcement of a €0.626 per share dividend reflects continued commitment to shareholder returns, payable on June 11, 2025. However, its yield of 3.65% is below the top tier in Portugal's market, and high debt levels may pose financial challenges moving forward.

- Unlock comprehensive insights into our analysis of Semapa - Sociedade de Investimento e Gestão SGPS stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Semapa - Sociedade de Investimento e Gestão SGPS is priced lower than what may be justified by its financials.

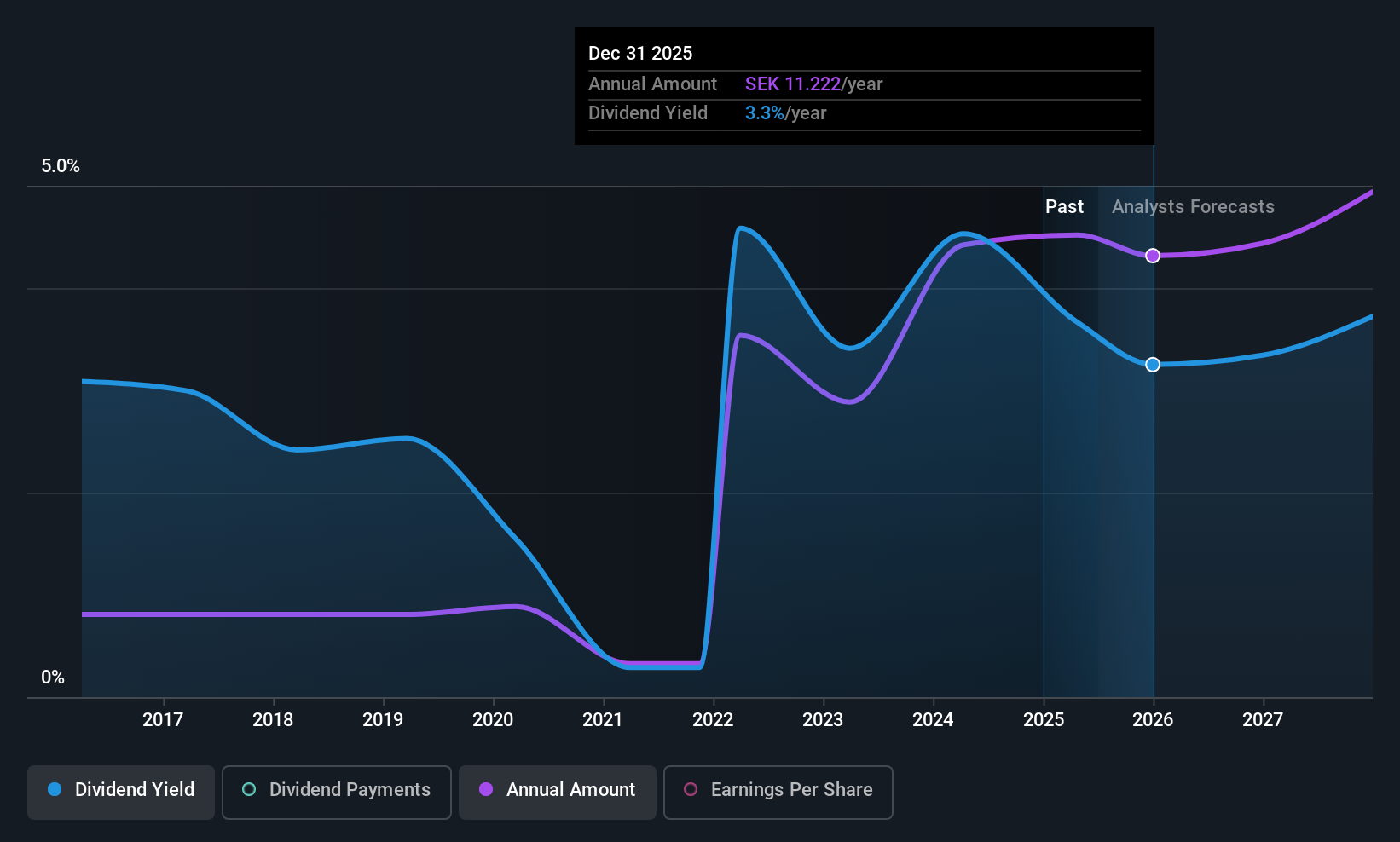

Avanza Bank Holding (OM:AZA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avanza Bank Holding AB (publ) operates in Sweden, providing a variety of savings, pension, and mortgage products, with a market capitalization of approximately SEK52.67 billion.

Operations: Avanza Bank Holding AB (publ) generates revenue through its diverse offerings in savings, pension, and mortgage products within the Swedish market.

Dividend Yield: 3.5%

Avanza Bank Holding's dividend payments, though historically volatile, are well covered by earnings and cash flows with payout ratios of 76.8% and 15.6%, respectively. Despite a recent increase to SEK 11.75 per share, its yield of 3.51% is below the top tier in Sweden's market. The company's earnings have shown growth, reporting SEK 707 million for Q1 2025 against SEK 555 million a year ago, supporting dividend sustainability amidst fluctuating payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Avanza Bank Holding.

- The valuation report we've compiled suggests that Avanza Bank Holding's current price could be inflated.

Where To Now?

- Click here to access our complete index of 237 Top European Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenaris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TEN

Tenaris

Manufactures and supplies steel pipe products and related services for the energy industry and other industrial applications in North America, South America, Europe, the Middle East and Africa, and the Asia Pacific.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives